ISM Manufacturing Declines As Investors Flee To Safety: TBL Weekly #72

Welcome to TBL Weekly #72—the free weekly newsletter that keeps you in the know across bitcoin, rates, risk, and macro. Grab a coffee, and let’s dive in.

River is the Bitcoin exchange of choice for the long-term investor.

Securely buy Bitcoin at the tightest spreads in the industry, have peace of mind thanks to their 100% full-reserve cold storage custody, and enjoy zero fees on recurring orders. Need help? They have US-based phone support for all clients.

Invest in Bitcoin with confidence at River.com/TBL

Good morning everybody, happy Saturday.

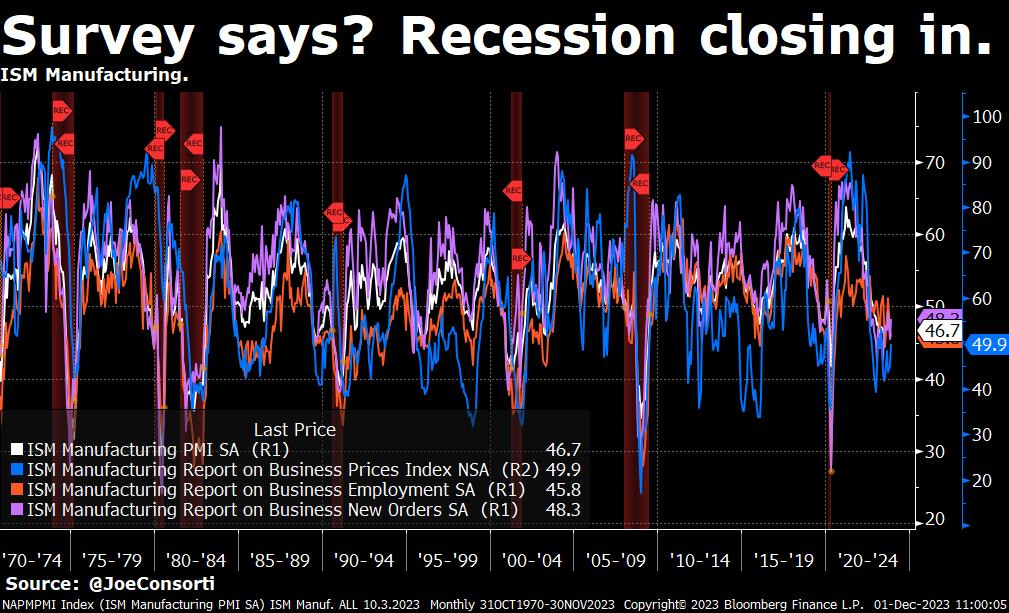

ISM manufacturing data released Friday came in lower than expected—two of three components rose, prices and new orders, while employment declined. On aggregate across the United States, more manufacturers are reporting worse conditions month-over-month than not.

Unlike previous cycles with a dramatic spike in consensus around worsening conditions, this cycle’s dip below the 50 contractionary level has been shallow. In our view, this atypical shallow behavior is likely due to the atypical nature of this cycle. The monetary and fiscal bazooka set off in 2020 and 2021 has had a lasting impact on the resilience of American consumers and businesses, hence the inconsistency in conditions across the United States, as evidenced by a shallow and prolonged contraction rather than a deep and truncated one:

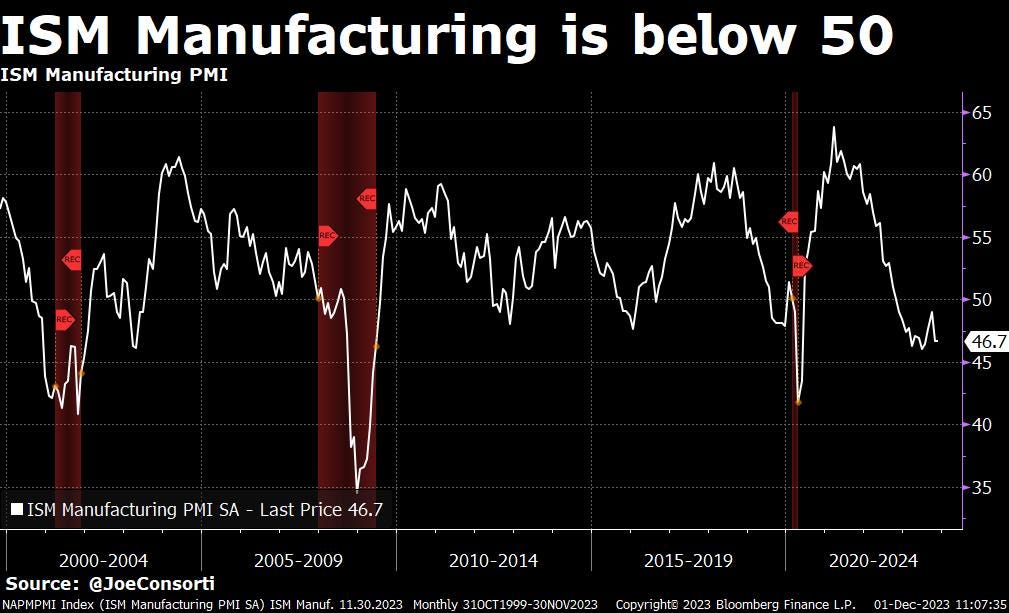

This post-2020 easing cushion currently supporting businesses is further evidenced when we strip away the subcomponents and observe the headline number on its own. Note how despite being firmly below the 50 contractionary for several months, we’ve yet to formally enter a recession as measured by GDP:

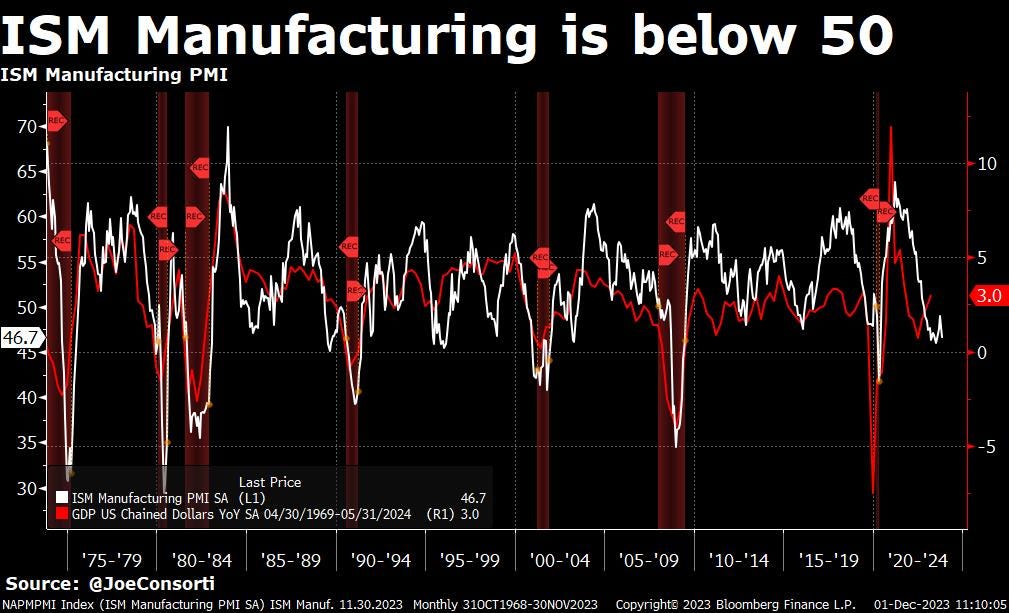

Year-over-year GDP growth tends to follow closely behind ISM manufacturing by ~5-to-6 months, and like ISM manufacturing hovering around the 50 level, yearly GDP too is not dramatically collapsing below 0%.

Manufacturing sentiment and activity isn’t collapsing, rather moderating after a historically hot 2.5 years, so the metric by which we measure economic growth here in the West (however inaccurate it may be) is following suit:

This still-poor economic survey data was enough to extend the historic bond rally—10s fell a staggering 13 basis points after ISM was released. Witnessing the economic slowdown picking up steam, investors piled into the long end of the curve for duration and outsized price appreciation in the face of falling rates that comes with it:

Speaking of anticipating falling rates, 2s fell 14 basis points to close out the week after ISM’s release. Investors are pricing for the Fed to cut rates, not singularly because of Friday’s dour print, but because of the totality of economic data shifting similarly dour:

Here’s the US Treasury rally broken up by tenor—unlike the myriad of false summits we’ve experienced throughout the last year and change, this rally has a decidedly definitive tone to it. The magnitude and swiftness of it paired with the lack of meaningful pullback suggests this is the real deal—the cycle shift:

Despite Powell’s attempts later in the day at a speaking engagement to quell the rally, with two full rate cuts priced in by June 2024. The Fed doesn’t set interest rates in the US Treasury market; it sets out to influence them using a narrow set of tools. Policy rate targeting has worn off in its effectiveness in influencing the UST market, and now Fed speak from the Chairman himself has lost its potency too—all the more reason to believe that this rally is the real deal:

On the bitcoin front, the SEC has indicated that potential approval orders for pending spot bitcoin ETF applications may come on January 8th, 9th, or 10th. These three dates are the three weekdays following the opening of the SEC’s rebuttal comment period to the latest and potentially final ETF application amendments. Should we get all applications approved at once, with ETFs going live not long after approval, and optionality galore available to the ostensibly eager hoards of institutional capital, all bets are off.

Next Week

In the week ahead, we will learn a great deal about the state of the US economy. ISM services on Tuesday is just one of several benchmark metrics arriving in the front half of the week. Friday will bring the infamous nonfarm payroll data, including the latest unemployment rate. While we always consider NFP a heavily manipulated and constantly adjusted metric, the more sanguine unemployment rate and how wages are tracking will have our eye. Thankfully there will be no Fed speak to provide the market with noise, and no Treasury auctions to jerk Treasury prices. In this way, we’ll get a decent glimpse into this post-rally period in Treasuries—has the sharp move lower in yields altered the equilibrium for rates? Can they keep falling with economic data that, as we mentioned, is neither brilliant nor catastrophic? The rally in global bonds was this week’s major story—next’s will be to measure if that rally was sustainable. If it is, it means bond investors are treading where others are hesitant to go: toward a strategy that works in a cutting cycle. Enjoy the packed week of data, and keep your eye out for all our analysis as the numbers come in:

If you’re enjoying today’s analysis, consider supporting us by becoming a paid subscriber. As a paid subscriber, you get full access to all research as it drops.

Here are some quick links to all the TBL content you may have missed this week:

Tuesday

First, it was Celsius’ eccentric CEO, Alex Mashinsky, arrested on charges of fraud for his exchange’s practices and offering an unregistered security. Then fell Sam Bankman-Fried, who was arrested and imprisoned on similar charges, making for one of the most ironic last-name-and-prison-sentence combos in history. Both face several hundred years in prison if found guilty.

Changpeng Zhao, or CZ for short, was the last man standing.

The Binance CEO engaged in the same shady practices, such as wash trading and misappropriation of customer funds. We reported on these backroom practices several times here at The Bitcoin Layer, but he simply had yet to be charged.

At long last, his sentencing came in the wake of a brush-clearing campaign by the SEC as it rids the system of as much fraud as it could prior to approval of a spot Bitcoin ETF. Rampant fraud was one of regulators’ last stated reservations before mass spot BTC ETF approvals could commence.

It is cosmically perfect that just over a year on from his speculative attack which sunk FTX, CZ now faces criminal proceedings of his own.

Check out—And Then There Were None.

Wednesday

In this episode, we are joined by Bloomberg Senior ETF Analyst Eric Balchunas. Eric breaks down the latest in BlackRock's and Fidelity's efforts to achieve approval for their bitcoin spot ETFs. His expectation is for approval early next year based on the SEC's latest requests and shares his thoughts on Binance and Coinbase.

Check out—Bloomberg Analyst: Bitcoin ETFs Are A Done Deal

Thursday

Earlier this week, Joe welcomed us all back from the Thanksgiving holiday with a takedown of CZ and Binance. After all, Joe had been banging the table that Binance as it currently existed would succumb to charges of fraud or failure—criminal prosecution was the ultimate route.

Today, Nik takes the wheel with a timely chart pack. Momentum in rates shifted in November—a stunning move that has left many speechless. Not this writer: while I easily admit that early calls to a Fed pause and early calls for a rates peak were not my most accurately timed predictions, they were simply early. The Fed has now been on pause for the back half of 2023, and rate cuts are right around the corner. How soon? Again, we might be early, but we won’t be wrong.

Over the last month of the year, Joe and I will continue to provide you with the latest research and analysis in both bitcoin and global rates markets. Readers’ most frequent questions are often answered via this platform—I have a pair of pieces underway on liquidity (following up with more on RRP and China) and on the top economic indicators to watch heading into a 2024 recession that I’m excited for you to read. While we produce a ton of written and video/audio content every week, our Tuesday and Thursday publications—only available to paid subscribers—really drive TBL’s core research. By joining that contingent, you are sending us a signal.

Lately, I’ve been slightly dumbfounded at the speed and strength of the global bond rally—these types of moves often happen right in front of our noses. But when they do, we must recognize them for what they are: a warning sign.

Check out—Have you recognized this warning sign?

Friday

In this episode, Joe breaks down the ISM Manufacturing survey for November into its subcomponents, explaining why the survey hasn't contracted as quickly as previous cycles and why the rates market's reaction has an equal shot at overdoing it as it has at being correct in preparing for the worst.

Check out—Data Worsens & Rates Plummet As Powell Tries To Pump The Brakes

Our videos are on major podcast platforms—take us with you on the go!

Apple Podcasts Spotify Fountain

Keep up with The Bitcoin Layer by following our social media!

YouTube Twitter LinkedIn Instagram TikTok

That’s all for our markets recap—have a great weekend, everyone!

River is the Bitcoin exchange of choice for the long-term investor.

Securely buy Bitcoin at the tightest spreads in the industry, have peace of mind thanks to their 100% full-reserve cold storage custody, and enjoy zero fees on recurring orders. Need help? They have US-based phone support for all clients.

Invest in Bitcoin with confidence at River.com/TBL for $5 free when you buy $100 in Bitcoin.