Largest Bitcoin Block Ever, Red-Hot Surprises in Economic Data: TBL Weekly #30

We've got you covered on all the latest in bitcoin and macro.

Welcome to TBL Weekly #30—the free weekly newsletter that keeps you in the know with everything going on in markets. Let’s dive in.

Bitcoin-Macro Monitor

Just quickly grabbing the headlines? Here’s your rapid-fire recap of the relevant action in bitcoin and macro:

Refer to TBL’s Bitcoin & Macro Term Glossary: thebitcoinlayer.com/glossary

Bitcoin ends yet another week in the green, moving ~$400 higher from last week’s Friday close. Consistent strength, alongside the looming Fed pause, leads to our cautious optimism that we have shifted into a more favorable price regime for bitcoin.

The S&P 500 has had a strong start to 2023 as investors shrug off recession worries and instead focus on less restrictive liquidity. We believe bitcoin and equities are expressing similar factorizations of forward monetary policy.

Both yield curves we watch closely remain in deep inversion territory—2s10s won’t un-invert until the Fed starts signaling for cuts. To be fair, neither will the difference between Fed Funds and 2s: without a declining Fed Funds, a disinflationary environment should lead rates traders to embrace any yield that can be locked in for two years or five years. Weak inflation and a generally injured economy lead to this inversion, make no mistake.

There are your headlines, now let’s take a comprehensive look under the hood.

This weekly update is brought to you by Cash App. Don’t miss our ad on Instagram!

Markets Analysis

This Wednesday, the largest bitcoin block ever was confirmed on the bitcoin blockchain at block height 774628, with a total size of 3.96 megabytes—far larger than the standard 1-2 MB block size limit.

How was this made possible? With the Taproot upgrade, individual satoshis can be tracked and imbued with unique meaning—in this case, a .jpeg of a wizard was inscribed onto a specific sat, transacted, confirmed, and appended onto the blockchain in that odd, ~4 MB size.

This is ordinal theory in practice. While we have yet to develop robust personal theses on whether or not this should be “allowed,” we remind ourselves that nobody controls bitcoin, and users get to decide how they use the blockchain. Was the Taproot upgrade arguably rushed out the door? We will be taking in the opinions of experts in this field to assess if there’s any true danger to bitcoin’s architecture. As a reminder, larger block sizes mean larger disk space required to house a copy of bitcoin’s full blockchain, making it more difficult to own and operate a full node, which threatens the decentralization of bitcoin that is enabled in part by the small size of its main blockchain.

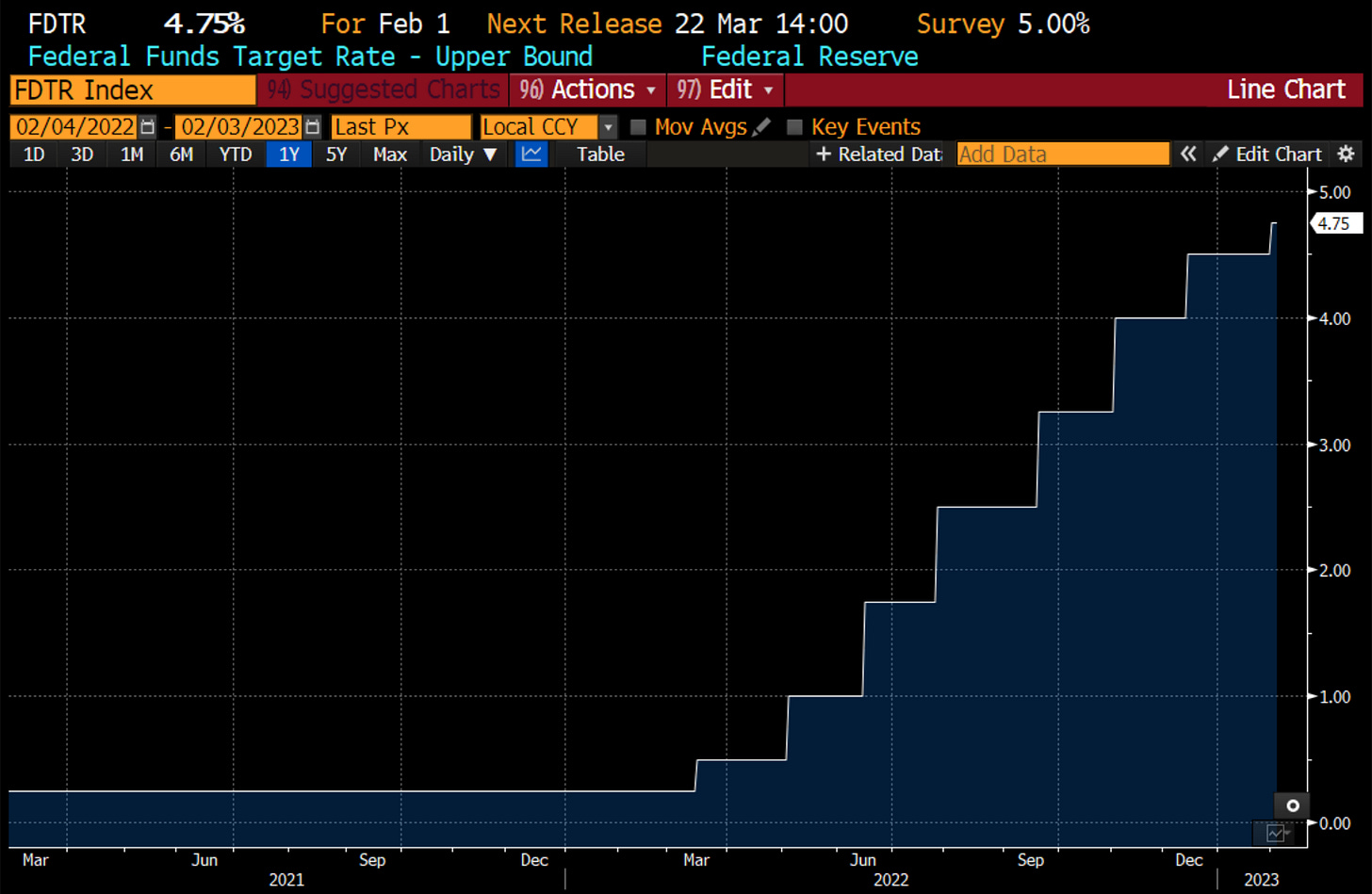

An Expected FOMC Rate Hike Downshift

The decision by the Fed to downshift the pace of policy rate hikes from 50 to 25 basis point increments was well-telegraphed and therefore directly in line with market expectations. The playbook of Jerome Powell’s Fed for the entire cycle has been: clear and explicit forward guidance, well ahead of time, correcting the market if it misinterprets. So far, this playbook has worked.

The downshift to 25 bps hikes along with the rest of the Fed’s moves this cycle have been readily forecasted before they take place, allowing the Fed to steer clear of causing any panic that may lead to a liquidity or credit event. The real test will be whether or not the Fed can maintain this zero-meltdown track record all the way through bringing inflation back down to its 2% target.

An Unexpected Pair of Hot Labor & Services Prints

Closing out a week stuffed to the gills with market action, those hoping for a respite from the action on Friday were disappointed as two data releases surprised even the wildest analyst expectations.

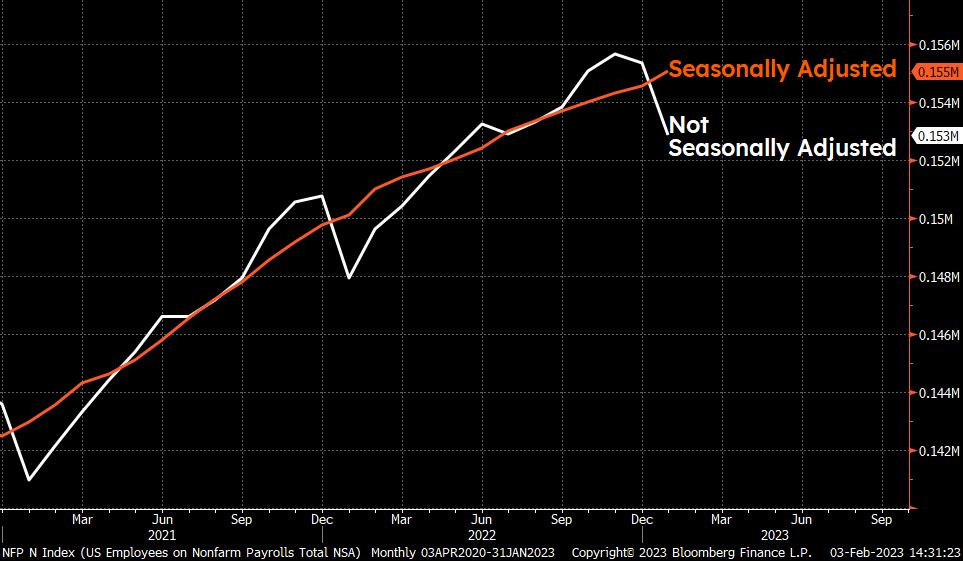

The first of these shocks was Seasonally-Adjusted Nonfarm Payrolls, which added 517,000 jobs in January, eye-wateringly higher than the survey estimate of 188,000:

However, there are two asterisks to this record-strong-labor-market narrative. First is Non Seasonally-Adjusted Nonfarm Payrolls, which regularly fall every post-holiday season—as such, this staggeringly high headline NFP print is largely if not entirely due to the seasonal adjustment. Outright labor market strength can’t be honestly inferred from this:

The second is ADP employment data, which clocked 108,000 jobs added in January down from 235,000 prior. This non-seasonally adjusted value should perhaps be taken with more salt than the headline, trumped-up, and adjusted value that is seasonally adjusted NFP.

The second surprise we received yesterday was the ISM Services Survey, which came in piping hot at 55.2, moving back into expansion from 49.6 prior and much stronger than the 50.5 expectation. However, such a large beat is not out of the ordinary; here we’ve circled a few instances in recent years that are of the same magnitude as this one—nothing to write home about, particularly if the letter’s topic is a booming services sector:

Despite these two colossal upside surprises in economic strength, which ostensibly give the Fed more room to tighten in the eyes of mainstream pundits, markets remain unfazed. Markets aren’t afraid of a wage-price spiral from a single positive jobs print. The market views these prints as innocuous outliers in a secular downtrend within labor and services, not a reversal or “second wave” of growth and inflation.

The Week Ahead

In the week ahead, we look forward to the distinct lack of economic data, as markets will have a full week of digestion and price discovery following this frantic week of important market-moving events. Of the new data, we will have our eye on the preliminary University of Michigan Consumer Sentiment survey for February which will shed some light on how the consumer is faring with tight policy continuing to transmit through the real economy:

If you’re enjoying today’s analysis, consider supporting us by becoming a paid subscriber. As a paid subscriber, you get full access to all research as it drops.

Here are your quick links to all of the TBL content for the week:

In our featured episode this week, Nik delivers a lecture to his students at USC Marshall School of Business about the Lightning Network. He covers its function as a payments solution for bitcoin, its instant speed and capacity, and why Cash App's new Lightning Network integration is revolutionary for ease of use and bitcoin adoption:

Wednesday

The February FOMC meeting has concluded, and with it, a downshifted rate increase of 25 basis points and another round of Fed rhetoric to be digested by the markets.

During the question period, Powell responded to one about the risks of overtightening versus not doing enough:

We have no desire to overtighten, but if we go too far and inflation is coming down faster than we expect, then we do have tools that we can work on that.

Wow! Markets had a field day with this one. Judging by the market’s reaction to this statement, it seemed to have interpreted the Fed’s remarks as a soft pivot. The mere indication of a nearing terminal rate and a future reversal in policy was enough to send risk sentiment through the ceiling.

2s shed a staggering 15 basis points from their high of the day, down to 4.10%:

All told, a meeting that unveiled the Fed is observing rapid disinflation and has adjusted its stance marginally—away from murder inflation at all costs to we’re getting what we want in slowing inflation, let’s maximize our odds of a soft landing by focusing on when to pause. If market pricing is any indication, the March meeting could hold the final rate hike of this cycle.

Let’s unpack all of the relevant information, dissect the rates market’s reaction, and note the forward market implications as we approach the end of the Fed’s hiking cycle.

Check out Powell's soft pivot, rates reaction

Joe starred in our Twitter promo for Cash App’s Lightning Network integration, which allows bitcoin to be transacted near-instantly and for free via Lightning over Cash App:

We thank you for your… uh… kind words in the comment section, as always:

Thursday

In this episode, Joe and Nik are joined by Dr. Jeff Ross to discuss the Fed's 25 basis point rate hike, the market's reaction to the FOMC statement and Powell's presser, and the favorable setup for risk assets as a Fed pause draws closer:

Friday

I am teaching bitcoin in a university setting for the first time this semester. The early weeks have been nothing short of thrilling—as somebody who loves bitcoin and enjoys teaching, I am finding joy in breaking bitcoin down, from the beginning, in an extended form. Bitcoin's scaling solution is maturing. Lightning Network adoption is about to take the next leap.

Check out Nik’s latest in Lightning Network Is Now Synonymous with Bitcoin

Last but not least, in this episode, Nik sits down with Mags Gronowska, an advisor at PRTI and a Quadriga Bankruptcy Inspector. Mags discusses her passion for bitcoin education, the recent developments in international bitcoin mining policy, and emerging markets where bitcoin is being used to unlock a higher echelon of human freedom:

Our videos are on major podcast platforms—take us with you on the go!

Apple Podcasts Spotify Fountain

Keep up with The Bitcoin Layer by following our social media

YouTube Twitter LinkedIn Instagram TikTok

That’s all for our bitcoin and macro recap—have a great weekend everybody!

The Bitcoin Layer does not provide investment advice.