Welcome to TBL Weekly #53—the free weekly newsletter that keeps you in the know across bitcoin, rates, risk, and macro. Grab a coffee, and let’s dive in.

Invest in Bitcoin with confidence at River.com

Securely buy Bitcoin with 100% full-reserve custody, enjoy zero fees on recurring orders, and even buy a hosted Bitcoin miner, completely hassle-free.

Foundation Devices is self-custody done right.

Start with their easy-to-use and private mobile wallet with Envoy, then transfer it to the most intuitive hardware wallet in Bitcoin with Passport.

“The only thing we have to fear is the lack of fear in markets.”

— FDR, 1933

If you were born in January, you’d be convinced that markets only had one direction. Here’s a clip from the start of 2023 that highlights the overwhelming euphoria that has engulfed the stock market:

Friday marked a full month that the ‘Fear & Greed Index’ for the stock market was in the Extreme Greed zone:

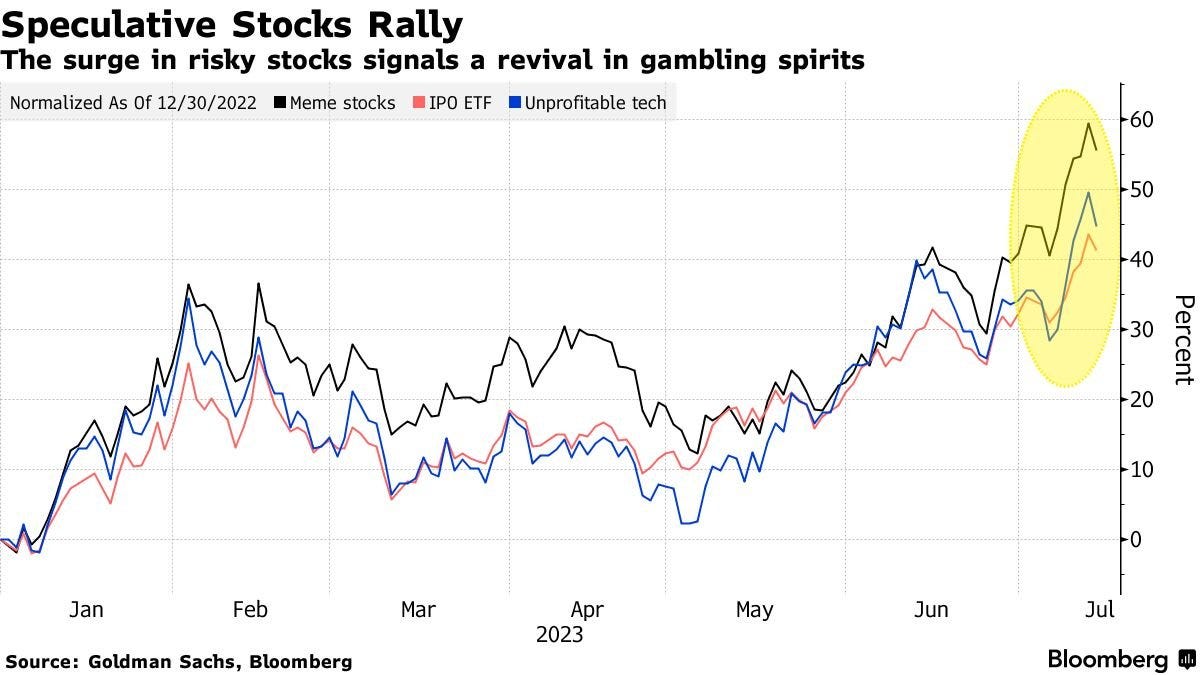

When greed gets out in front of fundamental investing, a buoyant stock market rally has exhausted itself and is primed for a reversal. Every so often, it may be the cycle that has exhausted itself and is reversing direction—from bull market to bear market. Another view of the unbridled bullishness is speculative stock growth, with meme stocks and IPOs up 50% or more this year:

The stock market is even threatening to reach an all-time high. When the Fed pauses its interest rate hikes, rallies are common behavior for the equity market. As companies’ margins get squeezed due to higher borrowing costs, with earnings downgraded and layoffs ensuing as a result, the up-only movement in stocks is increasingly detaching from reality. It could very well continue into Q3. We are nearing the point of peak euphoric bullishness, and peak exhaustion along with it. The S&P 500 is as high above its 125-day average as it was in 2019 when the stock market topped:

Like Iron Man’s thrusters freezing up as he greedily gains altitude and ultimately failing him, greed fuels an exhaustive rally until the pervasive sentiment is “this will never end”—that’s usually the point when it ends.

Will this be a cyclical trend shift or mark the turn of the bull market to bear? Will it come a week from now? A month? A quarter?

All we can be is data-dependent, probabilistic, and defer to being fearful when others are greedy.

Consumer sentiment (University of Michigan survey, one our favorites) came in at 72.6, blowing analyst estimates of 65.5 out of the water. This cements that the good vibes are not limited to markets but the broader economy as well, likely a combination of disinflation and the diminishing impact of rate hikes on the psyche of the consumer:

A timeline to keep an eye on is Federal Reserve members stepping down. In the leadup to the 2008 Financial Crisis, several Fed members either retired or left their posts to take up roles at colleges and universities. Fed Board of Governors member Frederic Mishkin, for example, left and took up the role of President of Columbia University’s Business School in 2008. Bullard’s retirement slated for August will mark the 5th resignation of a Fed member in a year and a half. In markets and in life, pattern recognition is your friend:

In the week ahead, we’ll get a beat on the consumer’s ultimate behavior during June with retail sales—retail sales numbers have an outsized impact on how GDP ultimately unfolds. While there is unlikely to be any single or even series of economic data points that shape the FOMC’s thinking heading into July 25th’s FOMC meeting in the coming week, markets are ultimately what influences the Fed, at the margin. In other words, as long as stocks stay buoyant and rates aren’t plummeting, the Fed has free reign to assign its policy rate another 25 basis points higher. While we cannot imagine a scenario in which the risks are still balanced to higher-for-longer inflation—CPI has fallen from 9% to 3% over the past year—FOMC voters still mostly seem to believe this. That either means they don’t think the move from 9% to 3% is all that convincing yet, or they don’t see the dangers in the economy. Granted, with positive GDP and a sub-4% unemployment rate, contractionary economic data is easier to dismiss. We remain extremely cautious on the US economy, primarily due to declining ISM and regional Fed metrics, trends that have been in place for several months, and somewhat as a result of the lagged effects of monetary policy. After all, rates have increased more in the past 12 months than they have in, statistically speaking, most of our lifetimes:

Zero-fee DCA, 100% full-reserve custody, and hassle-free turnkey mining.

Invest in Bitcoin with confidence at River.com

See what a best-in-class Bitcoin mobile wallet feels like with Envoy.

Download it today for free on the iOS App Store or the Google Play Store.

If you’re enjoying today’s analysis, consider supporting us by becoming a paid subscriber. As a paid subscriber, you get full access to all research as it drops.

Here are your quick links to all of the TBL content for the week:

Monday

Nik sat down with TBL Africa Correspondent Noelyne Sumba to discuss the growing popularity of Bitcoin in Africa, the game-changing Lightning Network, and the optimism fueling Africa's economic landscape. She also shares how BTC is reshaping the continent and empowering individuals and businesses alike.

Check out—Africa Is Ahead Of The World On Bitcoin Adoption

Tuesday

A day out from the June CPI report—where the yearly pace of inflation is expected to fall from 4.0% to 3.1%—Cleveland Fed President Loretta Mester says that more rate hikes are required for inflation to come down to its 2% target. After 11 straight months of falling yearly price increases and a 12th month of descent locked in tomorrow at 8:30 AM, some members of the Fed are still adamant that more rate hikes are needed. With disinflation set in, the only target for rate hikes left on the battlefield is the banks.

Check out—The inflation battle is won, now banks are in the crosshair

Wednesday

Nik chronicles the path of inflation from last year's 9% mania to potentially less than 2% by the end of 2023. He explains why there are finally some renewed inflation risks, why disinflation is still the more likely outcome, and goes through the price action in 2-year US Treasuries.

Check out—CPI Now BELOW 3%! What Does It Mean For Rate Hikes?

Thursday

Two-year yields have declined by 45 basis points in a week. Over the same time horizon, the dollar has weakened by 3% and given up all gains of the last 15 months. Major shifts are underway, but there is little coverage of what’s going on under the surface. Why, you might ask? Because stocks are racing to all-time highs. Equity investors exhibit euphoria, but we aren’t so sure they should. Let’s see if we can remove their blindfold.

Check out—Credibility, Euphoria, & Disaster

Friday

In this episode, one of the Joes explains yesterday's decision in the SEC v Ripple Labs case very simply to the other Joe, and the implications it will have for whether or not "crypto" is ultimately categorized as a security.

Check out—SEC v Ripple Analysis With Legal Expert Joe Carlasare

Join Nik Bhatia for LIVE online classes on Bitcoin and Macro at thebitcoinlayer.com/learn

Our videos are on major podcast platforms—take us with you on the go!

Apple Podcasts Spotify Fountain

Keep up with The Bitcoin Layer by following our social media!

YouTube Twitter LinkedIn Instagram TikTok

That’s all for our markets recap—have a great weekend, everyone!

River is the Bitcoin exchange of choice for the long-term investor.

Securely buy Bitcoin with 100% full-reserve custody, enjoy zero fees on recurring orders, and even buy a hosted Bitcoin miner, completely hassle-free.

Invest in Bitcoin with confidence at River.com

Bitcoin's most intuitive hardware wallet just got cheaper.

Passport is now just $199. Set it up in minutes, take your bitcoin off of exchanges with ease, and experience unmatched peace of mind.

Get it at thebitcoinlayer.com/foundation & receive $10 off with code BITCOINLAYER

A good video from TXMC on YouTube regarding why inflation might be bottoming, another reason to be cautious

https://youtu.be/Lkb_vnL2f18