Powell is afraid to pivot again, the decimation of regional banks is the price: TBL Weekly #43

Despite several consecutive regional bank failures, directly and indirectly the fault of the Fed, Powell's pursuit of legacy will not allow him to shift policy.

Welcome to TBL Weekly #43—the free weekly newsletter that keeps you in the know across bitcoin, rates, risk, and macro. Grab a coffee, and let’s dive in.

See what best-in-class Bitcoin storage feels like at thebitcoinlayer.com/foundation

With his eyes firmly fixated on runaway inflation that he was six months too slow to identify, Jerome Powell hiked the Fed’s policy rate yet again. This rear-view mirror approach to conducting monetary policy is the Fed’s specialty, making lagging decisions based on lagging data, and it is detrimental to the financial system. High rates have wreaked havoc on regional banks that have had their depositors drained for higher-yielding US Treasuries and Money Market Funds, and rising rates have bloodlet ~30% on the price of long-end US Treasuries that these banks have been mandated to hold, leaving a gaping hole in their collective asset base.

From the deposit drain:

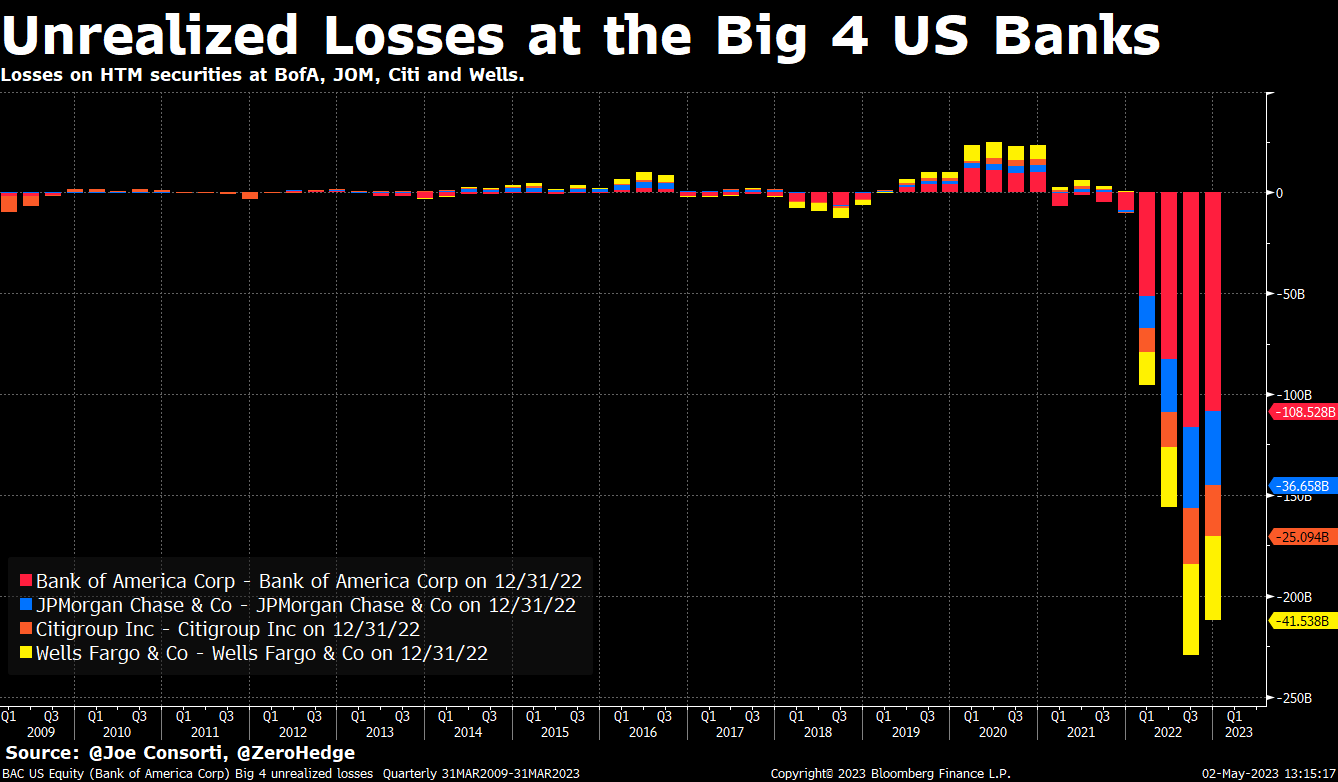

—to the unrealized losses on Treasuries that acutely impact small and midsize banks:

Powell is so fearful of making the same mistake of being too soft with financial markets in 2019 that he has swung in the entirely opposite direction, creating a problem far worse for the US, and by proxy, the global financial system.

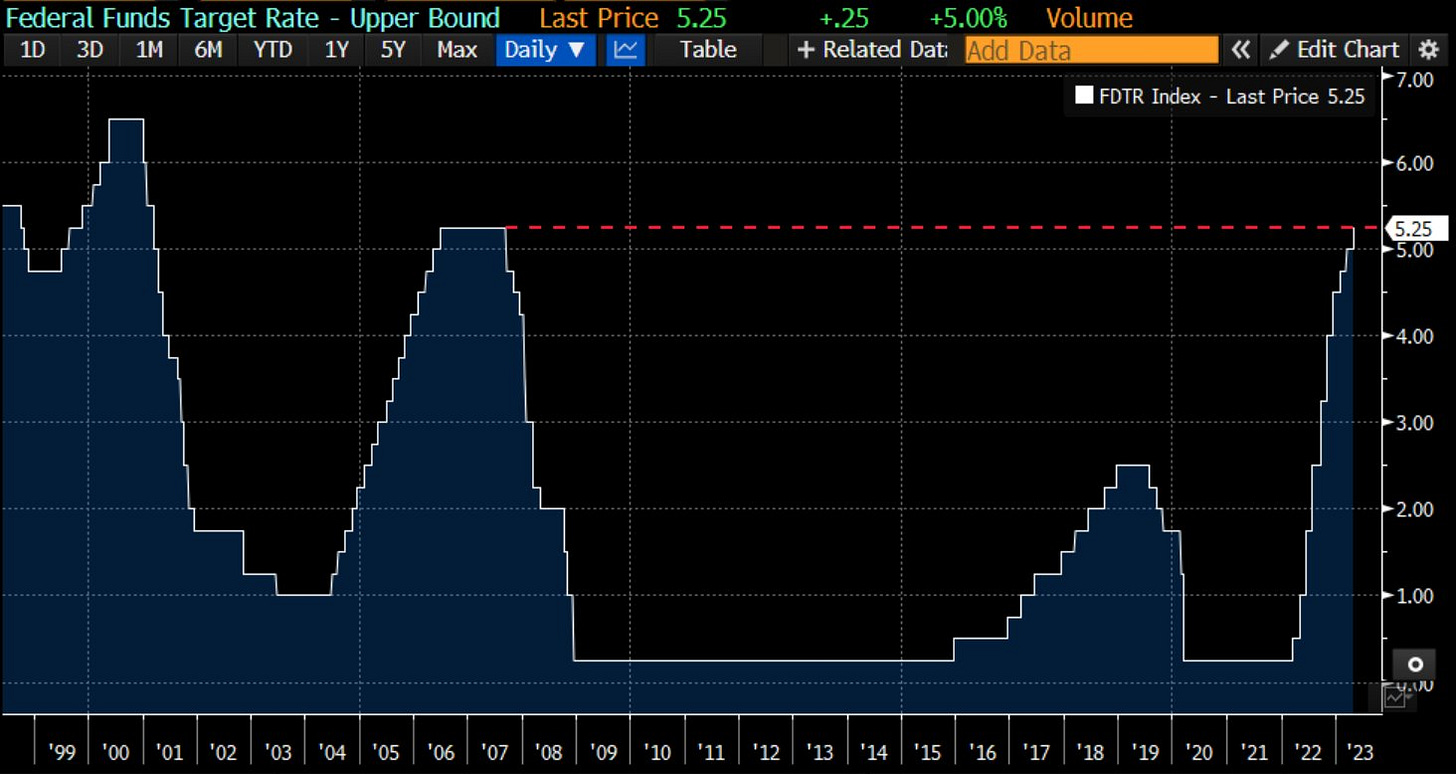

The goal of the Fed’s policy rate hikes is to bring down economic activity and create a sustained period of below-trend growth to bring inflation back down to its long-run 2% target. The Federal Funds Rate is the Fed’s benchmark overnight interbank lending rate, and raising it eventually trickles through to reduced credit entering the real economy, slowing economic growth and by extension, price inflation.

But here’s the thing, banks are starting to fail. One surefire way to see that we’ve reached a point of sufficient monetary tightness is when banks start to fail—at this stage, it is fair to say that less credit will get to the economy, and the job of the Fed is nearing completion. Further hikes are reckless and unnecessary. So what does Jerome Powell, still reeling from the embarrassment of his 2019 pivot, decide to do in the face of bank failures? Raise the interbank lending rate in the Fed Funds market even more, to its most restrictive level since 2008:

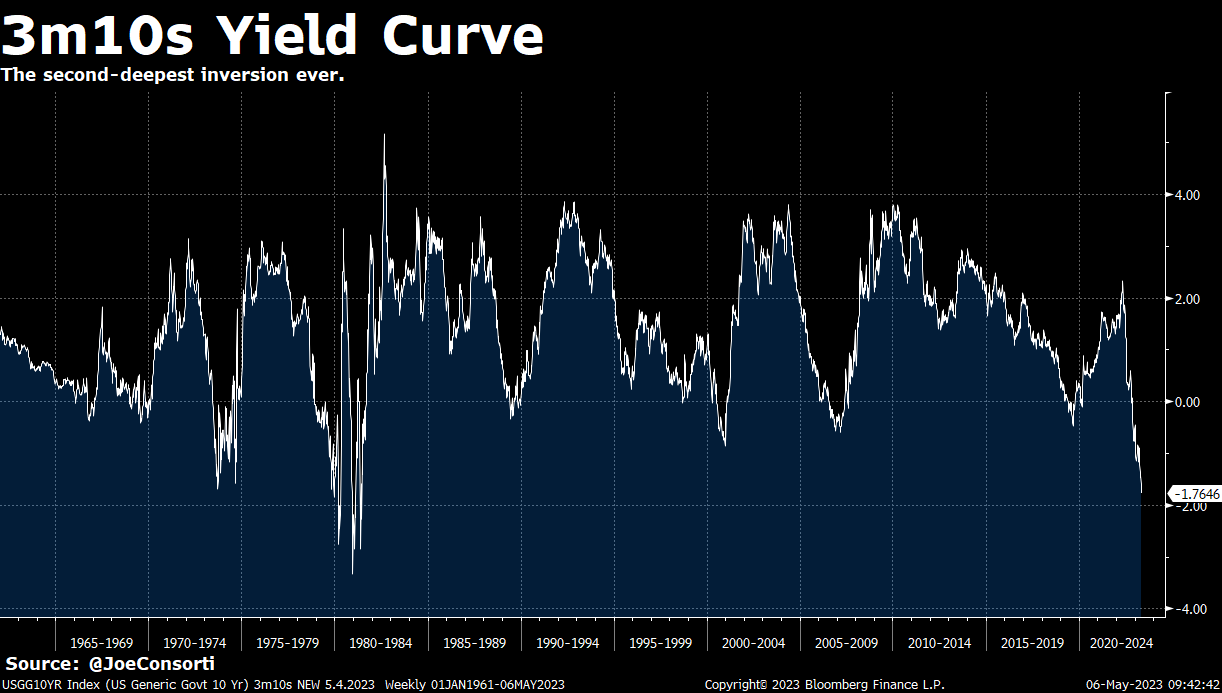

By asset size, the failures of Silicon Valley, Signature, and First Republic Bank in the last three months are already larger than the failures of the first year of the Great Financial Crisis. Credit destruction is all but accomplished, and further tightening of credit is blatant policy error—that’s what the market is screaming at the Fed with the 3-month bill yield now a full 176 bps below the 10-year note yield:

The 2-year note yield is 133 bps below the Fed Funds new upper bound of 5.25%, which means that the market is pricing front-end rates way lower than where the Fed has set its feet:

The market is screaming blue-bloody murder for Powell to stop the hikes because it sees what he doesn’t. Turmoil in financial markets is a slippery slope. No matter how many emergency loan facilities are created, the problem of unrealized losses on banks’ assets coupled with proliferating fear of banks has created a toxic combination that will continue claiming the lives of banks with small asset bases. The crusade to fight inflation is coming at the expense of regional banks that are now on their deathbed courtesy of the aggressive, and now at the tail end, even pride-induced rate hikes courtesy of one Jay Powell. This is not for a lack of seeing the failures, but rather from seeing and ignoring them.

The economic fallout of an abrupt disappearance in credit and loan creation due to these equally sudden bank failures won’t make itself known in the headline economic data just yet, but one thing is for certain, it is beginning to transmit into the real economy gradually. A TBL subscriber who is the CEO of a large retail company recently sent us a note that demand for labor is down, discretionary retail is softening indicating waning consumer strength, and input costs are falling.

In other words, Powell is getting his disinflation and soon, his recession, but he may be just as late to adjust policy for it as he was to adjust policy for inflation.

The Week Ahead

In the week ahead, we look to CPI’s April reading for a sense of the economy in the aftermath of Silicon Valley Bank’s demise. In our opinion, however, the major story will continue to be the way regional banks handle the systemwide decline in reserves, deposit flight, and their own volatile equity prices. Economic data, as we discussed in Thursday’s post, seems to have taken a slight backseat to financial stability and Powell’s insistence that he can balance the policy rate and emergency facilities to manage the banking crisis. Inflation has fallen from 9% to 5%—we cannot see 5% inflation sustaining itself with the current backdrop of tightening credit and are convicted it heads to 4% and lower as soon as this year. But this decline might not be enough to please the FOMC, which could in turn bring an even sharper decline in economic activity. For now, we at The Bitcoin Layer remain steadfast in both our disinflation and recession expectations but will continue to digest incoming economic data alongside the market. With 2-year yields 133 basis points inverted to the policy rate, we are not the only ones seeing a sharp decline in Fed Funds over the next year:

If you’re enjoying today’s analysis, consider supporting us by becoming a paid subscriber. As a paid subscriber, you get full access to all research as it drops.

Here are your quick links to all of the TBL content for the week:

Monday

To kick off the week, Joe sat down with David Seroy for a discussion about the evolution of Bitcoin-native interest rates, the Lightning network and other potential scaling solutions, and how these BTC-LN-native interest rates can pave the way for future Bitcoin-native capital and money markets.

Check out—Bitcoin-Native Interest Rates Are Here | David Seroy

Tuesday

We have spent several trading sessions the last few weeks pondering just what exactly the Fed is doing. March’s bank failures now look to be followed up with April and May failures, and Treasury Secretary Janet Yellen has officially warned Congress that we are less than 30 days away from a default. But don’t worry Jerome, follow your gut.

Check out—Banking crisis is not going anywhere, and the Treasury is out of money

Wednesday

Joe and Nik sat down with Checkmate, the Lead Analyst at Glassnode, an on-chain analytics provider. Checkmate discusses trends he's observing using data derived directly from bitcoin's blockchain, including why he believes bitcoin put in a textbook cycle bottom last November.

Check out—Bitcoin Is Building Strength On-Chain | Checkmate

Thursday

In the hierarchy of money, instruments are ranked. Why it took Americans until 2023 to fully realize this is a longer study, but with Treasury bills and money market funds yielding 4% more than traditional bank deposits, deposit flight became the “rational” financial behavioral impulse, leaving us in the middle of an absolute meltdown of bank equity values. Only a few weeks removed from the failure and FDIC backstop of Silicon Valley Bank, we witnessed yet another similar move in First Republic. Now PacWest, First Horizon, and Western Alliance are begging to join the club. And the only reason the entire financial system isn’t melting down alongside them is the implicit nationalization of the bank deposit as a monetary instrument itself.

Check out Nik’s timely update—Full Blown Banking Crisis Is Here, Nationalization Underway

Friday

Joe walks through why regional banks are dropping like flies, how the lion's share of the blame lies with the Fed, and why further banking failures will occur and the economic fallout will be far more severe if the Fed doesn't change course, away from Powell's pride-fueled tightening.

Check out—The bank failures are bigger than 2008, Powell hikes anyway

Our videos are on major podcast platforms—take us with you on the go!

Apple Podcasts Spotify Fountain

Keep up with The Bitcoin Layer by following our social media!

YouTube Twitter LinkedIn Instagram TikTok

That’s all for our bitcoin and macro recap—have a great weekend everybody!

Passport is the Bitcoin hardware wallet you already know how to use. With a gorgeous design and familiar interface, Passport makes it easier than ever to self-custody your Bitcoin. No more sitting at your computer or squinting at tiny screens. Passport seamlessly connects to your phone, empowering you to quickly view your balance and move Bitcoin in and out of cold storage.

See what best-in-class Bitcoin storage feels like at thebitcoinlayer.com/foundation

& receive $10 off with promo code BITCOINLAYER

The Bitcoin Layer does not provide investment advice.

If you keep your eyes glued to the rear-view mirror, you're eventually gonna crash the car... maybe Mr. Powell needs to retake drivers ed.