Leveraged-longs get liquidated, good economic news is bad news for markets: TBL Weekly #34

Welcome to TBL Weekly #33—the free weekly newsletter that keeps you in the know across bitcoin, rates, risk, and macro. Grab a coffee, and let’s dive in.

Bitcoin pukes in a mighty leveraged-long liquidation cascade

A less desirable characteristic of bitcoin is its overabundance of leveraged speculators, and last night we got yet another taste of what can happen when too many of them are caught offside when the price moves against them.

Bitcoin absorbed $61.48 million in long liquidations late Thursday evening, sending the price down roughly 5%—compared to the selloff observed last year, this is peanuts:

If we look at aggregated open interest—the total amount of bitcoin perpetual futures contracts open—we see that February’s rally was fuelled by leverage, all of which is now liquidated, some 2.5 billion contracts worth. To borrow a term coined by our friend Dr. Jeff Ross, this was another all-too-familiar LLLC, or leveraged-long liquidation cascade, and bitcoin finds itself back at square one:

After last evening’s dramatic after-hours selloff, which is nothing new to bitcoin, we find ourselves back roughly where February began at $22,380—bitcoin’s second rejection of its 200-week moving average:

The market’s reaction function has changed

Economic data has been robust as of late. As data relesases have surprised to the upside for many weeks now, more rate hikes have been priced into the market, with the terminal rate pushed all the way out to September, and cuts are entirely priced out of possibility for this year.

The Citi Economic Surprise Index measures data surprises relative to market expectations. A positive reading means that data releases have been stronger than expected, and a negative one means that data releases have been worse than expected. January saw data releases come in worse than expected and the stock market did well, whereas February saw all upside surprises in the economy and stocks sold off. In other words, we are in a regime where good news is bad news:

This all has to do with how the market’s reaction function has changed. The Fed keeps its eye on the market and expectations for monetary policy, while markets keenly observe economic data and how it may influence Fed policy—markets and the Fed have a reflexive relationship with one another.

These relative results matter a lot, and during January, when economic data was worsening, the market rallied, expecting that the Fed would pause hikes and ease policy in response to the weakening economy. Now that upside surprises occurred all throughout February, the reverse is happening: the market is expecting the Fed will be able to have a restrictive monetary policy stance for longer. The narrative has shifted from “Fed pause soon, let’s rally” to “the labor market is clearly very tight, and personal consumer spending is not falling, the Fed has way more room to hike.”

This is why rates are up so much. We do, however, have our eye on US Treasury 30-year yields in particular. A reluctance thus far, including a notable rejection today, for traders to allow yields in this part of the curve to drift above 4% speaks volumes. The below is the weekly chart, in which you can see that 30s are trying to move higher but the momentum is fading.

On a more daily look, we’re seeing about 10 sessions in a row in which 30s neared or eclipsed 4% but failed to do so, concluding with today’s strong bid and further curve flattening.

In Europe, new highs in yield are being achieved, a different story than in the US Treasury longer end of the yield curve. Bunds had a major breakout this week, pushing above the 2.50% resistance level and closing in on 2.75%—investors continue selling bunds as inflation has yet to see material decline across the Eurozone, and the expectation is that policy rates will be kept elevated until inflation can turn the corner:

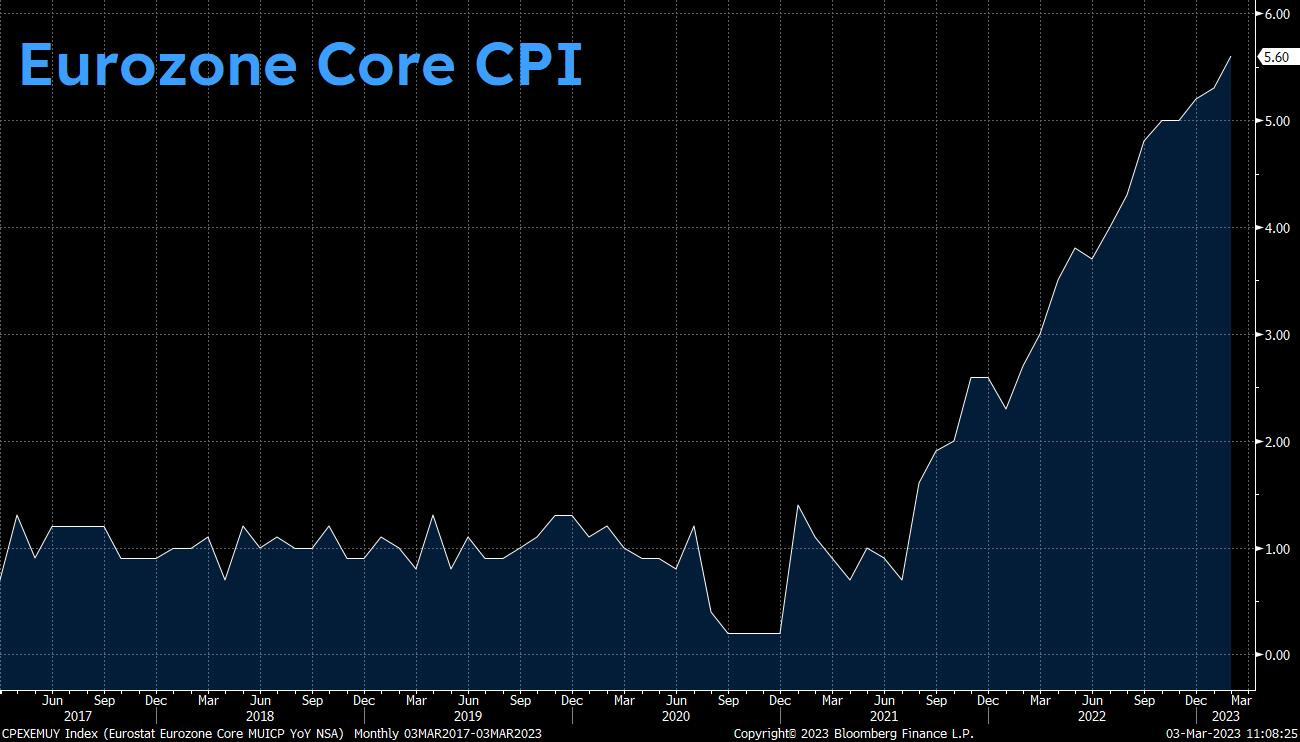

Here’s Eurozone Core CPI which just updated yesterday—yet another increase in the pace of core price inflation to 5.6% year-over-year. The ECB is honing in on getting this under control with more rate increases and QT now underway. Strength in the euro weakens the US dollar on a relative basis and is, all else being equal, a tailwind to risk assets:

The Week Ahead

In the week ahead, we’ll be keenly observing factory orders as a confirmation for the strong PMIs as of late and whether strong business activity is slated to continue or reverse, but the star of the week will be the release of the unemployment rate for the month of February to give us an indication on the tightness of the labor market, and what that infers for the path of Fed policy:

Bitcoin-Macro Monitor

Refer to our Bitcoin & Macro Term Glossary for more information: thebitcoinlayer.com/glossary

If you’re enjoying today’s analysis, consider supporting us by becoming a paid subscriber. As a paid subscriber, you get full access to all research as it drops.

Here are your quick links to all of the TBL content for the week:

Tuesday

In this episode, Joe discusses last week’s upside surprise in core PCE inflation, why the Fed's preferred inflation metric gives it clearance to hold higher for longer, and how it, in addition to other robust economic data, is moving the markets to adjust to tighter monetary policy with a lower possibility of easing in 2023:

Wednesday

Mortgage applications are at a fresh 28-year low and down 44% from last year. Housing prices have been falling for almost a year—six-month annualized rates are now negative across the entire nation, and soon the annual rates will also be in the red. Manufacturing firms in the US have indicated contractionary conditions regarding new orders several months in a row. Despite a resilient services sector and solid (though unconvincing) employment data, the US economy is not in great shape. You might wonder, why?

Check out—The Plane Must Land

Dr. Jeff Ross, Founder & CEO of Vailshire Capital Management LLC, releases a monthly portfolio and markets update for his clients. Thanks to him, we’re privileged to distribute his excellent work to you, our alpha-hungry TBL readers.

He walks through current market conditions, portfolio updates, and what he’s paying close attention to across the real economy and markets. Read his update here.

Thursday

In this episode, Joe sits down with Caitlin Long, Founder and CEO of Custodia Bank, which plans to specialize in digital asset payment and custody solutions for US commercial customers.

Caitlin discusses how regulatory bodies have been warned for years that leverage and crypto do not mix, the Ex-Post crackdowns coming in the wake of FTX, and the progress on folding good faith bitcoin financial institutions into the regulatory window:

Our videos are on major podcast platforms—take us with you on the go!

Apple Podcasts Spotify Fountain

Keep up with The Bitcoin Layer by following our social media

YouTube Twitter LinkedIn Instagram TikTok

That’s all for our bitcoin and macro recap—have a great weekend everybody!

The Bitcoin Layer does not provide investment advice.

An absolute mega week of content. The interview with Pierre was enlightening and inspiring, and the partnership with Dr Jeff Ross was a dream come true. TBL is the best content out there in the bitcoin space right now.