Welcome to TBL Weekly #65—the free weekly newsletter that keeps you in the know across bitcoin, rates, risk, and macro. Grab a coffee, and let’s dive in.

River is the Bitcoin exchange of choice for the long-term investor.

Securely buy Bitcoin at the tightest spreads in the industry, have peace of mind thanks to their 100% full-reserve cold storage custody, and enjoy zero fees on recurring orders. Need help? They have US-based phone support for all clients.

Invest in Bitcoin with confidence at River.com/TBL

Strong headline data

Friday saw a slew of US labor data released, including the unemployment rate and nonfarm payroll report. The front-and-center data cited on news chyrons showed a relatively stable if not robust labor market.

The unemployment rate for September rose to 3.8% year-over-year versus analyst expectations of stagnation at 3.7%. Average hourly earnings did decline by 0.1% on both a monthly and yearly basis. Not too shabby.

September payroll additions absolutely blew it out of the park, though. Monthly payrolls soared by 336,000 last month in the biggest jump since January—this doubled the consensus estimate of 166,000 and was a whopping 86,000 jobs higher than the highest analyst estimate submitted for the report.

Despite the labor strikes across the country that have shut many companies down, payrolls continue to rise—

—but, there’s a big catch.

Not all sunshine and rainbows

As per usual, the data trotted out before the masses paints a rosier picture than the reality of the situation.

Why is it that unemployment is rising but total payrolls in the US are surging?

People are taking on second jobs—both full- and part-time.

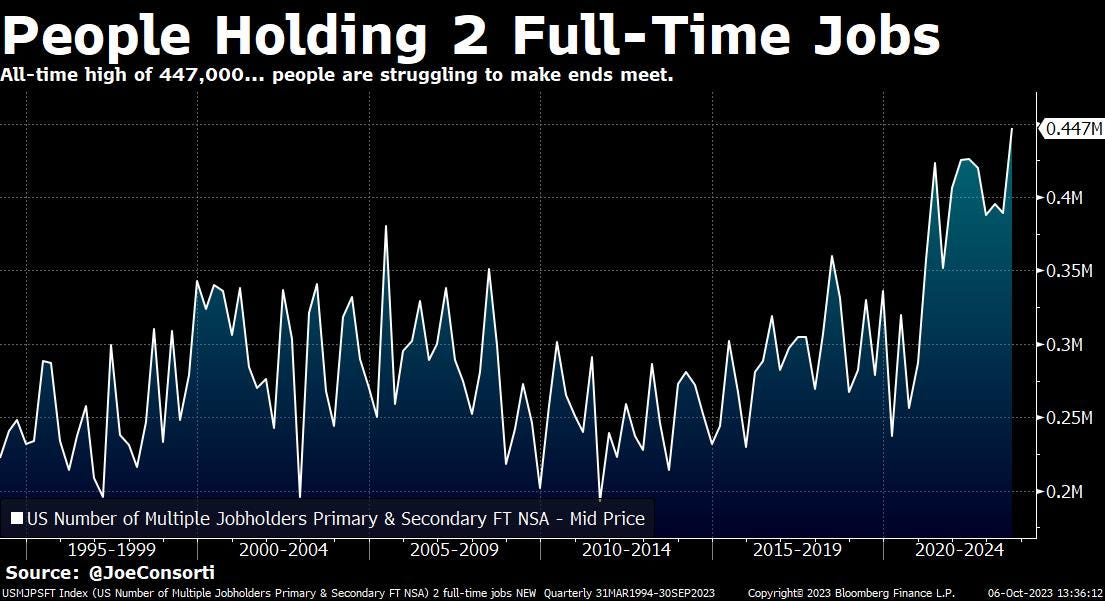

Americans are struggling to make ends meet. The number of people holding two full-time jobs just hit an all-time high of 447,000—you read that correctly, taking on another full-time job, not a part-time side gig. While part of this could be attributable to remote work and automation enabling users to split time effectively between two would-be full-time roles, it’s undeniable that people are increasingly destitute and taking on additional work to support their lifestyles.

Tight credit will drag up the cost of capital and limit companies’ ability to give adequate pay raises. Ostensibly, wage gains at companies will lag behind price inflation as a result of this, so this phenomenon will only get worse:

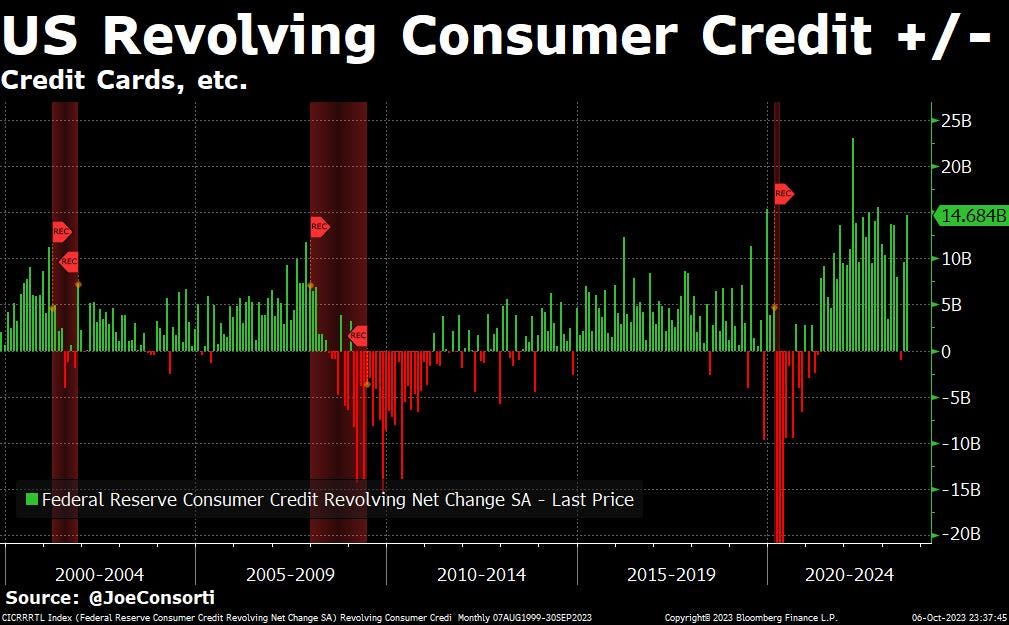

Americans who’ve experienced a 25-50% price increase in daily necessities that will never come down thanks to the Fed’s no-deflation mandate are now also experiencing increasingly high interest rates on credit cards to fund those purchases. Credit card debt exploded higher by $14.68 billion last month. This happens at the end of every economic cycle, when personal savings are all but drained and people turn to credit cards they don’t intend to pay back. A classic blow-off top in consumer credit is underway:

Even on two full-time incomes, regular people report on a daily basis that buying a home and saving for their future is increasingly out of the picture. Pure 21st-century American excellence, brought to you by the Federal Reserve.

If we include part-time jobs in the aforementioned measure, there is a grand total of 8.51 million people with 2 or more jobs. We see this in previous cycles: life becomes unaffordable toward the top, people take on several jobs to make life tenable, until conditions turn and unemployment finally gives way:

Household survey shows far less jobs gained than establishment survey reports, at just 86,000 jobs added in September compared to the establishment-recorded and seasonally adjusted 366,000, the lowest since May. Also, if you include those missing from the labor force, some ~5 million Americans, the unemployment rate is closer to 6.8%—funny how weak the labor market seems when we don’t goose the numbers, isn’t it?

The preposterous headline payrolls upside can be attributed to seasonal adjustments more than anything—leisure & hospitality shed 466,000 jobs across the sector, despite it adding 96,000 jobs thanks to its “seasonal adjustment”.

Not seasonally adjusted, the picture is clear.

Total payrolls rose by 585,000, yet private payrolls dropped by 399,000—therefore all of the job gains in September came from the US government. The match checks out, too. The US government added some ~1 million jobs in September, while non-government jobs fell by 400,000.

This did not stop the administration, known for lying through its teeth with heavily cherry-picked and dissembled data, from boasting about the strength of the economy. Anything to get re-elected, we suppose.

Full-time jobs fell by 885,000 when not seasonally adjusted, marking the biggest decline in full-time jobs since March 2020 after the government shut down businesses:

The long and the short of it is this—

Part-time jobs and multiple jobholders are rising as people try to make ends meet, and that is being fraudulently flaunted by the powers that be as economic resilience. People who aren’t in the workforce are pushing down the unemployment rate, and seasonal adjustments make the zero-sum event of teachers returning from summer break an Earth-shattering development for the US labor market.

With an increasingly high cost of capital precluding firms from giving adequate pay raises to keep up with rising prices, expect the already-narrow gap between earnings and price inflation to close and flip negative:

Pundits are calling the US economy an Energizer Bunny, but eventually, all batteries die after a while if they’re being drained.

Given the extreme selloff in US Treasuries that we covered extensively as of late, and the losses incurred on the balance sheets of every world financial institution, the odds are pricing in a less than 30% chance we see another Fed rate hike—even with Friday’s “strong” jobs data.

To close off on a sweeter note, Su Zhu, the founder of the maligned former “hedge” fund Three Arrows Capital, was arrested in Singapore. With this, the SBF trial underway, and several “crypto” scammers being arrested the world over, we for one are grateful for this pocket of retribution in a worrisome world.

Next Week

In the week ahead, there will be a significant fall in the importance of CPI inflation now that it’s almost normalized—far from the >4% danger zone that would send real wages further negative, and nowhere near the 1% level at which policymakers begin to worry about deflation. From an investor perspective, our opinion is that the main event of the next several months' economic calendars will be unemployment data, particularly Thursday’s continuing claims data, to signal when a labor-market unwind and recession is imminent. For now, we watch unemployment with bated breath as the last straw before recession and rate cuts come to the fore.

The star of the week, however, will be the 10 and 30-year Treasury auctions that mark the start of a fourth-quarter duration deluge are finally here. While we are attributing much of the recent increase in yields to investors "pricing in" all of this coming supply, there's no telling what the actual auctions will bring in terms of crowding out and potentially sending yields soaring even higher:

Foundation Devices is self-custody done right.

Start with their easy-to-use and private mobile wallet with Envoy, then transfer it to the most intuitive hardware wallet in Bitcoin with Passport.

If you’ve been on the fence about taking your bitcoin off of exchanges, Foundation’s suite of intuitive self-custody solutions is for you.

Take custody of your Bitcoin today by visiting foundationdevices.com

If you’re enjoying today’s analysis, consider supporting us by becoming a paid subscriber. As a paid subscriber, you get full access to all research as it drops.

Here are your quick links to all of the TBL content for the week:

Monday

In this episode, Nik is joined by TBL's Africa Correspondent Noelyne Sumba. Based in Kenya, Noelyne regularly joins our show to discuss bitcoin adoption throughout Africa. Today, we learn about the inflation crisis and union strikes in Nigeria, as well as why Nigerians are extremely reliant on Tether and other dollar stablecoins for business survival. Also discussed are bitcoin as a savings tool and coups in areas affected by French neocolonialism.

Check out—In Africa, It's Stablecoins For Survival, Bitcoin For Saving

Tuesday

It’s the second day of Q4 for markets, and the leaves have begun to turn from green into bright autumn reds, yellows, and oranges here in New England.

While we ring in the fall season Stateside, all around the world, nations’ central banks are hunkering down and readying their phone-dialing fingers: the raging US dollar is wreaking havoc on global markets, and The Bitcoin Layer is officially on intervention watch.

Check out—Intervention Watch: Bear Steepening & Dollar Rally Has Central Banks On Edge

Wednesday

In this episode, Nik joins us from Pacific Bitcoin's Mining Industry Day in Santa Monica, California. He recaps a panel consisting of CEOs of publicly traded bitcoin miners, and explains why Bitmain's dominance of cutting-edge ASIC production poses enormous risks for these firms. Bitcoin miners integrating with the power generation industry is also discussed.

Check out—Bitcoin Mining CEOs: Bitmain Concentration Worries Us!

Thursday

Hearts fluttered on Monday as the quarter opened with a very serious reminder that markets are in a new, more precarious regime. Headlines about breakout yields were autogenerated referencing 16-year highs in yields, but the details are much more important than the absolute yield levels—underlying market indicators suggest that risk assets are in trouble—the reemergence of volatility and the reintroduction of risk premium are here to shake things up. You’re not going to want to miss what comes next.

Check out—Can't blink, won't blink

Friday

In today's episode, Joe explores the latest candidates for "worst data manipulation of all time" as he breaks down the lies and damned lies from the statisticians tasked with reporting on the US labor market.

Check out—The Great Labor Market Lie

Our videos are on major podcast platforms—take us with you on the go!

Apple Podcasts Spotify Fountain

Keep up with The Bitcoin Layer by following our social media!

YouTube Twitter LinkedIn Instagram TikTok

That’s all for our markets recap—happy Columbus Day weekend, everyone!

River is the Bitcoin exchange of choice for the long-term investor.

Securely buy Bitcoin at the tightest spreads in the industry, have peace of mind thanks to their 100% full-reserve cold storage custody, and enjoy zero fees on recurring orders. Need help? They have US-based phone support for all clients.

Invest in Bitcoin with confidence at River.com/TBL for $5 free when you buy $100 in Bitcoin.