Inflation Roars & Stocks Slide On The 15th Anniversary of Lehman's Demise: TBL Weekly #62

Welcome to TBL Weekly #62—the free weekly newsletter that keeps you in the know across bitcoin, rates, risk, and macro. Grab a coffee, and let’s dive in.

River is the Bitcoin exchange of choice for the long-term investor.

Securely buy Bitcoin at the tightest spreads in the industry, have peace of mind thanks to their 100% full-reserve cold storage custody, and enjoy zero fees on recurring orders. Need help? They have US-based phone support for all clients.

Invest in Bitcoin with confidence at River.com/TBL

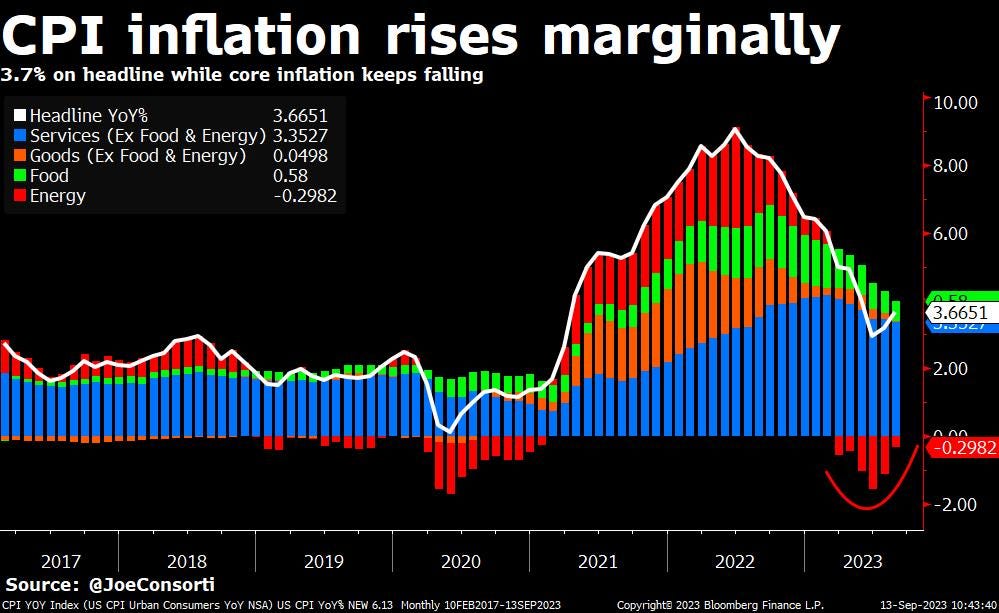

CPI inflation came in hotter than expected at 3.7% on Tuesday, led by energy inflation. Take a look at the red. Energy deflation dragged CPI inflation down until July, but now it has pushed CPI inflation higher over the last 2 prints:

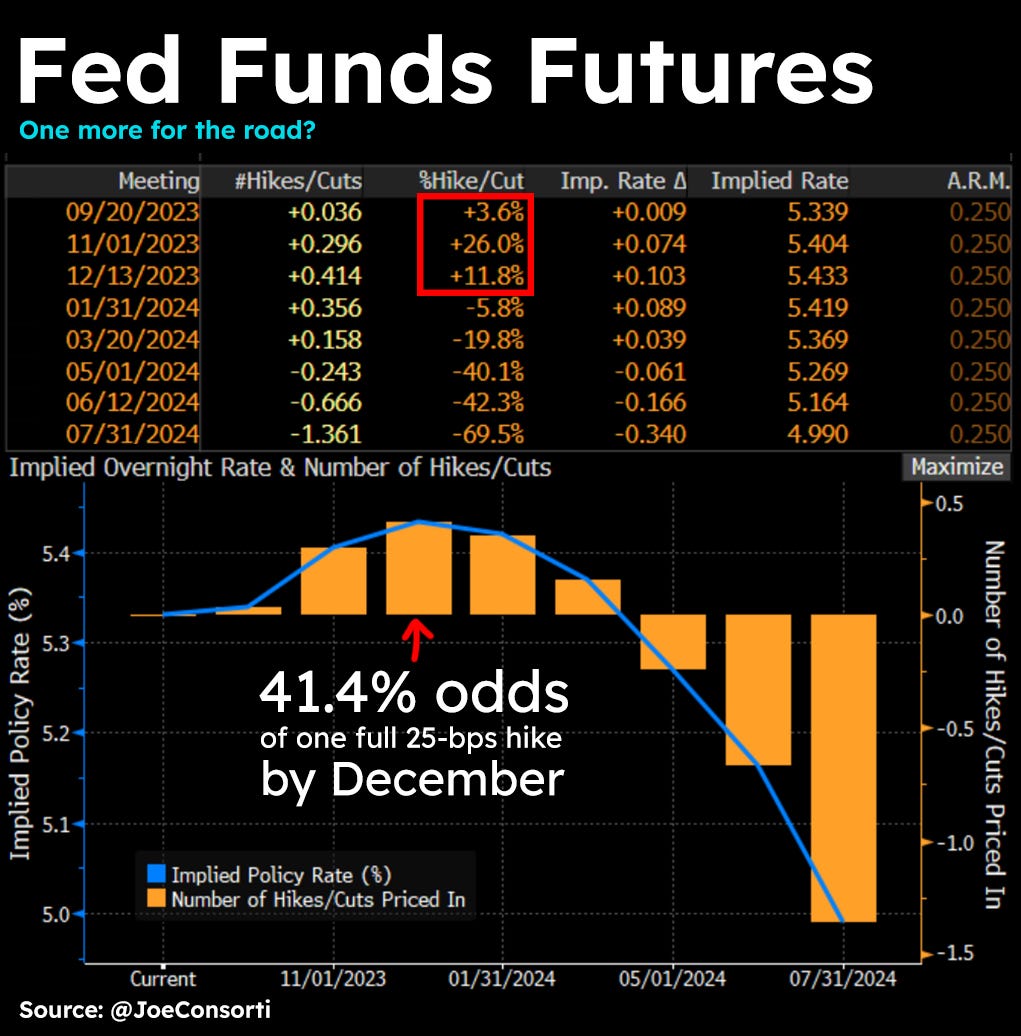

One more for the road?

Given this hot print, despite our view that it’s a temporary hiccup on an otherwise straight-down path for price inflation, there's now a ~50% chance the Fed hikes again. If the Fed decides to hike further in the wake of these two outlier CPI prints despite the slowdown witnessed elsewhere from their 18 months of nonstop rate hikes, a "soft landing" becomes increasingly unlikely:

Lehman filed for Chapter 11 bankruptcy protection on September 15th, 2008, exactly 15 years ago. Time flies! The failure of the $680 billion asset manager is to this day the largest bankruptcy filing in US history, and arguably posthumously marked the beginning of the Great Financial Crisis and ensuing recession.

With banks facing such acute turmoil today, are we bracing for a similar impetus to kick off the next recession? Modern Fed tools don’t allow for that.

The Fed’s discount window and Bank Term Funding Program (BTFP) allow distressed borrowers to restore their collateral long before collateral devaluation becomes a systemic problem.

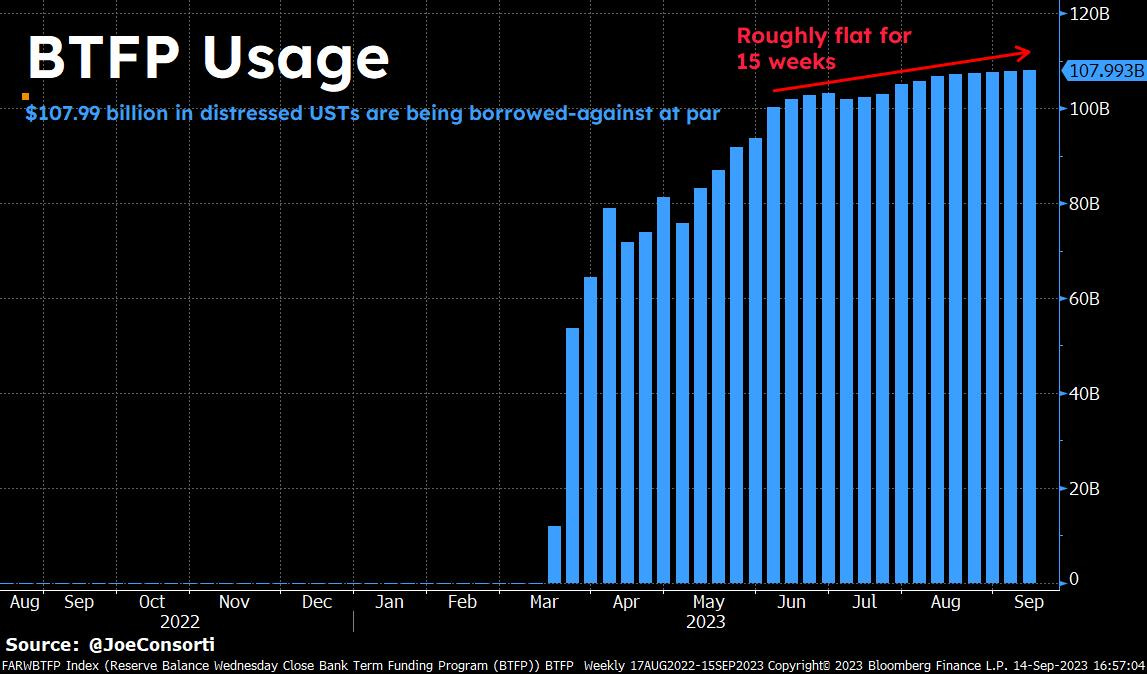

Emergency loans from the Fed's BTFP facility hit a new high of $107.99 billion:

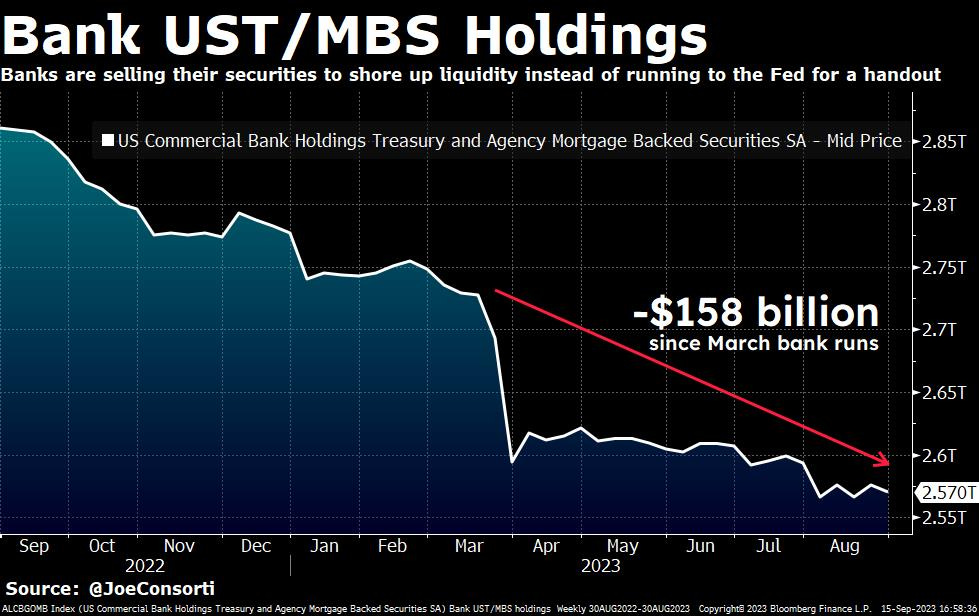

Growth of the facility has been flat for 15 weeks, but acute regional bank stress hasn't fully faded. Banks are just selling securities instead of going to the Fed’s discount window or BTFP for a handout—better optics we suppose. Banks' US Treasury and mortgage-backed security holdings are down $158 billion since the March bank runs:

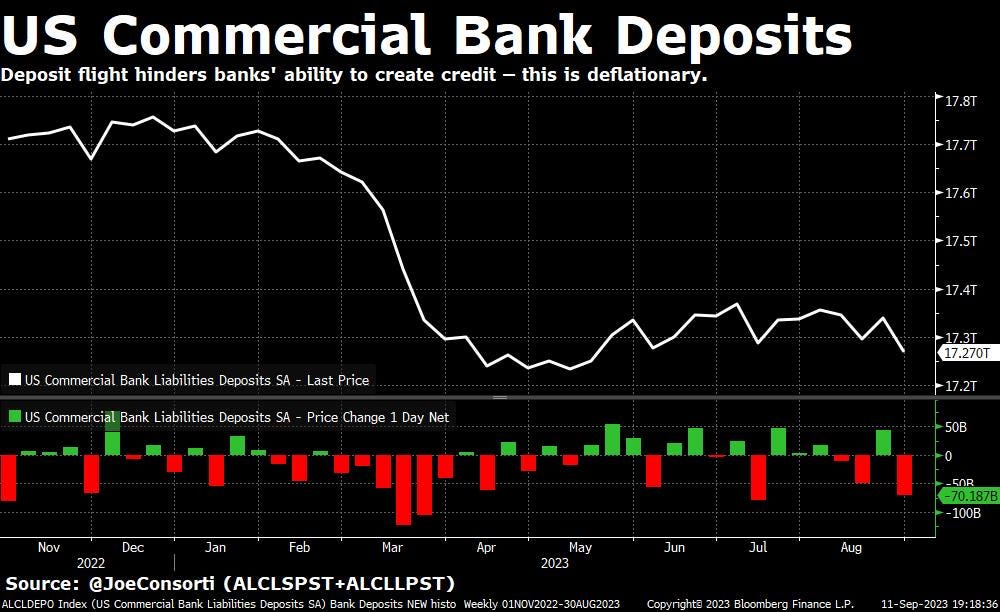

It is no wonder why banks are rushing to shore up liquidity, depositors are fleeing (albeit in slow motion) and they need to meet those withdrawal requests. US commercial banks lost $71.2 billion in deposits last week. If this was 2008, that would've been the 3rd largest outflow during the entire Great Financial Crisis. Since the March 2023 banking panic... it's only the 8th largest.

Let the scale of this banking sector stress really sink in…

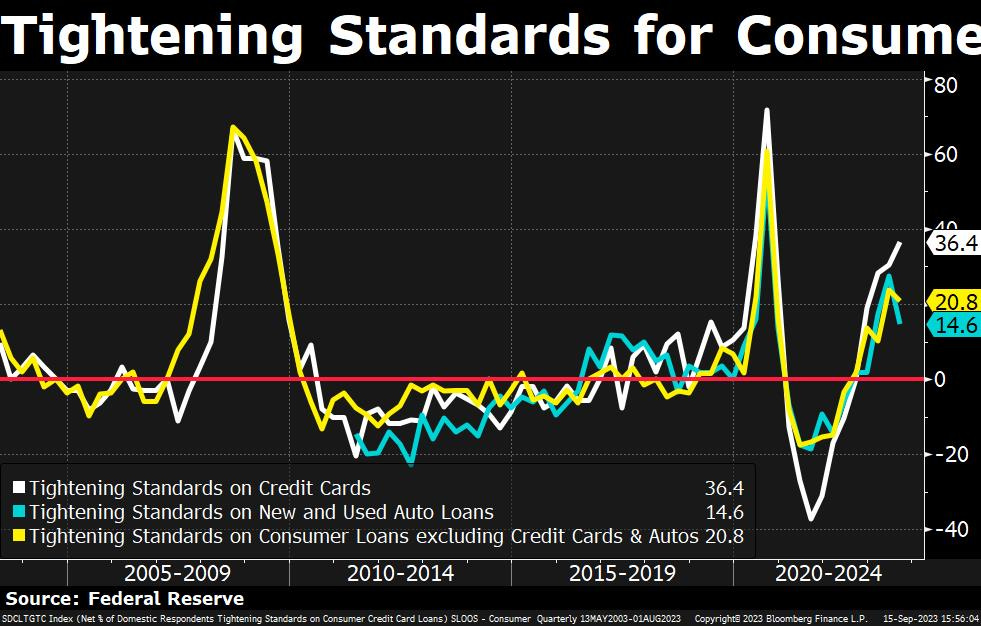

This has had the effect of banks extending far less credit to consumers, tightening standards across the spectrum of loans to pre-recession heights:

This has consumers very wary. Although inflation expectations fell among consumers surveyed in this month’s University of Michigan consumer survey, interest rates are now the main factor making life unaffordable for Americans.

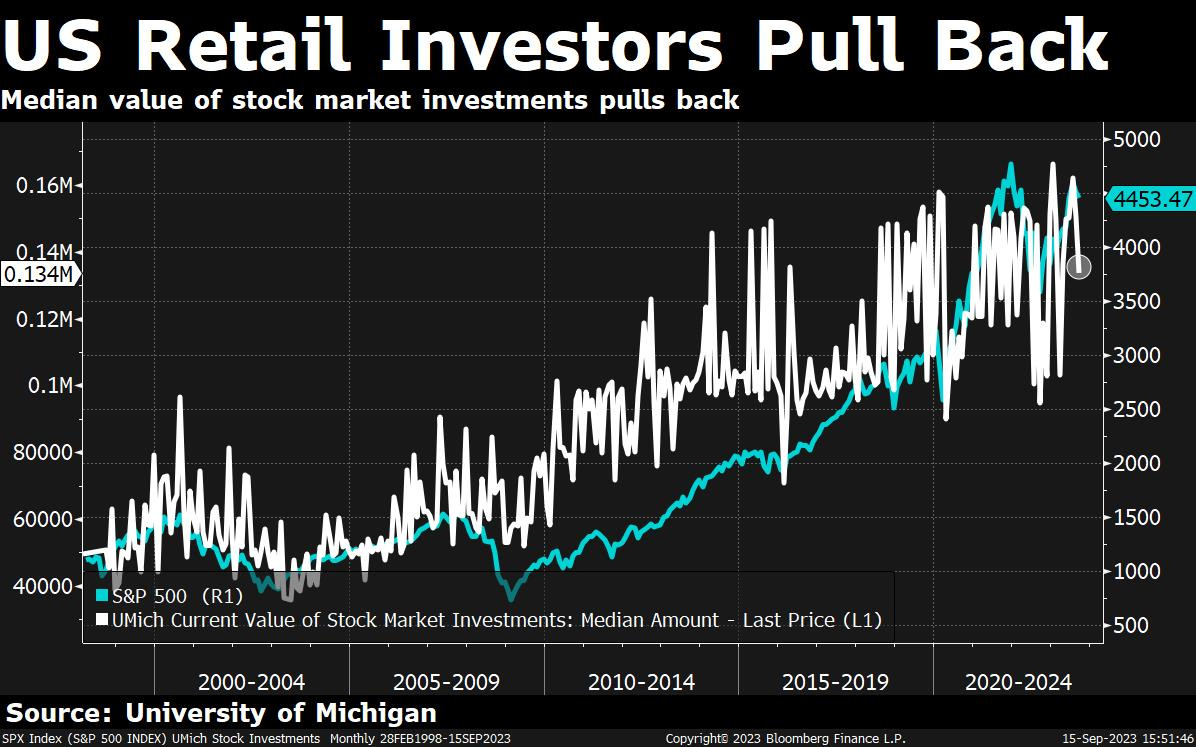

Consumers are derisking amid higher interest rates, divesting from stocks as they do. The median value of retail stock market investments is in decline:

Where is it all going? About 60% of the aforementioned US commercial bank deposit outflows are going into higher-yielding, safe & liquid money market funds that are yielding 4.5% or more. Money market funds saw $41.8 billion dollars of inflows last week and have ballooned in size above $5.6 trillion:

The final chart we leave you with today is the reality of homebuilders teetering on the edge of a cliff. With all of this demand destruction, it is only a matter of time before consumers don’t have the legs to buy new homes and homebuilders finally underperform similarly to how regional banks, the primary lenders of US real estate, are performing. As goes the housing market, so goes the economy:

In The Week Ahead

In the week ahead, we look forward to a light smattering of less important economic data paired with an uneventful Wednesday where the Fed will likely not hike its policy rates. We look to housing data on Tuesday for insight into the slowdown we just discussed, as well as jobs and housing data on Thursday to color it further, followed by previews of this month’s PMI data to close out the week with a window into manufacturing and services sector weakness:

Foundation Devices is self-custody done right.

Start with their easy-to-use and private mobile wallet with Envoy, then transfer it to the most intuitive hardware wallet in Bitcoin with Passport.

If you’ve been on the fence about taking your bitcoin off of exchanges, Foundation’s suite of intuitive self-custody solutions is for you.

Take custody of your Bitcoin today by visiting foundationdevices.com

If you’re enjoying today’s analysis, consider supporting us by becoming a paid subscriber. As a paid subscriber, you get full access to all research as it drops.

Here are your quick links to all of the TBL content for the week:

Tuesday

The bitcoin crab market has been tumultuous—chopping up and down in a narrow range, completely directionless. Among the tumult has been some unusual price action, but not from BTC, instead from an illiquid “crypto” token that was spun up by the world’s largest exchange that services this industry.

Binance Coin, BNB, a token created by its namesake that functions as the common stock equivalent for the questionably incorporated enterprise, has a market capitalization of only $32 billion yet has performed remarkably well and even in line with the granddaddy of them all in BTC.

So, who is buying, and why are they buying?

Chances are, it’s Binance, and they’re doing it so that they can live to die another day. Let’s discuss the latest state of affairs in the Binance saga and what it all means for bitcoin as the macro horizon darkens.

Check out—BNB, Binance & Bitcoin Are On The Brink

Wednesday

In this episode, Nik walks us through the implications for bitcoin if we enter a global recession. We start with a quick recap of what's happening around the global economy, what central banks might be doing over the next year, and examine if bitcoin is positioned to benefit or not during that time horizon.

Check out—Bitcoin's First Recession: What Will Happen?

Thursday

Confirmation bias is a doozy. As rates analysts, it’s our job to flag curve inversions as recession indicators up to three years in advance. Now that we’re about 18 months into the current instance of 2s10s inversion, it’s almost impossible to unsee the end-cycle dynamics in the data, such as contractionary US manufacturing, German recession, and Chinese monetary easing. Interestingly, policymakers, instead of having trouble escaping negative economic news, are quite comfortable in their position. This sets up for the next few months of Fed and ECB inaction, while markets once again regain their form as discounting mechanisms. Let’s just say summer is over.

Check out—Boring FOMC meetings & spicy markets

Our videos are on major podcast platforms—take us with you on the go!

Apple Podcasts Spotify Fountain

Keep up with The Bitcoin Layer by following our social media!

YouTube Twitter LinkedIn Instagram TikTok

That’s all for our markets recap—have a great weekend, everyone!

River is the Bitcoin exchange of choice for the long-term investor.

Securely buy Bitcoin at the tightest spreads in the industry, have peace of mind thanks to their 100% full-reserve cold storage custody, and enjoy zero fees on recurring orders. Need help? They have US-based phone support for all clients.

Invest in Bitcoin with confidence at River.com/TBL for $5 free when you buy $100 in Bitcoin.