Recession Imminent As Yields Plummet & Economy Sours: TBL Weekly #69

“There are three kinds of lies: lies, damned lies, and the US Labor Secretary."

Welcome to TBL Weekly #69—the free weekly newsletter that keeps you in the know across bitcoin, rates, risk, and macro. Grab a coffee, and let’s dive in.

River is the Bitcoin exchange of choice for the long-term investor.

Securely buy Bitcoin at the tightest spreads in the industry, have peace of mind thanks to their 100% full-reserve cold storage custody, and enjoy zero fees on recurring orders. Need help? They have US-based phone support for all clients.

Invest in Bitcoin with confidence at River.com/TBL

It was a monster of a week in markets over these last five trading days—as we outlined in last week’s TBL Weekly #68, with the largest economic release calendar of the year, this would be a make-or-break week for our position in the cycle.

And ‘break’ it did, as the slew of data confirmed that the economy is in fact slowing, with market participants now bracing themselves for impending economic recession at a brisk pace not seen yet this cycle.

On Wednesday, we received ISM Manufacturing, which is in shambles, as all of its components continue moving down except for prices paid. Said differently: US manufacturers have fewer new orders and fewer employees than last month. Not a great state to be in:

Later in the day, the Fed decided to keep policy rates unchanged, in line with market expectations. During the press conference, Powell was asked about extending the BTFP emergency loan program beyond when it’s set to expire in March. He had this to say:

BTFP is preventing a cascade of bank failures that could occur if the ~$1.5 trillion of unrealized losses in the US Treasury market had to be realized.

With the program set to end in March, are he and his fellow Fed members really not thinking about it at all? Of course they are.

He’s simply lying so as to not stir panic and accelerate the current derisking in markets. Admitting that the temporary bank loan facility is now a permanent monetary policy fixture would hurt the Fed’s credibility and cast doubt on the solvency of the US banking system.

Like all “emergency facilities” of yore, this will be permanent. It is working too well for it not to stick around. The Fed will permanently backstop its own government’s bond market, eliminating what is left of true price discovery in US Treasuries, eliminating the left tail risk of a fire sale, and casting aside any notion of “separation” from the US government once and for all.

Now that the US government and Federal Reserve are working more in tandem with one another than ever before and interests are fully aligned, the moral hazard of a US central bank has never been more clear.

On Thursday and Friday, we received a new set of jobs numbers.

If it wasn’t already clear: job data is deliberately overestimated to create false confidence about the strength of the US labor market.

8 out of the 9 job reports in 2023 have been revised lower the following month. The cycle goes a little something like this:

Payrolls are strong → it makes national headlines & the media talks about it → it gets revised down 10,000+ next month → it gets no media coverage.

What makes us so confident in this assertion? One time is a mistake, but eight times is a pattern. Sure, there are more data misses than data beats during an economic downturn, but the frequency and magnitude of the overestimation is too farfetched to be coincidental. As we’ve said, all they have left is propaganda:

If you’re enjoying today’s analysis, consider supporting us by becoming a paid subscriber. As a paid subscriber, you get full access to all research as it drops.

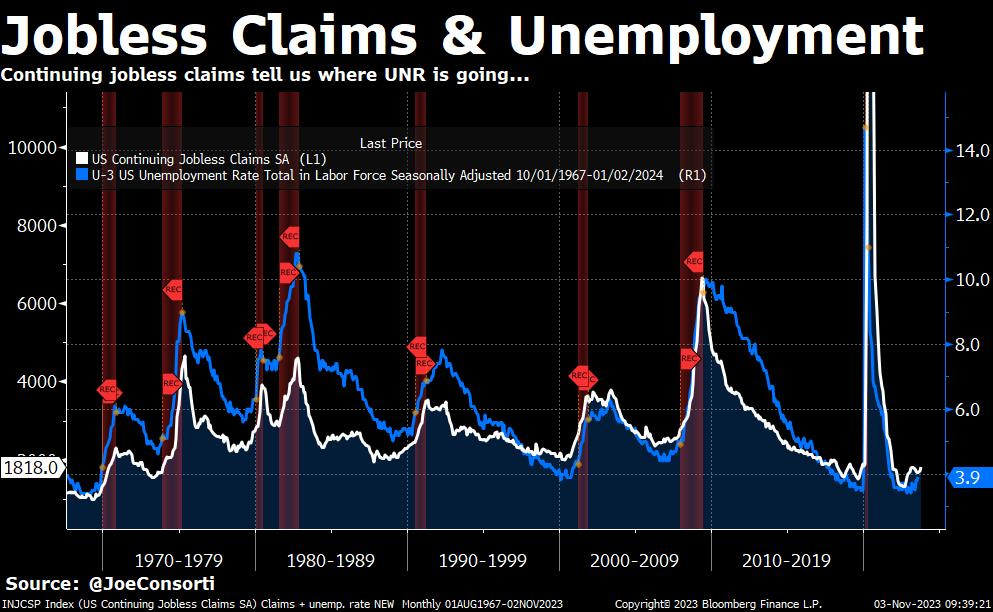

Continuing jobless claims breached a new cycle high of 1.818 million on Thursday, setting a new high for this cycle.

Tighter credit conditions are starting to translate into labor market weakness after a multi-month lag—bye-bye record-low unemployment rate.

Joe pointed out on Thursday that the unemployment rate follows continuing claims with a ~1-quarter lag—and like clockwork, the following day’s unemployment rate reflected this ⏰

The unemployment rate rose to 3.9% on Friday. As our friend TXMCtrades points out, when it rises 0.5% above its low, recession comes shortly after. We’ve now risen by that much off of the cycle low—only one thing comes next. Every single time, recession comes within months, take a look:

People with two or more jobs just hit an all-time high of 8.356 million in the United States. Americans are at the end of their rope with higher interest rates amidst still-high prices. This is #Bidenomics, right?

It's so bad that instead of a victory lap speech from the President, which has followed every one of the previous “good” nonfarm payroll data releases, the White House sent out its Chief Propagandist. Key laughable moments from the talk include:

"It's a good jobs report"

"These numbers are inconsistent with a recession"

"The 3-month average is still 204k"

We have no leaders; instead, we have propagandists who will stop at nothing not to fix America’s problems, but to convince you that they’re not real:

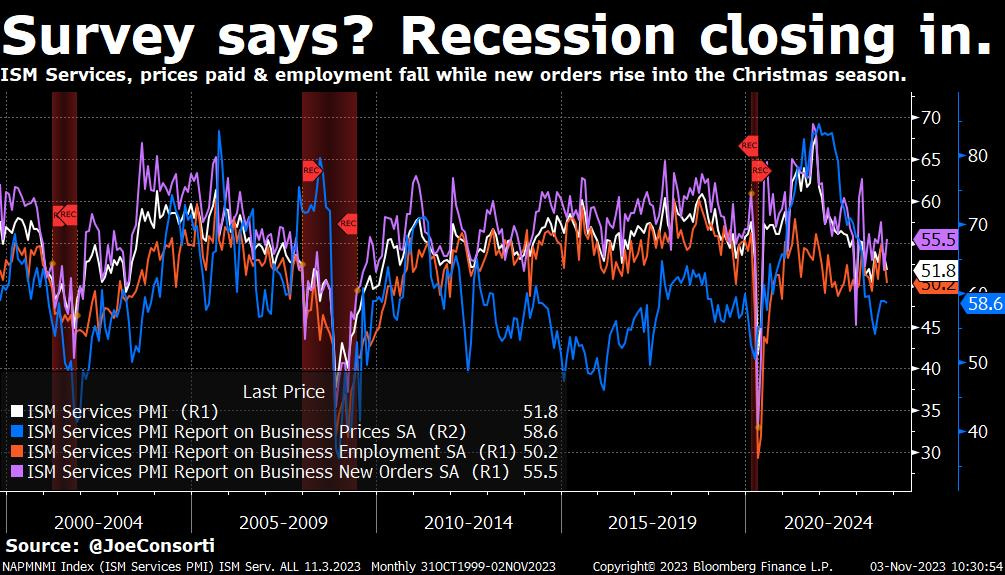

ISM Services PMI closed out the week as the very last data report on Friday, and it was a fittingly dismal one. In confluence with Monday’s ISM Manufacturing survey which did the same, it fell to its lowest level in 5 months as each of its components apart from new orders, still rising as the Christmas season approaches, fell:

As a result of the terrible economic data, the week saw a monster move in yields. The economy is slowing rapidly according to this week's releases, between survey data deteriorating and withering payroll gains and unemployment data.

In response, yields are plummeting.

2s are down 28 bps in 30 days, and down a whopping 13 bps on Friday alone. 10s had a similar fall. Not helping this precipitous fall in Treasury yields was the introduction of the word “financial” by the Fed—admitting that rising yields have done damage was enough for investors to think that they will soon be coming down. The higher phase of ‘higher for longer’ is undoubtedly over, now the lingering question is how long can the longer phase last.

Survey says? Hikes over, recession soon:

One final question remains: what does this mean for markets?

To answer that, we need to first ask another: how much more time on the ‘bad news is good’ shot clock is left?

This is what Michael Kantro asked on Twitter earlier on Friday in reference to the unemployment rate rising past the aforementioned point of no return. Per their correlation with the Citi Economic Surprise Index, stocks have been rallying off of bad economic news for the past three months—this correlation has flipped in the other direction recently. If stocks can hold this correlation change, where bad economic news causes a selloff in stocks, we know with near certainty that the endgame for markets this cycle is nigh. Until then, let irrationality reign supreme in the stock market:

Next Week

In the week ahead, data is incredibly light, and what a relief. With the most robust economic calendar week of the year concluded, we all deserve a respite from the onslaught of information. So once again, we will turn our attention to the markets and a continued digestion of last week’s data. University of Michigan preliminary data will arrive on Friday, but Thursday’s unemployment claims data, which arrives weekly, probably has the most significance:

If you’re enjoying today’s analysis, consider supporting us by becoming a paid subscriber. As a paid subscriber, you get full access to all research as it drops.

Here are some quick links to all the TBL content you may have missed this week:

Tuesday

With ~85% of 2023 behind us, performance in the stock market has started to tumble lately. Not only are investors foaming at the mouth looking at 5% interest on 10-year US Treasuries, but the companies that stock prices rest on may be starting to feel the pain of a Fed hellbent on slowing US business activity.

With all of this in mind: are we in a bull or a bear, and does the Fed even care?

Check out—Bull or Bear, and does the Fed care?

Wednesday

In this episode, Nik walks us through his entire global macroeconomic framework. From Treasuries to economic indicators to the Federal Reserve's seemingly unlimited money creation, join us for a masterclass in economic and markets analysis. This lecture combines interest rates, inflation, yield curve, business surveys, and asset performance into one study.

Check out—Global Macro Masterclass with Nik Bhatia

Friday

Congrats to us all. In what has certainly been the most active week in rates coverage since the Spring’s regional banking crisis, the takeaways are bullish Treasuries and bearish on the economy. Risk, however, becomes more difficult to assess, as the stage in which we find ourselves has transitioned from “tightening” to “awaiting easing.” Did you feel it?

Check out—Did you feel that?

“There are three kinds of lies: lies, damned lies, and the US Labor Secretary." In this video, Joe walks through the largest week of economic data in 2023 which is bound to be a cycle turning point thanks to an overwhelming influx of bad data on all fronts.

Check out—Recession Imminent As Yields Plummet & Economy Sours

Our videos are on major podcast platforms—take us with you on the go!

Apple Podcasts Spotify Fountain

Keep up with The Bitcoin Layer by following our social media!

YouTube Twitter LinkedIn Instagram TikTok

That’s all for our markets recap—have a great weekend, everyone!

River is the Bitcoin exchange of choice for the long-term investor.

Securely buy Bitcoin at the tightest spreads in the industry, have peace of mind thanks to their 100% full-reserve cold storage custody, and enjoy zero fees on recurring orders. Need help? They have US-based phone support for all clients.

Invest in Bitcoin with confidence at River.com/TBL for $5 free when you buy $100 in Bitcoin.