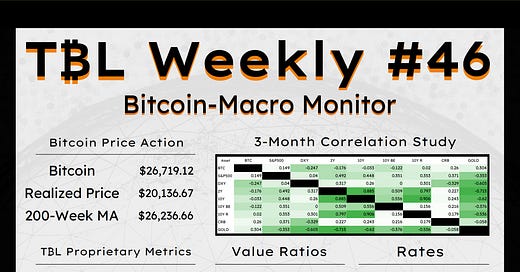

Market Soars Like The Roaring '20s, Robust Data Brings Rate Hikes Back: TBL Weekly #46

Welcome to TBL Weekly #46—the free weekly newsletter that keeps you in the know across bitcoin, rates, risk, and macro. Grab a coffee, and let’s dive in.

Envoy is an easy-to-use Bitcoin mobile wallet with powerful account management & privacy features.

Set it up on your phone in 60 seconds then set it, forget it, and enjoy a zen-like state of finally taking your Bitcoin off of exchanges and into your own hands.

Download it today for free on the iOS App Store or the Google Play Store.

Kicking things off with a quick update on the US government’s funding situation, the US Treasury is now left with a meager $38.83 billion in its cash balance—some 2-3 days’ worth of cash needs left before the US can no longer fund itself due to the debt ceiling precluding it from new debt issuance. This freeze on UST issuance has only exacerbated the global dollar shortage, eliciting more nations to begin capital controls in an effort to stem the outflow of US dollars. Should a debt ceiling resolution not be reached in time, expect this cash balance to dwindle down to near-zero before we see government employee furloughs, the shutdown of national parks, and a GOVERNMENT SHUTDOWN emblazoned in big red letters across every news chyron in the country. Like the innumerable other “shutdowns”, it will be temporary:

The roaring ‘20s all over again

Year-to-date, this is the Nasdaq's best-performing year of the last 30—with a whopping 31.6% returns in just 5 months. Remember folks, never underestimate the power of using the word 'AI' on earnings calls:

NVIDIA also reached its highest market cap ever this week of $962 billion, doubling in size during the same 14-month period that the Fed’s main policy rate rose from 0.25% to 5.25%—a remarkable display of risk-loving animal spirits bidding up the riskiest equities of the bunch despite a substantially higher cost of capital not supporting them on a fundamental level:

The record-breaking performance of highly-interest-rate-sensitive stocks we have seen in the last five months may fly in the face of “efficient markets”, but ultimately it is more fruitful to understand why it is happening. Is there any impetus for these absurd levels of risk-taking and equity bidding? We can only venture a probabilistic guess: this is likely a combination of global liquidity rising since last October paired with rejuvenated risk-taking behavior thanks to the Fed pausing rate hikes in the near term and the AI-boom.

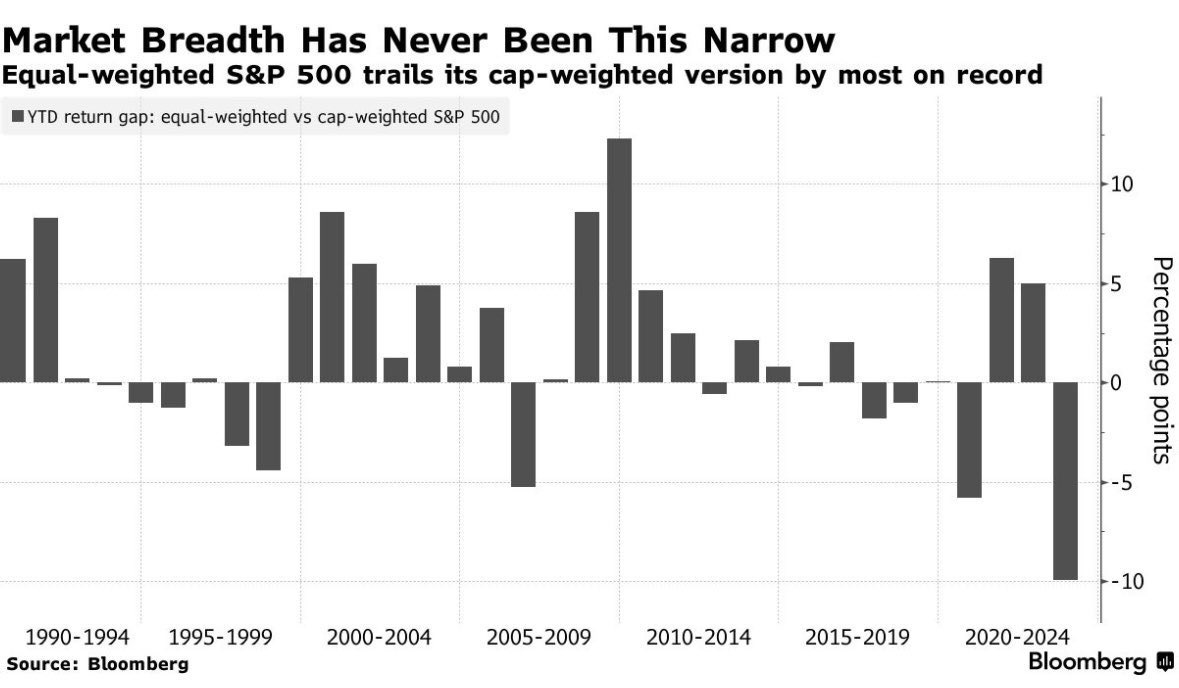

Not unlike the 1999 dot-com bubble, major equity indices are being led by one or a few key names that make up the lion’s share of outperformance. Piggybacking on the buzzword that is Artificial Intelligence or AI, the market is running almost entirely on the fumes of NVIDIA and friends—breadth has never been this narrow. While not a sign of imminent doom for the stock market, it illustrates the fragile foundation that recent performance can thank, and how severe a reversal could be when these players eventually lose steam:

Growth hiccups in recent economic data

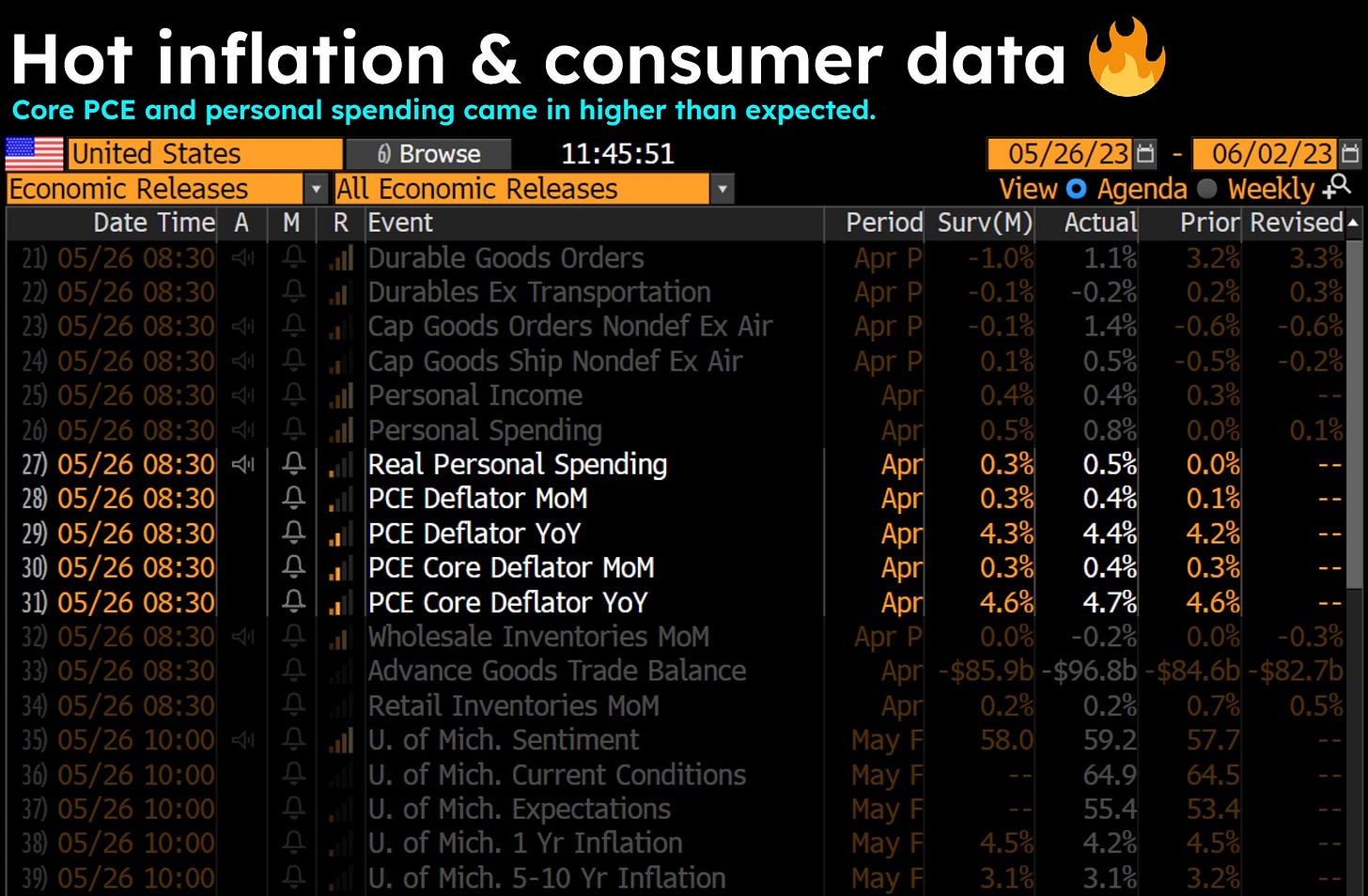

The Fed’s preferred inflation measure is PCE, since their interest rate-setting has more direct passthrough to personal consumption than other measures. Yesterday, real personal spending rose in tandem with headline and core PCE, a combo of robust consumer strength that almost certainly elicited a hawkish Fed reaction function:

After pricing in exclusively cuts following March and April’s bank failures, the Fed Funds futures market has whipsawed back in the other direction thanks to these stronger-than-expected reads on consumer spending—a full 25-bps hike is now priced back in by the July Fed meeting:

The 2sFFs curve has become less inverted by 33 bps in one week, narrowing the proverbial gap between where the market thinks Fed Funds should be and where the Fed has set it:

Emergency loan facilities are regularly utilized by the banks that need them, supporting liquidity and allowing credit creation to continue normally. The Fed’s management of the credit cycle has worked as intended so far: the slowdown in credit creation may be more gradual rather than coming in the form of bank failures thanks to these facilities, currently facilitating $192 billion in outstanding loans to banks:

Credit standards are tightening for consumers, but delinquencies on outstanding loans and credit have yet to rise and are still sitting at record lows, even lower than prior to the pandemic. The passthrough of the Fed’s hikes has not reached the brunt of consumers yet:

With all of this in mind, hikes are back on the table.

Recessions are the process of economic deterioration and slowdown, most often paired with an unwind in the labor market. They are also a continuous process, a cycle, not a discrete state change from 1 to 0 and vice versa. Economic activity is a constant state change, ebbing and flowing from expansion to contraction over the course of several months, corroborated by more data points over time until the totality of the picture is painted one way. The fact is, we simply aren’t there yet where all of the headline data paints the same picture.

We are now experiencing the very early stages of this downturn, but not visible in headline data, and therefore nothing the Fed will care about, nothing risk markets will care about, and something that rates will begin to care about when these growth hiccups subside and the secular downtrend resumes.

One final chart for you to kick off the long weekend. In the background, as the headline data is shifting, quietly but significantly, 3m10y has resteepened by 45 bps in two weeks—a curve that always signals recession by the time it normalizes. Remember: no cycle is a clean expansion or contraction, there are bumps along the way. This round of hot data is a bump, we may not know how long it will last, but the secular downtrend is still intact. Always keep your eye on the ball:

The Week Ahead

In the Memorial Day-shortened week ahead, we have some first-tier data in the form of employment and ISM surveys. Expectations are still for solid data, even though ISM manufacturing will likely remain in contraction. With our analysis today, we are expressing that although cycle position suggests sluggish data, most releases are not enough to cause any panic. Another way to say this is the split of FOMC members discussing waiting for some time to decide the next move. This is also the last week we can hear from the Fed before their June quiet period begins ahead of the June 14th announcement. We should also witness Case Shiller confirming a nationwide annualized decline in home prices:

If you’re enjoying today’s analysis, consider supporting us by becoming a paid subscriber. As a paid subscriber, you get full access to all research as it drops.

Here are your quick links to all of the TBL content for the week:

Tuesday

Memorial Day is upon us, as are summer getaways, low fixed-income volumes, and the hint of perhaps less market action. This is not always the case, however. Last summer brought the thrills and despairs of exchange collapses, one of bitcoin’s historic price drawdowns, and the best Paul Volcker impersonation my generation has ever seen. What will we see this summer? How about a banking crisis and global recession? On Tuesday, we walk you through The Bitcoin Layer’s full summer playbook, including support and resistance levels to watch across rates, stocks, and bitcoin.

Check out—Germany enters recession, dollar charges back

Wednesday

In this episode, Nik sits down with Cognitive Investments Director of Geopolitics Jacob Shapiro. They discuss signs of optimism in US-China relations, Xi Jinping's harsh economic realities, and Taiwan drifting slowly toward China. Jacob also shares his thoughts on India's position as a global tech hub and the latest on the war in Ukraine.

Check out—

Global Update: US-China Relations, India Tech Hub & The War In Ukraine

Thursday

Quick hits from some of the brilliant minds in Nik’s fixed-income class at USC Marshall this year—digestible excerpts to align your thoughts with markets and concepts. As Nik wraps up his fifth semester teaching rates/Fed/macro and first semester teaching bitcoin, we wanted to share some excerpts from the most thought-provoking theses he’s come across yet. Their LinkedIn profiles will be linked too, so feel free to connect and reach out!

Check out—Market Insights on Yield, QT, and Loan Forgiveness

Friday

In this episode, TBL Africa Correspondent Noelyne Sumba sits down with South African developer Kgothatso Ngako to discuss how he is leveraging his technical skills to enable bitcoin use without internet access. Kgothatso describes his path to becoming an entrepreneur, how he gleaned inspiration from countries with separation between state and money as he worked to gain financial independence for the people of Africa, and how central planning simply does not work.

Check out—

Striving for Financial Independence | Bitcoin in Africa with Noelyne Sumba

Our videos are on major podcast platforms—take us with you on the go!

Apple Podcasts Spotify Fountain

Keep up with The Bitcoin Layer by following our social media!

YouTube Twitter LinkedIn Instagram TikTok

That’s all for our bitcoin and macro recap—have a great weekend everybody!

Bitcoin's most intuitive hardware wallet just got cheaper.

Passport is now just $199. Set it up in minutes, take your bitcoin off of exchanges with ease, and experience unmatched peace of mind.

Get it at thebitcoinlayer.com/foundation & receive $10 off with code BITCOINLAYER