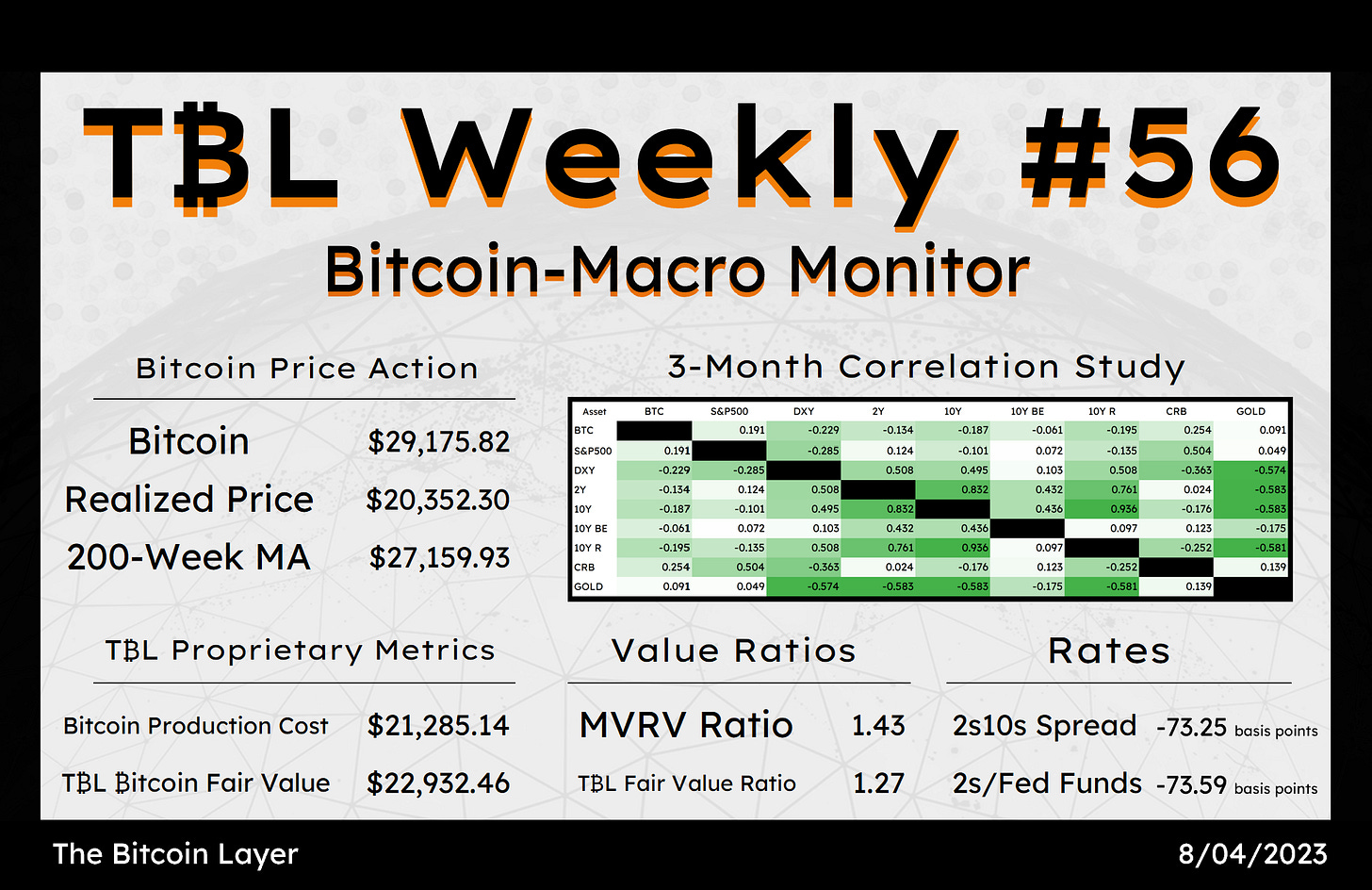

Welcome to TBL Weekly #56—the free weekly newsletter that keeps you in the know across bitcoin, rates, risk, and macro. Grab a coffee, and let’s dive in.

Invest in Bitcoin with confidence at River.com

Securely buy Bitcoin with 100% full-reserve custody, enjoy zero fees on recurring orders, and even buy a hosted Bitcoin miner, completely hassle-free.

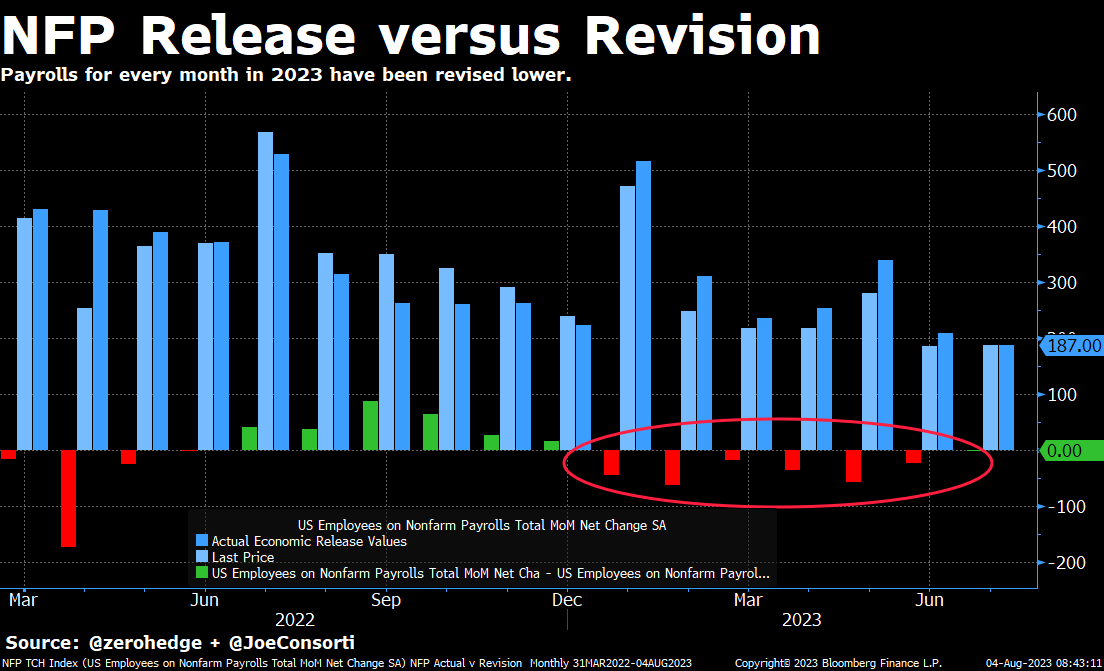

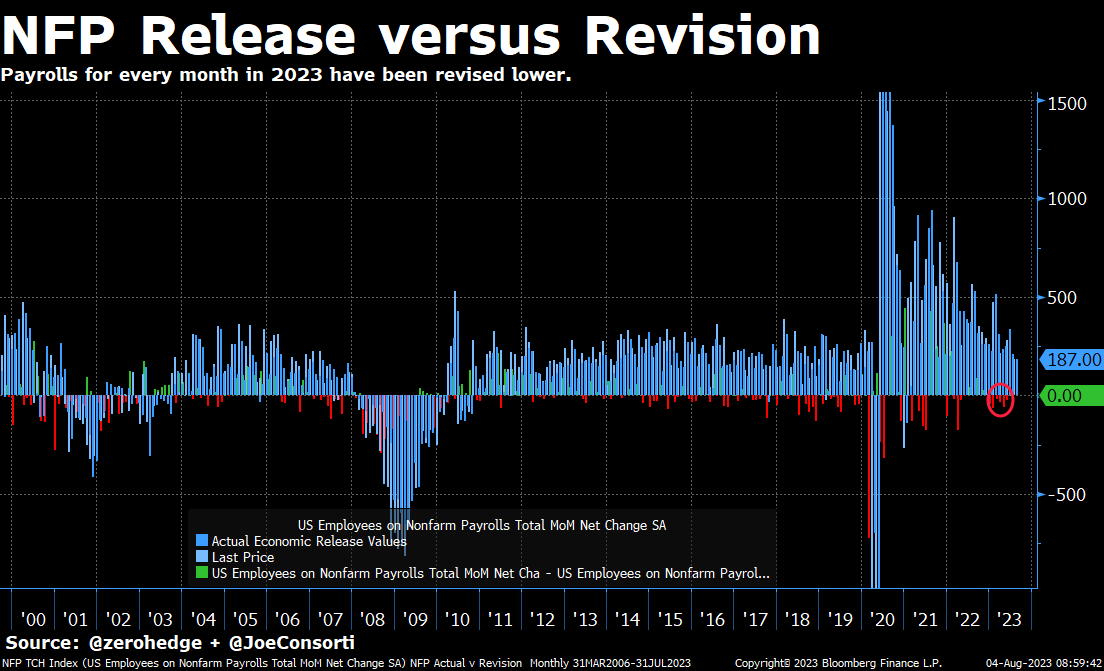

US payroll gains missed expectations yesterday, rising by just 187,000 versus the 200,000 addition that was expected. This is a slowdown from the 209,000 jobs added in June. Well, that would’ve been the case, but June’s job gains were revised down by 24,000 jobs to 185,000. That marks the 6th month in a row of weaker-than-expected payrolls—something that has never happened in the last 25 years. These more frequent downward revisions in labor data are typical of the final few months before an economic recession:

Here's a zoomed-out view. Clusters of downward revisions appear before recessions, then payroll gains usually turn into payroll losses. It's never been this persistent, though—again, 6 straight months of downward NFP revisions haven’t happened in the last 3 recessions experienced in the US. We are at the stage of the cycle where the strength of the labor market, and probably the economy at large, is wildly overestimated, either maliciously or out of stupidity.

Then again, is there a difference?

Also of note, July part-time workers rose by 972,000, while full-time workers dropped by -585,000 and multiple jobholders rose by 118,000. Full-time workers are declining, and people are increasingly taking on part-time roles, several of them at once, in order to make ends meet.

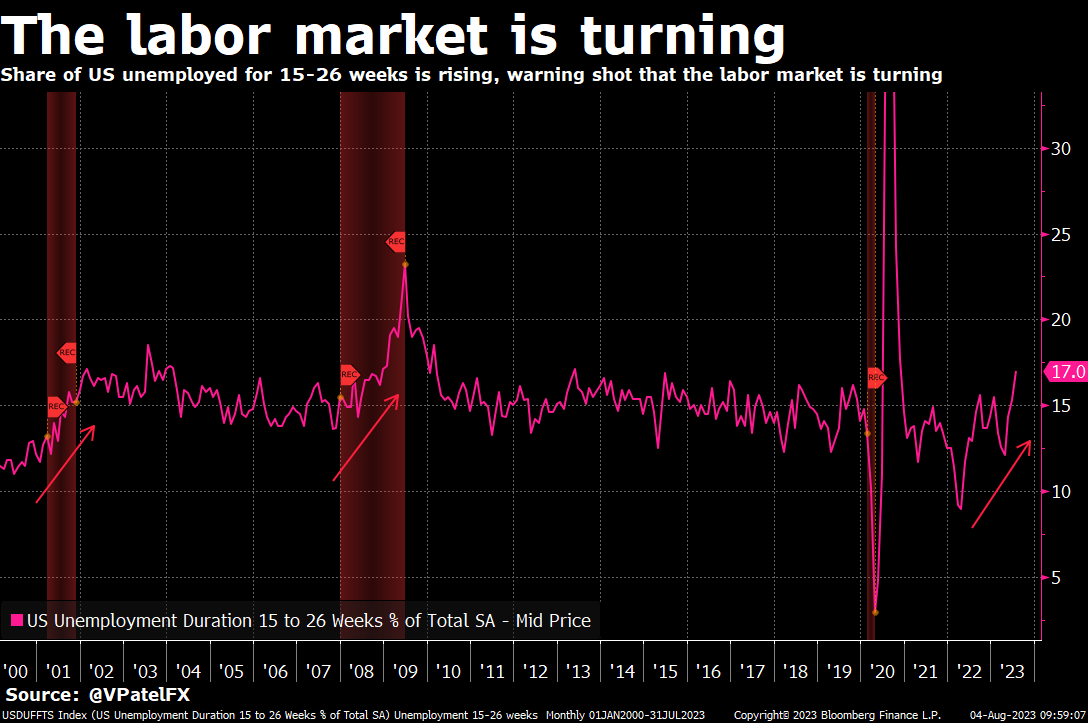

The US labor market is turning.

People who’ve been unemployed for 15-26 weeks have risen for 3 straight months—from 12.1% in April to 17% as of yesterday’s data. This means that more people are losing their jobs and not finding new ones. This only happens when the labor market is unraveling. And as goes the labor market, so too goes the US economy. A rise in those 15-26 weeks unemployed as a percentage of total unemployment was a recessionary warning shot in 2000, 2007, and again today:

With job market jitters spreading across the economy like a thick morning fog and CPI inflation nearly back at the Fed’s long-run 2% target, the Fed’s rate hikes are now squarely focused on impairing banks’ assets.

Last Friday marked the fifth bank failure this year, as Heartland Tri-State Bank went insolvent after trading hours. It had $139 million in total assets, a relatively small regional bank in Kansas, not as large as the other banks that have gone belly-up in 2023. The disconcerting foil is the $54.2 million in losses that caused them to go insolvent—losses nearing 40% of the size of the bank.

Therein lies the problem with the Fed’s management of the banking turmoil so far: many small banks whose assets don’t meet the requirements for emergency loans can’t help but go insolvent while the bigger banks are protected.

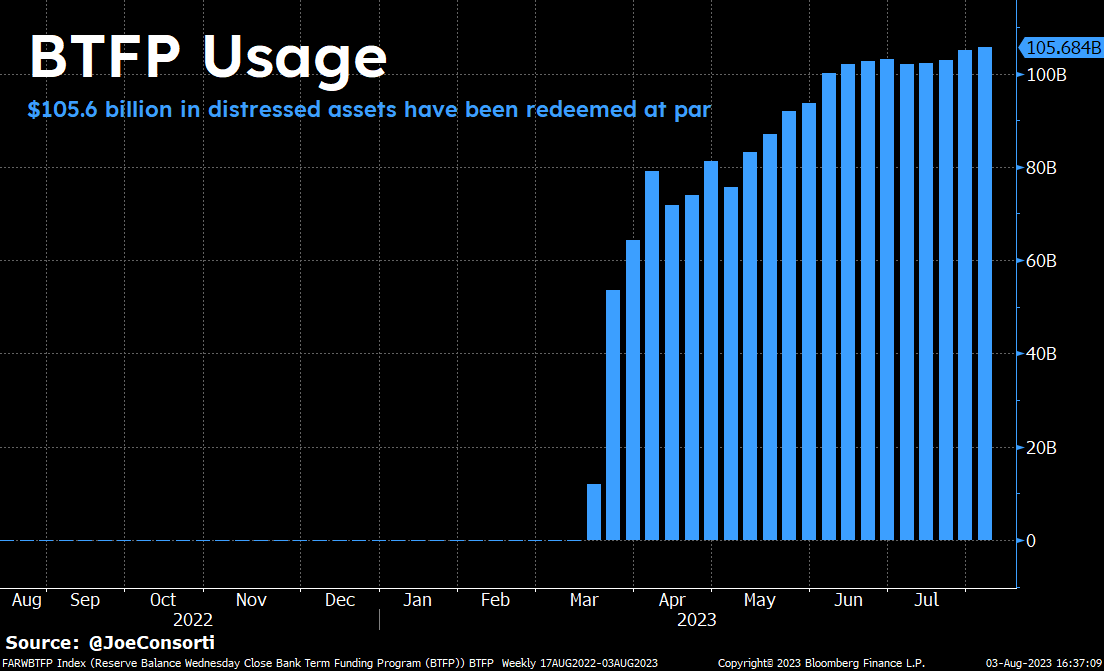

The Fed's BTFP facility is $105.6 billion in size. Unrealized losses on US Treasuries total $1.1 trillion. That means roughly 1/10th of duration losses caused in part by the Fed's rate hikes are being papered over. That's a pretty big band-aid. And it’s a band-aid inaccessible by banks like Heartland Tri-State: smaller banks who, without the cushion for losses, will fail and be absorbed by bigger fish:

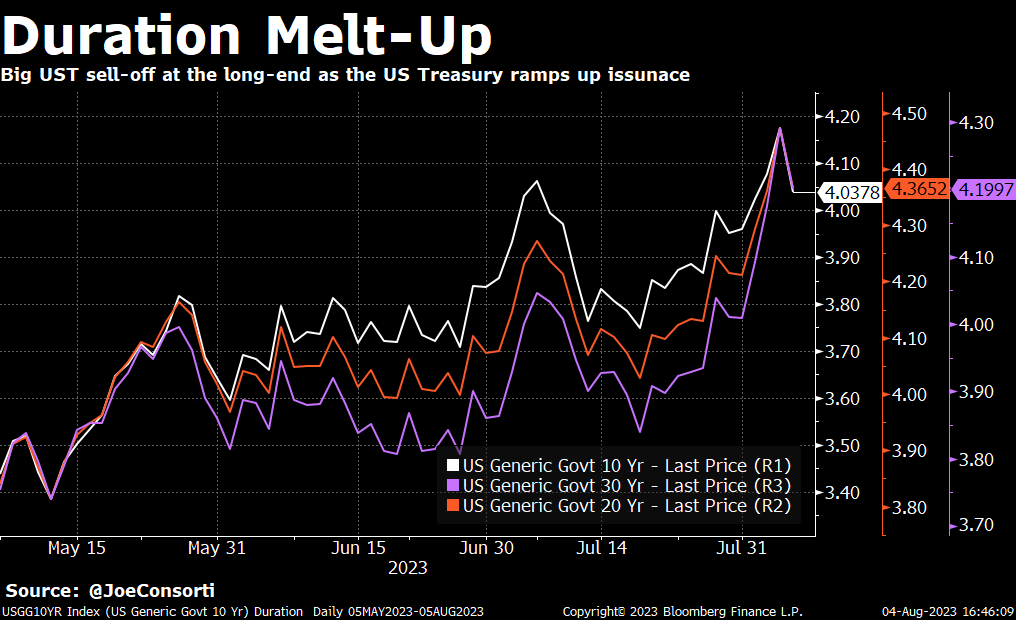

US Treasuries had an absolutely wild week. From last week’s close at 3.95% to 4.20% all the way back to closing at 4.04% in an enormous “outside” day for 10s. An outside day happens when today’s candle has a higher high and a higher low than yesterday’s. It can indicate a reversal, but absent being a trading signal, the price action yesterday was marvelous to observe. Just as everybody was calling for the supply tsunami to send interest rates through 5%, Treasury shorts took a large hit as rates put in a strong performance into the afternoon session:

US Treasury 30-year yields were up 22 basis points on the week due to a massive relative increase in long-term Treasuries to be issued in the fourth quarter—yield curves steepened materially this week. Things have finally gotten interesting again in the rates world, as Treasury supply and Fed hawkishness keep rates elevated, which put risk in jeopardy, which makes the less risky Treasuries seem attractive. This loop, which we discussed in greater detail in our Thursday post, will dominate investors’ minds for the rest of the year. Not to mention the corporate borrowing and mortgage rates which are marching higher as their respective UST reference rates rise. Godspeed, economy.

One final chart to leave you with. As the S&P 500’s companies have all but completed a resilient Q2 earnings season, will there be enough positive catalysts to keep it from breaking below this 9-month-long trendline? We’ll know next week.

Next Week

In the week ahead, we’ll see if the disinflation wave is finally taking a break. CPI is expected to rise from 3% to 3.3%, and energy prices would certainly echo such an increase. We would argue that with everything the Fed has said over the past couple of months about the tight labor market, inflation that is anywhere north of 2.00000% will be considered out of line and justification for “higher for longer.” Said otherwise, inflation bouncing around between 2.5% and 4% will be enough to keep the Fed fully hawkish—a plummet from 9% to 3% did nothing to wake the doves. With some rates volatility and some equity investors spooked by higher rates, markets will mostly have their eyes on, well, themselves outside of Thursday’s CPI:

Foundation Devices is self-custody done right.

Start with their easy-to-use and private mobile wallet with Envoy, then transfer it to the most intuitive hardware wallet in Bitcoin with Passport.

If you’ve been on the fence about taking your bitcoin off of exchanges, Foundation’s suite of intuitive self-custody solutions is for you.

Take custody of your Bitcoin today by visiting foundationdevices.com

If you’re enjoying today’s analysis, consider supporting us by becoming a paid subscriber. As a paid subscriber, you get full access to all research as it drops.

Here are your quick links to all of the TBL content for the week:

Monday

In this episode, we are joined by River Founder and CEO Alex Leishman. Alex takes us through his bitcoin journey, starting in 2012, and explains his path toward starting River and his mission to onboard in the easiest and safest way possible. They discuss the state of Lightning Network, what he's optimistic about regarding bitcoin adoption, and some of his cypherpunk inspirations.

Check out—Cypherpunks & Lightning Network | Alex Leishman

Tuesday

Just like the US, Japan’s central bank plays a role in its own government bond market.

Last Friday, the Bank of Japan announced that it would loosen its interest rate target on the 10-year JGB from 0.5% to 1%.

This action promoted a swift selloff that caused the BoJ to intervene with an emergency bond-buying operation. Recall that fast government bond selloffs can leave some important owners unprepared for the volatility and lead to important financial institutions such as pension funds failing—think last September in the UK before the Bank of England intervened.

Check out—Japan Back To QE After 48 Hours, US Banks Tighten Lending, and Bitcoin Is A Stablecoin

Wednesday

In this episode, TBL Africa correspondent Noelyne Sumba is joined by Nikolai Tjongarero (Okin). Okin is the visionary founder of okinent.com. They delve into the world of Bitcoin in Africa. Discover the innovative ways to earn and utilize Bitcoin through content creation, encompassing realms like music, podcasts, art, and beyond. They explore the intersection of technology, creativity, and education, shaping the future of Africa's Bitcoin economy.

Check out—Bitcoin Is Reshaping Namibia's Commerce | Okin

Thursday

The United States government’s credit rating was just downgraded from AAA. Again, just by another agency. Jokes aside, ratings agencies are simply lagging indicators on market fundamentals. In the case of the United States, debt to GDP of 118% doesn’t exactly scream AAA, and so a downgrade doesn’t tell anything we couldn’t already see for ourselves. Markets also don’t care—they price in events months and years before ratings agencies react. Headlines on the downgrade were a day too early to capture the real story: the US Treasury is about to hit the market with a debt bomb.

Check out—Yields Melt Up: Treasury Duration Hitting Markets Now

Friday

In this episode, we are joined by author and economist Saifedean Ammous. @saifedean teaches us the principles of economics from his latest book and attributes human flourishing to our capitalistic system. Nik asks Saifedean about the general idea of owning stocks versus owning government bonds and why trade brings about peaceful interaction.

Check out—Unapologetic Capitalism Drives Human Flourishing | Saifedean Ammous

Our videos are on major podcast platforms—take us with you on the go!

Apple Podcasts Spotify Fountain

Keep up with The Bitcoin Layer by following our social media!

YouTube Twitter LinkedIn Instagram TikTok

That’s all for our markets recap—have a great weekend, everyone!

River is the Bitcoin exchange of choice for the long-term investor.

Securely buy Bitcoin with 100% full-reserve custody, enjoy zero fees on recurring orders, and even buy a hosted Bitcoin miner, completely hassle-free.

Invest in Bitcoin with confidence at River.com

🙏🙏👍