Objects In The Mirror Are Closer Than They Appear: TBL Weekly #39

"Robust" jobs data closed out the week — but after many weeks of contractionary economic data, commodity prices, and investor positioning, do not be fooled.

Welcome to TBL Weekly #39—the free weekly newsletter that keeps you in the know across bitcoin, rates, risk, and macro. Grab a coffee, and let’s dive in.

Passport is the Bitcoin hardware wallet you already know how to use. With a gorgeous design and familiar interface, Passport makes it easier than ever to self-custody your Bitcoin. No more sitting at your computer or squinting at tiny screens. Passport seamlessly connects to your phone, empowering you to quickly view your balance and move Bitcoin in and out of cold storage.

See what best-in-class Bitcoin storage feels like at thebitcoinlayer.com/foundation

& receive $10 off with promo code BITCOINLAYER

Headline data lags, but the slowdown is here

A few pieces of labor data came in slightly above expectations on Friday, leading to a knee-jerk reaction in a somewhat illiquid Good Friday rates market, which modestly repriced for one more Fed hike.

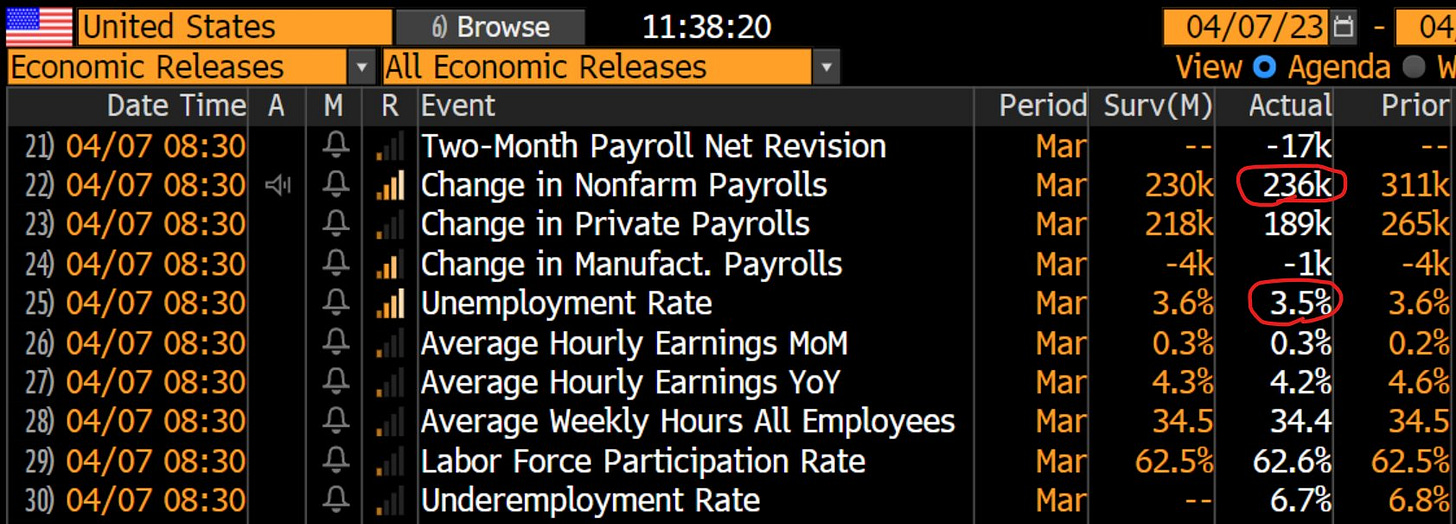

Nonfarm payrolls added 236,000 jobs versus the 230,000 expectation, and the unemployment rate dropped to 3.5%, below the 3.6% expectation:

These two prints, both very lagging, had macro pundits high-fiving, many seemingly forgetting that the credit crunch has already hit banks and will begin to slow down business activity and unwind the labor market over the next several months.

A puzzling reaction at first, but it’s important to remember: markets have the memory of a goldfish.

Not only did we receive bad labor data in the form of higher jobless claims and continuing claims the day before, but we’ve now been in a multi-week period of contractionary economic data, commodities prices, and investor positioning.

We have entered the contraction phase of the economic cycle, where demand for key commodities falls, lending slows down as banks back away from risk-taking, and the real economy slows, causing disinflation (also known as price cuts) and rising joblessness. For market pundits to forget this fact is foolish but not surprising—that’s why we’re reminding all of our readers today to not get lost in the hullabaloo that sometimes envelops macro circles when conflicting data is released.

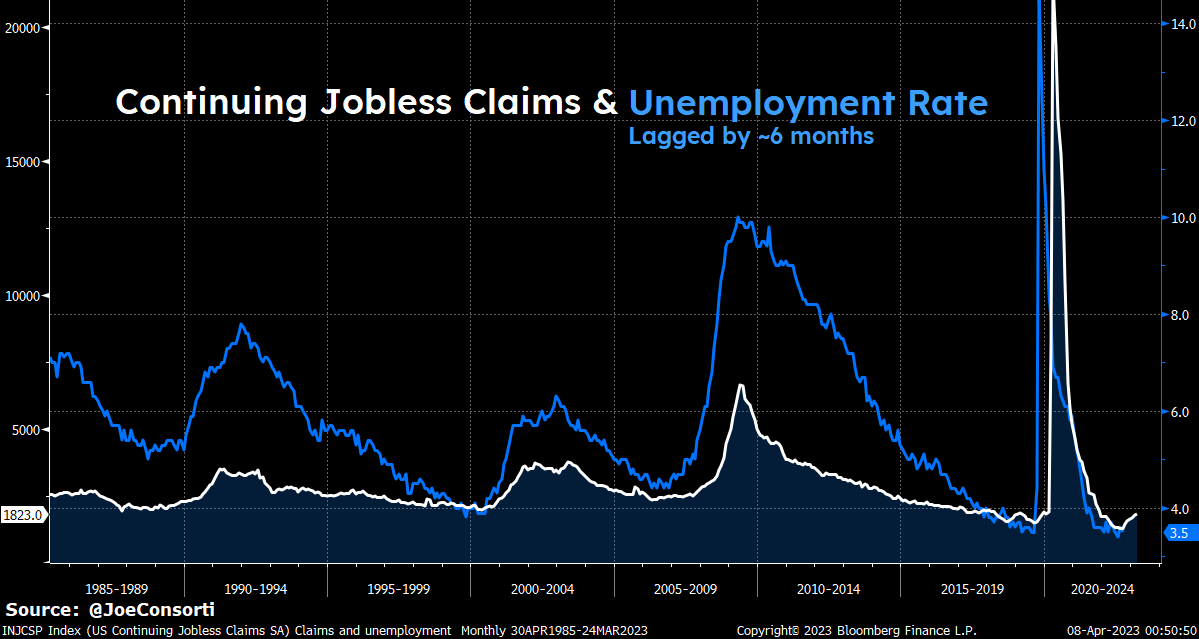

Headline data can lag by several months. There are much better, more leading indicators for key economic trends such as joblessness and price inflation than the unemployment rate and CPI, both of which are very backward-looking. The cycle is just now turning, and while the slowdown is not yet present in the backward-looking but popular headline data, it has fully started materializing in the leading indicators.

A forward-looking indicator of joblessness? Let’s use the number of people that continue to remain on unemployment benefits each week, or continuing jobless claims. This print not only leads unemployment, it is also published weekly rather than monthly. Continuing jobless claims lead the unemployment rate by ~6 months, and they have already started rising materially as more people get on and stay on unemployment benefits—rising US joblessness abounds:

A forward-looking indicator of price inflation? Let’s head upstream to the headwaters of the U.S. economic river, manufacturing. As manufacturers pay less on inputs, they inevitably charge less for the end products that consumers pay for and appear in the CPI basket. ISM manufacturing prices paid leads CPI inflation by ~6 months, and if 2008 is any point of reference, we are in for some rapid disinflation here in the US:

We don’t know when the ‘recession’ will be formally declared, but we know why it will be, and the why is outweighing the why not with each passing day and the contractionary economic, financial market, and commodity data that comes with it.

The recession is rapping at the door, and denial won’t make it go away.

Go read further into all of the aspects across our global macro framework that are signaling the economic downturn in our latest Substack post from Thursday.

Bitcoin Price & Fair Value Analysis

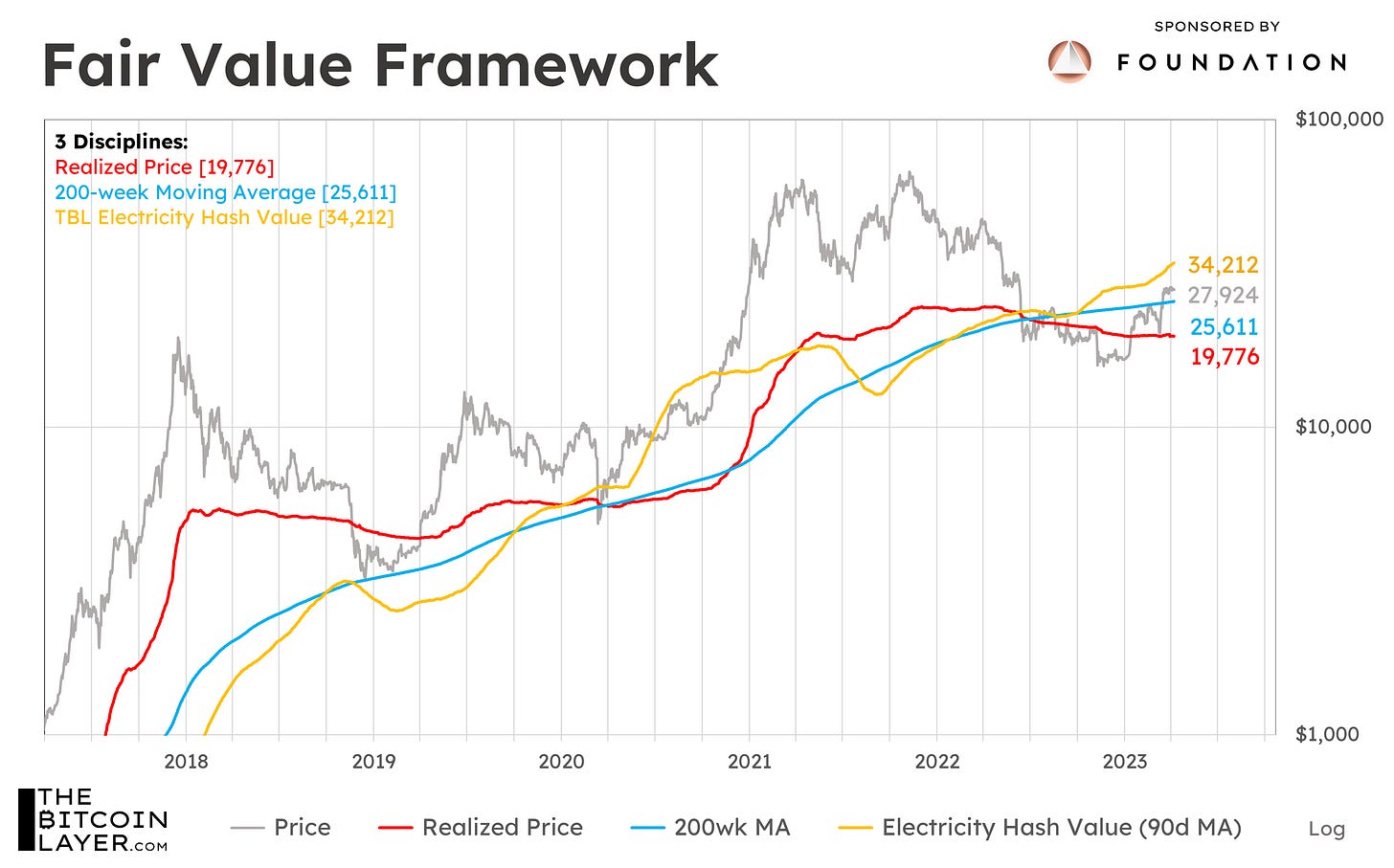

Bitcoin’s hash rate is soaring to new all-time highs with regularity. This means that the amount of hashes generated by machines simultaneously mining bitcoin is at a record, indicating that the thirst has never been higher to convert energy into the digital commodity. Our TBL Electricity Hash Value, a metric that estimates the cost it takes publicly traded miners to earn 1 BTC, reflects this dynamic, registering above $34,000 today. Bitcoin’s price, however, only trades at a discount to one of the three components of our Fair Value Framework:

Relative to its 200-week moving average and its realized price, the average cost basis of bitcoin investors, bitcoin trades at a small premium. This is contrary to the late months of 2022, during which bitcoin traded at a material discount to all three components, a time period we at The Bitcoin Layer categorically declared bitcoin as cheap. Now, bitcoin trades around its fair value—this doesn’t necessarily limit the upside to bitcoin over any 12-month time horizon, but it is important to note that bitcoin trades above 1 on our TBL Fair Value Ratio, no longer in deeply discounted territory using our trio of valuation metrics.

The Week Ahead

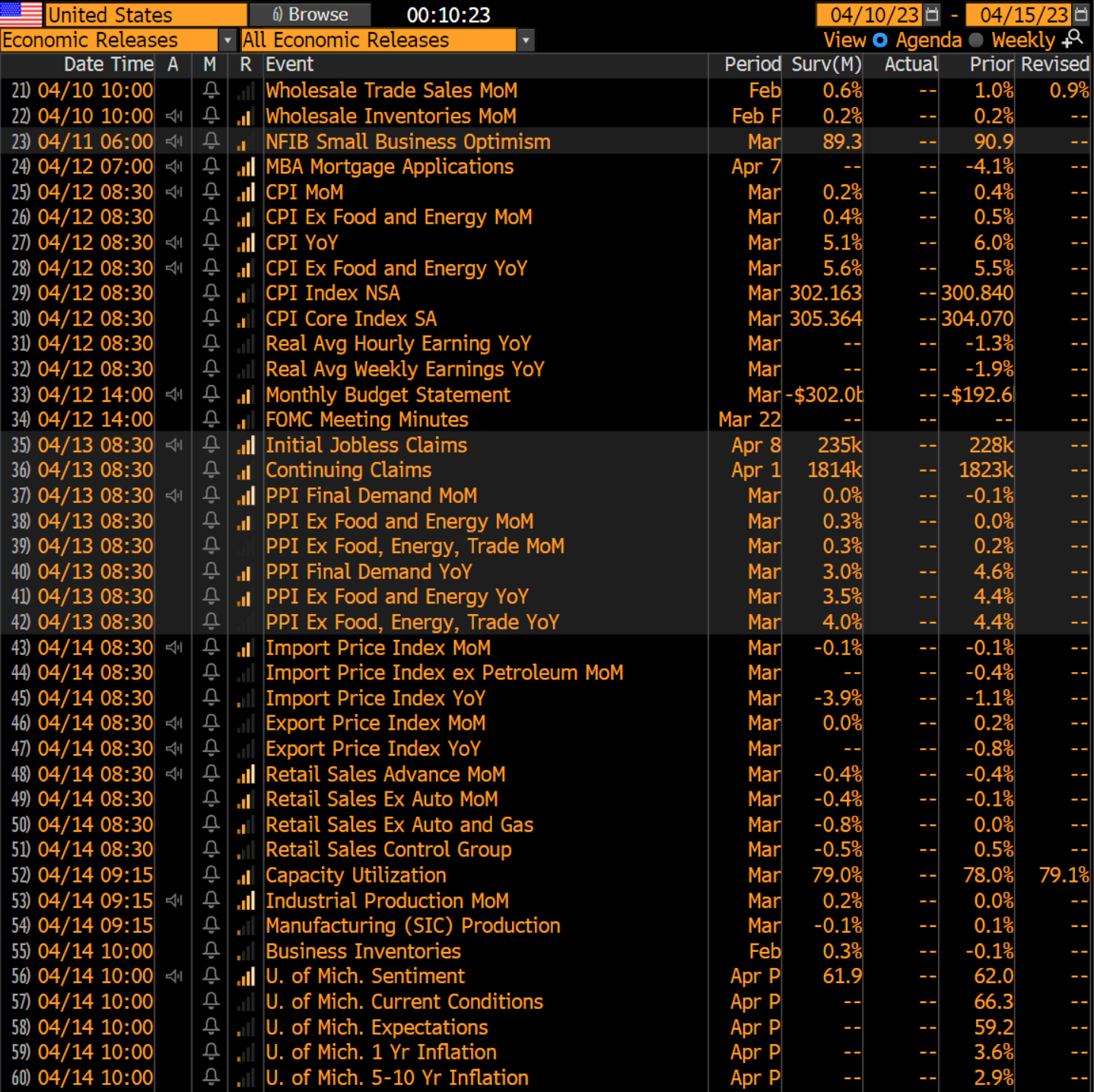

In the week ahead, starting Wednesday, important March economic data will come flooding through our terminals. It kicks off with CPI on Wednesday, continues with producer inflation (input costs) on Thursday, and concludes with our best read on the consumer with Retail Sales on Friday. Our base case is that the recession is now underway, but we’ll have to dissect the March data to search for confirmation while still remembering that no one data print can make or break an economy:

Our hunch tells us that once we get past some of this crucial economic data, Fed speakers will once again attempt to influence the market for May’s FOMC meeting pricing.

If you’re enjoying today’s analysis, consider supporting us by becoming a paid subscriber. As a paid subscriber, you get full access to all research as it drops.

Here are your quick links to all of the TBL content for the week:

Sunday

As we transition from Q1 to Q2, major asset classes are in the black. Bonds are up 3%, stocks are up 7%, and bitcoin is up 70% (insert any appropriate emoji stream here). So it’s all good right? Everything is fine now? In my experience, the only way to truly tell the longer-term story is through price study, and the only way to study price is to start by zooming out. “When in doubt, zoom out,” they say.

Check out—Emergency chart pack: when in doubt, zoom out

Monday

Joe discusses how the recent bank failures are exacerbating the already-tight funding situation for commercial real estate developers who are facing rising rates and vacant property, and how the upcoming gargantuan maturity wall and potential for default could create a feedback loop of bank failures and fire-selling of property in the United States.

Check out—A Crisis Is Brewing in Commercial Real Estate

Tuesday

Dr. Jeff Ross, Founder & CEO of Vailshire Capital Management LLC, releases a monthly portfolio and markets update for his clients. Thanks to him, we’re privileged to distribute his excellent work to you, our alpha-hungry TBL readers.

He walks through current market conditions, portfolio updates, and what he’s paying close attention to across the real economy and markets. Read his update here.

Check out—Risk Asset Rally in the Eye of the Storm—April 2023 Update

Wednesday

Nik confirms his belief that we have entered a period of economic recession that started sometime in March. Nik talks through the three signs of this slowdown that come in conjunction with the SVB fallout, a loss in confidence in the banking system, a credit contraction, and an associated slowdown throughout the rest of the economy.

Check out—3 Signs The Recession Has Started

Thursday

The economic cycle is an unrelenting force that dictates the ebb and flow of markets. Our job is to monitor risk, rates, commodities, and economic data extensively so we can keep you readily updated on our position in the cycle—well, after observing the Fed’s aggressive tightening campaign for 13 months, an equally aggressive economic contraction is materializing in the data. The long-awaited recession is at our doorstep.

Buckle up, let’s get into it.

Check out—5 Signs The Global Recession Is Here

Friday

Joe sits down with the inimitable Professor Peter St Onge. Peter breaks down the banking crisis and Fed's response, where the credit contraction is headed next, how fractional reserve banking introduces fragility to the financial system, how fully-reserved banks could still prove tenable, and why this is the latest but not last in a long line of bailouts from the Fed unless serious changes are made.

Check out—The Follies of Fractional Reserve Banking | Peter St Onge

Our videos are on major podcast platforms—take us with you on the go!

Apple Podcasts Spotify Fountain

Keep up with The Bitcoin Layer by following our social media!

YouTube Twitter LinkedIn Instagram TikTok

That’s all for our bitcoin and macro recap—have a great weekend everybody!

Passport is the Bitcoin hardware wallet you already know how to use. With a gorgeous design and familiar interface, Passport makes it easier than ever to self-custody your Bitcoin. No more sitting at your computer or squinting at tiny screens. Passport seamlessly connects to your phone, empowering you to quickly view your balance and move Bitcoin in and out of cold storage.

See what best-in-class Bitcoin storage feels like at thebitcoinlayer.com/foundation

& receive $10 off with promo code BITCOINLAYER

The Bitcoin Layer does not provide investment advice.