Welcome to TBL Weekly #63—the free weekly newsletter that keeps you in the know across bitcoin, rates, risk, and macro. Grab a coffee, and let’s dive in.

River is the Bitcoin exchange of choice for the long-term investor.

Securely buy Bitcoin at the tightest spreads in the industry, have peace of mind thanks to their 100% full-reserve cold storage custody, and enjoy zero fees on recurring orders. Need help? They have US-based phone support for all clients.

Invest in Bitcoin with confidence at River.com/TBL

We are in the endgame of the economic cycle.

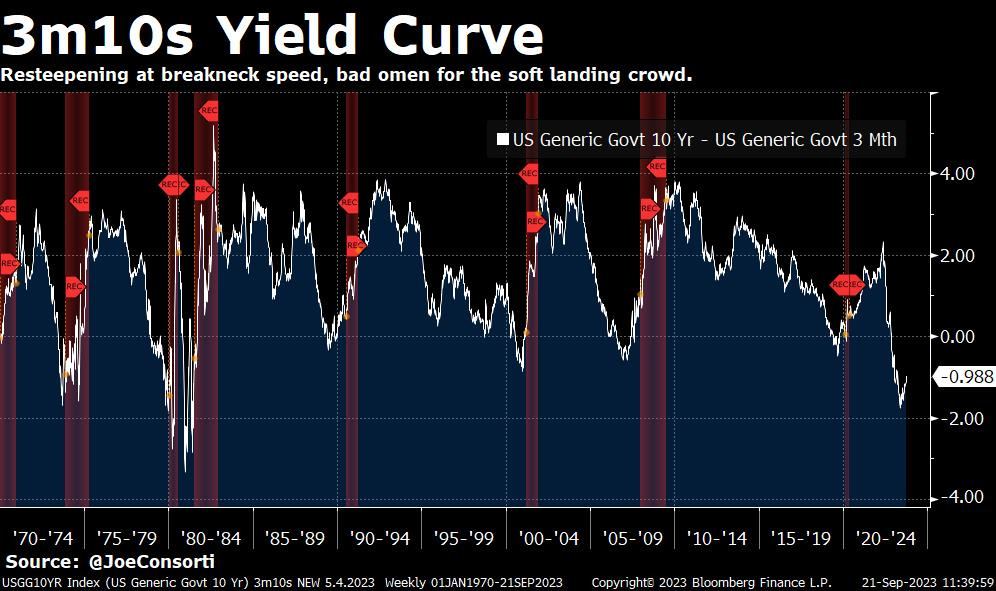

This time last year we reported to you that the US Treasury yield curve had inverted when short rates surpassed long rates. This meant that investors were discounting growth expectations—a worsening outlook for the US economy. Well, one year later the yield curve is normalizing at breakneck speed—the market is looking ahead to rate cuts.

You see, the Fed doesn’t set interest rates, it attempts to influence rates using its monetary policy tools. When front-end rates that the Fed is influencing higher don’t rise despite all the hawkish rhetoric in the world, the market is anticipating that the Fed will lower rates from where they currently are. That is what the yield curve is telling us.

Do you know what happens when the yield curve steepens, every single time? The Fed only cuts rates in response to a recession, so an uninversion of the yield curve which signals rate cuts, precedes all recessions:

After months of teasing and false inversion depths, this one seems to be the real deal.

Bonds yield spikes and bouts of volatility like the one we’re currently experiencing tend to break things in financial plumbing—the Fed always steps in when something breaks. Regardless of the Fed’s two stated mandates of stable prices and full employment, financial stability trumps them all.

So if the yield curve is ringing loud and clear that something is breaking that will warrant rate cuts, what is broken?

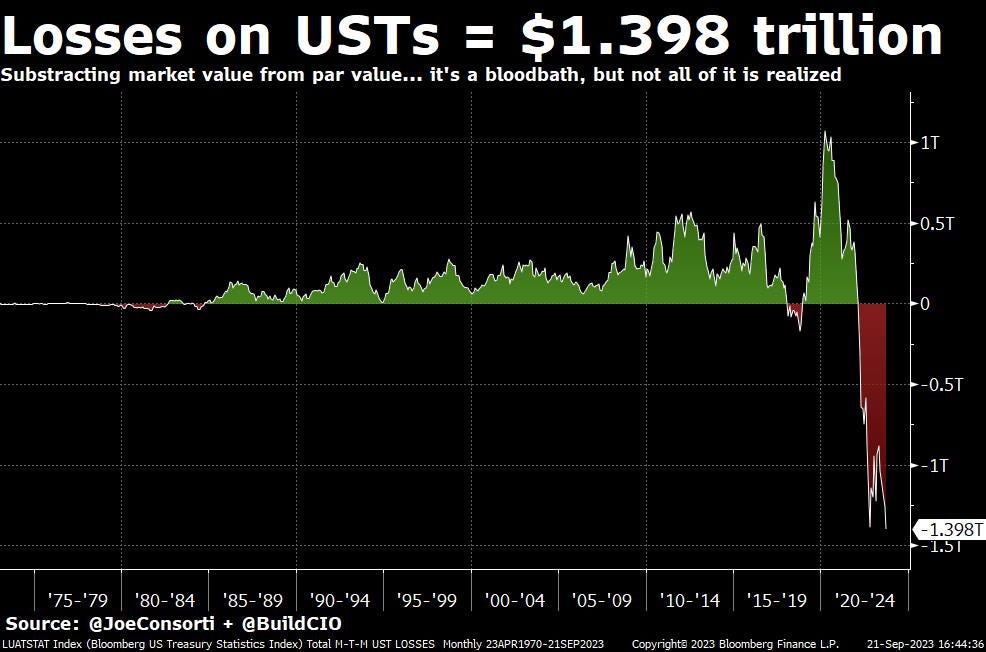

We begin with losses on US Treasuries due to interest rate hikes.

As rates go up, the price of existing bonds falls. This is called interest rate risk, or duration, and the US Treasury market is beholden to it too:

How much value have they lost?

US Treasuries have lost ~$1.398 trillion in value largely due to interest rate hikes. As the Fed holds higher for longer & the US Treasury floods the market with debt, rates could push even higher, pushing this hole only bigger:

This creates financial instability.

Banks borrow short and lend long. They borrow in the form of deposits and oftentimes hold Treasuries as reserve assets. That means they need to sell US Treasuries and other assets in order to meet withdrawal requests, which have been frequent since March’s acute banking stress kicked off a slow-motion bank run, which is still underway. However, when USTs lose value, banks may not have enough dollars to liquidate to meet the dollar amount of all the withdrawal requests.

This pushes banks to the brink of, and sometimes into insolvency and in need of a rescue by the FDIC and/or another often larger bank. Banks are having to mark these losses to market and sell their US Treasuries in order to meet withdrawal requests—banks’ holdings of US Treasuries and agency MBS, also beholden to duration losses, have fallen $166 billion since the March crisis:

Banks are dumping their holdings to private credit and hedge funds which are now flooded with rate-sensitive assets as the Fed keeps rates higher for longer. This is a problem that will only get worse considering a deluge of UST issuance is slated to begin next week, bringing the dangerous scenario of even higher yields and more losses in the UST market.

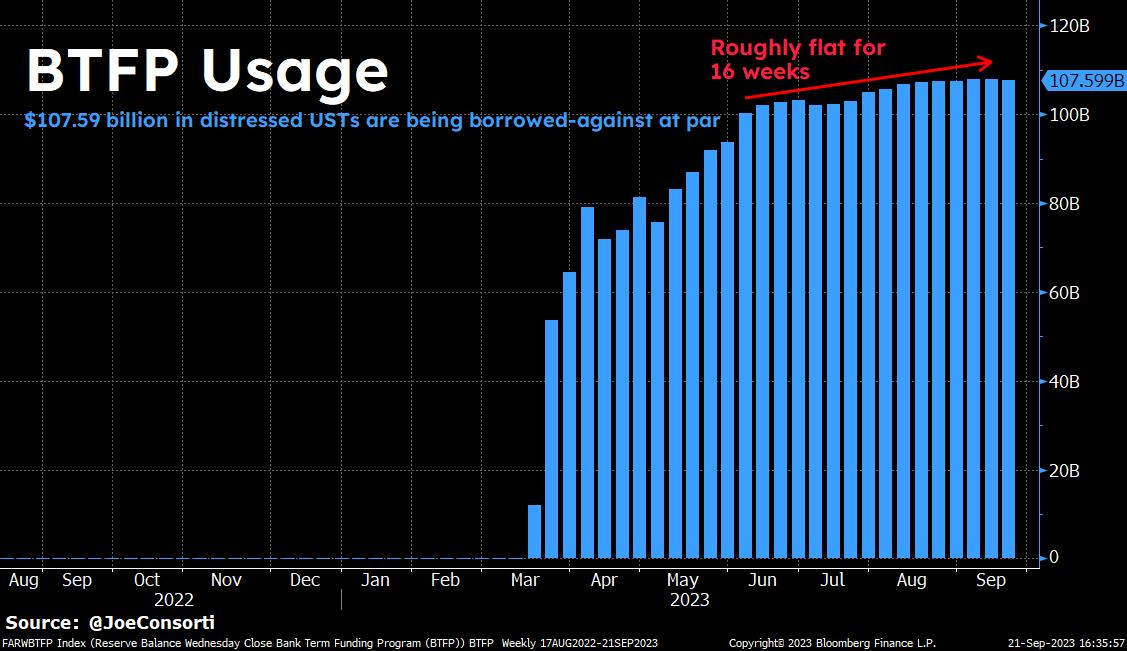

They can and have also gone to the Fed for a handout instead of selling and locking in losses. A total of $107.59 billion in emergency loans have been extended to banks through the Fed’s BTFP emergency loan program. It is worth noting that this yield spike and sudden bout of volatility happened on Wednesday, and this number is updated as of Wednesday’s market close. So, it is very likely that next week’s data will show banks flocking to the Fed to get an emergency loan against their devalued US Treasuries:

By all accounts, as rates stay high and keep climbing, it will get worse—creating more financial instability that the Fed will eventually step in to fix. We’ve characterized it as a staring contest, and the Fed will do its best not to blink, but with its behavior in financial crises over the past decade and a half, it’s nearly impossible for us to imagine a Fed that stands by as financial stability falters. We’ll be here to cover it all.

Next Week

In the week ahead, the market will receive a fair amount of let’s call it tier-1.5 data—releases are not NFP/CPI level of importance but we’ll get a better sense of how the third quarter is closing out. The most important release of the week will be Friday’s Personal Income and Personal Spending numbers, the latter of which is a material contributor to GDP. With Europe in a nasty recession, the US is showing its resilience once again on the global stage. A strong dollar threatens global growth, but by all accounts, the US consumer is not going away, even if consumption is debt-funded. With the return of traces of volatility, a failure of the S&P 500 around its 61.8% retracement of the all-time highs to last year’s October lows, the deluge of Treasury supply in October, and the increased pace of Quantitative Tightening, there is no shortage of reasons to have your guard up for market events. The fourth quarter is sure to bring us some drama.

Foundation Devices is self-custody done right.

Start with their easy-to-use and private mobile wallet with Envoy, then transfer it to the most intuitive hardware wallet in Bitcoin with Passport.

If you’ve been on the fence about taking your bitcoin off of exchanges, Foundation’s suite of intuitive self-custody solutions is for you.

Take custody of your Bitcoin today by visiting foundationdevices.com

If you’re enjoying today’s analysis, consider supporting us by becoming a paid subscriber. As a paid subscriber, you get full access to all research as it drops.

Here are your quick links to all of the TBL content for the week:

Monday

In this episode, Nik is joined by Michael Saylor to discuss bitcoin in relation to government debt. Michael shares the importance of upcoming accounting changes that will allow corporations to build bitcoin endowments, a fundamental shift in treasury management of operating companies. Michael also shares his thoughts on spot ETFs, systemic inflation, and long-term bitcoin adoption.

Check out—Bitcoin Revolutionizes Corporate Finance | Michael Saylor

Tuesday

Do you ever get the feeling that something is wrong, but you just can’t articulate it? Whether or not you lived through more idyllic times, our current society can feel upside down. Debt is encouraged, and inflation eats away at our purchasing power. As long-time participants in bitcoin as an asset class, technology, and learning gateway, we are aware of the central banking and commercial banking monetary layers and their limitless bounds, but even we were blown away at the corporate finance revelation described by Michael Saylor and what it could mean for our world. It demanded a follow-up for our subscribers.

Check out—Profound implications of Saylor's latest revelation

Wednesday

In this episode, Nik is joined by Alex Thorn, head of research at Galaxy. Alex explains how investors are supposed to think about bitcoin valuation, breaks down how institutional adoption is helping to moderate volatility and bring in more stability for bitcoin as payment, and forecasts the driving factors behind bitcoin markets going forward.

Check out—How To Properly Value Bitcoin | Alex Thorn

Thursday

Interest rates here in the United States are at multi-decade highs. The Federal Reserve’s unelected board of elders just held its interest rate target in the 5.25-5.50% range as the 2-year and 10-year US Treasury yields soar to 17 and 15-year highs respectively, squeezing both short and long-term borrowers alike, the whole world over. Powell still insists that a recession is years away, but takes a “soft landing” off the table for the US economy. Let’s talk about it.

Check out—The World's Borrowing Cost Hits 15-Year High As Powell Says No Recession Until 2027

Friday

In this episode, Joe discusses the rapid yield spike, yield curve uninversion, and why the market believes the Fed will cut rates sooner rather than later.

Check out—WARNING: The US Economic Endgame Is Here

Our videos are on major podcast platforms—take us with you on the go!

Apple Podcasts Spotify Fountain

Keep up with The Bitcoin Layer by following our social media!

YouTube Twitter LinkedIn Instagram TikTok

That’s all for our markets recap—have a great weekend, everyone!

River is the Bitcoin exchange of choice for the long-term investor.

Securely buy Bitcoin at the tightest spreads in the industry, have peace of mind thanks to their 100% full-reserve cold storage custody, and enjoy zero fees on recurring orders. Need help? They have US-based phone support for all clients.

Invest in Bitcoin with confidence at River.com/TBL for $5 free when you buy $100 in Bitcoin.