"Soft Landing" Headlines Soar... A Great Recession Indicator: TBL Weekly #71

Happy Thanksgiving 🦃🌽

Welcome to TBL Weekly #71—the free weekly newsletter that keeps you in the know across bitcoin, rates, risk, and macro. Grab a coffee, and let’s dive in.

River is the Bitcoin exchange of choice for the long-term investor.

Securely buy Bitcoin at the tightest spreads in the industry, have peace of mind thanks to their 100% full-reserve cold storage custody, and enjoy zero fees on recurring orders. Need help? They have US-based phone support for all clients.

Invest in Bitcoin with confidence at River.com/TBL

First things first, Happy Thanksgiving! We hope you enjoy spending plenty of time with your loved ones, reflecting on all that you’re thankful for.

Starting on Monday, let’s walk through the week’s market action day-by-day.

Michael Sonnenshein, CEO of Grayscale and its GBTC closed-end bitcoin trust, tweeted the following bright and early to kick off the week:

Upon this news, GBTC’s discount to the fund’s net asset value rose to a level not seen since 2021 of -10.35% as investors priced in that his words could mean imminent approval of GBTC’s conversion into a spot ETF, potentially dragging all pending spot bitcoin ETF to approval as well:

Tuesday saw US consumer price inflation fall in October, going from 3.7% year-over-year price increases down to 3.2% YoY. Economists and leaders of the free world took this moment to celebrate, as per usual, with all of the pomp and enthusiasm of a 95-year-old’s birthday party, to boot.

The 2-year yield nuked in response, down 15 bps in the moments after the faster-than-expected slowdown in consumer prices. The 10-year yield also fell 15 bps given that in our consumer-oriented economy measured by spending, prices in decline mean less spending and therefore slower growth:

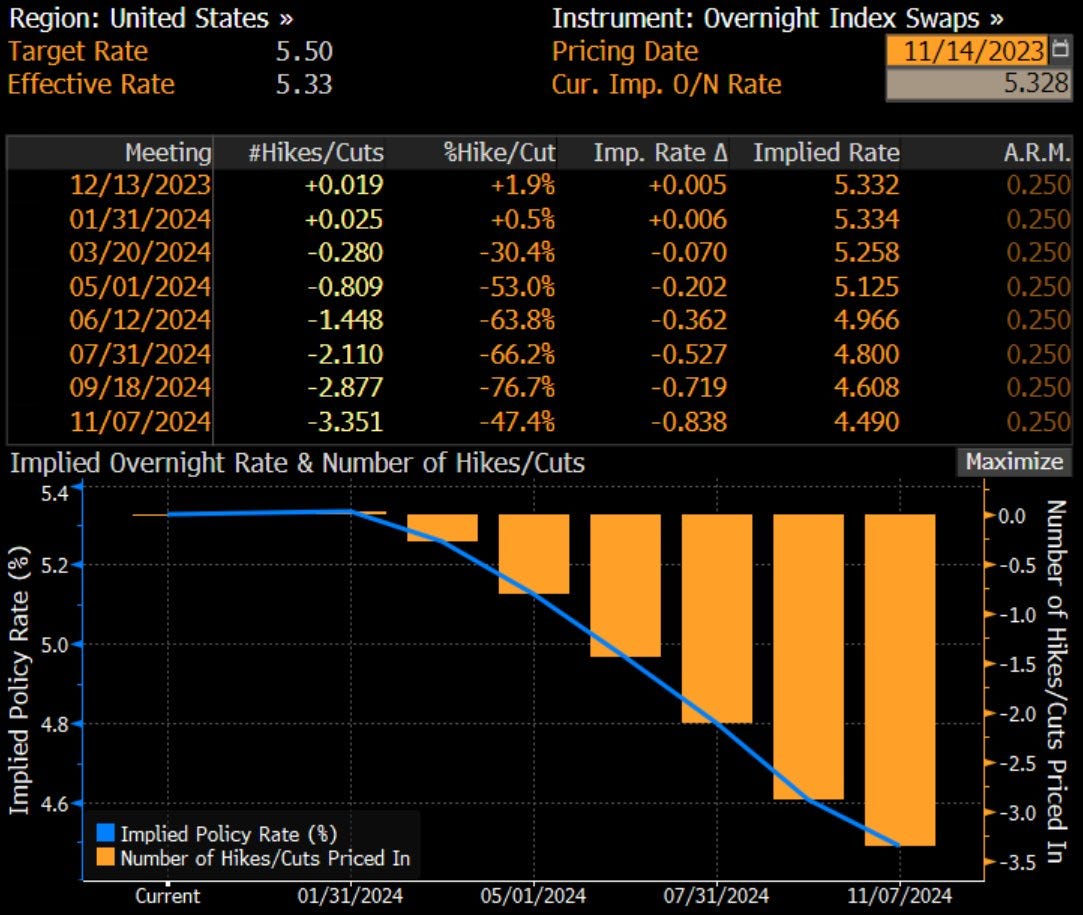

Auction truthers waxing on the end of the world due to last week’s horrific auction have been met with… the market pricing in rate cuts, and rates staying flat on the week. Doomsayers and soothsayers calling for a 7% two-year yield cannot beat the market’s prognosis in the face of swift disinflation: rate cuts. We are now seeing zero probability of any more hikes, coupled with the first rate cut arriving by May/June:

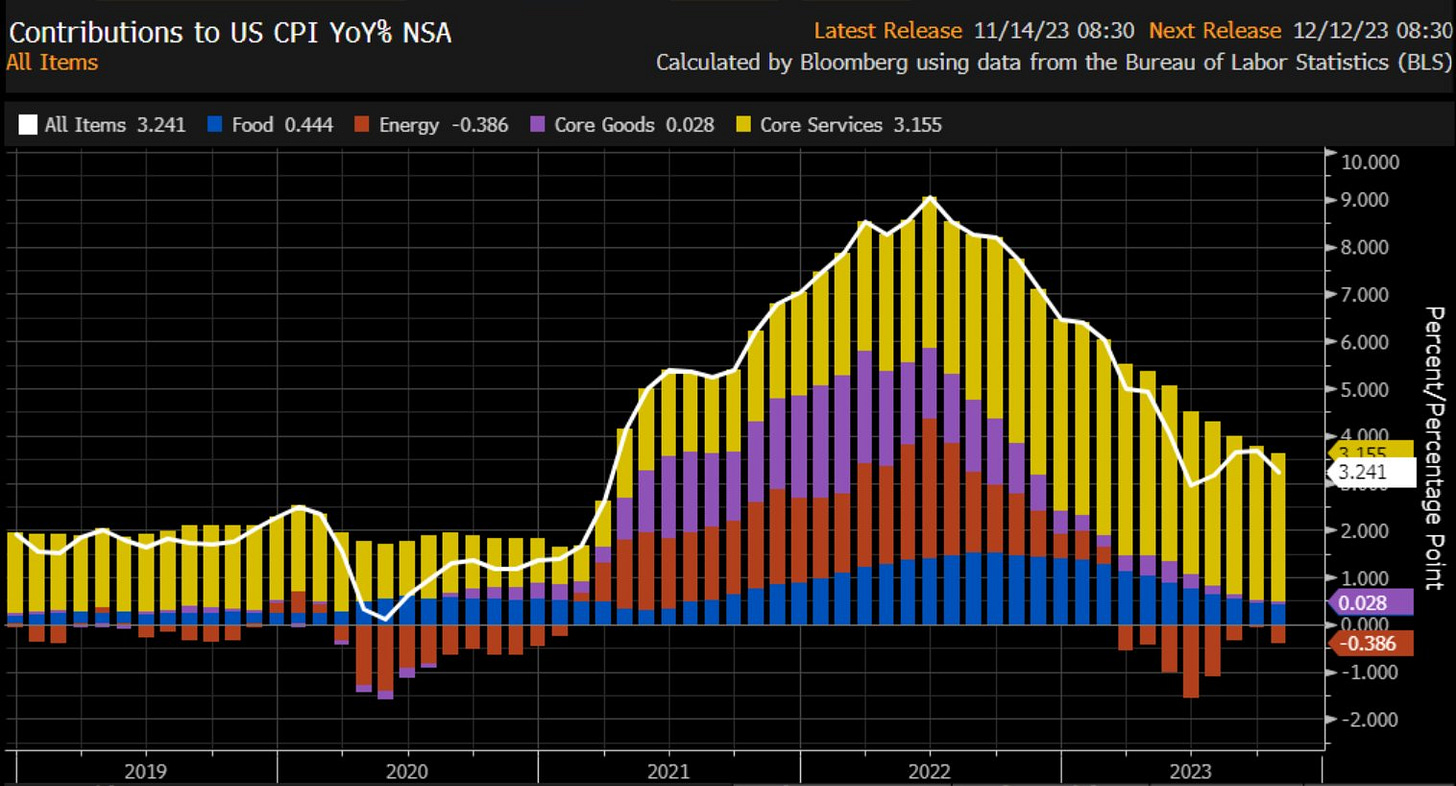

With CPI inflation making a swift fall last month, what’s still holding up the britches from falling past the economy’s ankles and down to the floor?

Mostly, core services. Shelter, trash collection, medical care, transportation, etc. These are life's necessities and only meaningfully stabilize during recessions. The only way the Fed "brings down" price inflation to its target is by inducing a recession, wherein people are so destitute that they cut back on life’s necessities. Disinflation accelerates rapidly during recessionary environments, and Tuesday’s print may have been the signpost for this to begin. Core goods, in purple, looks like it might be turning negative any month now:

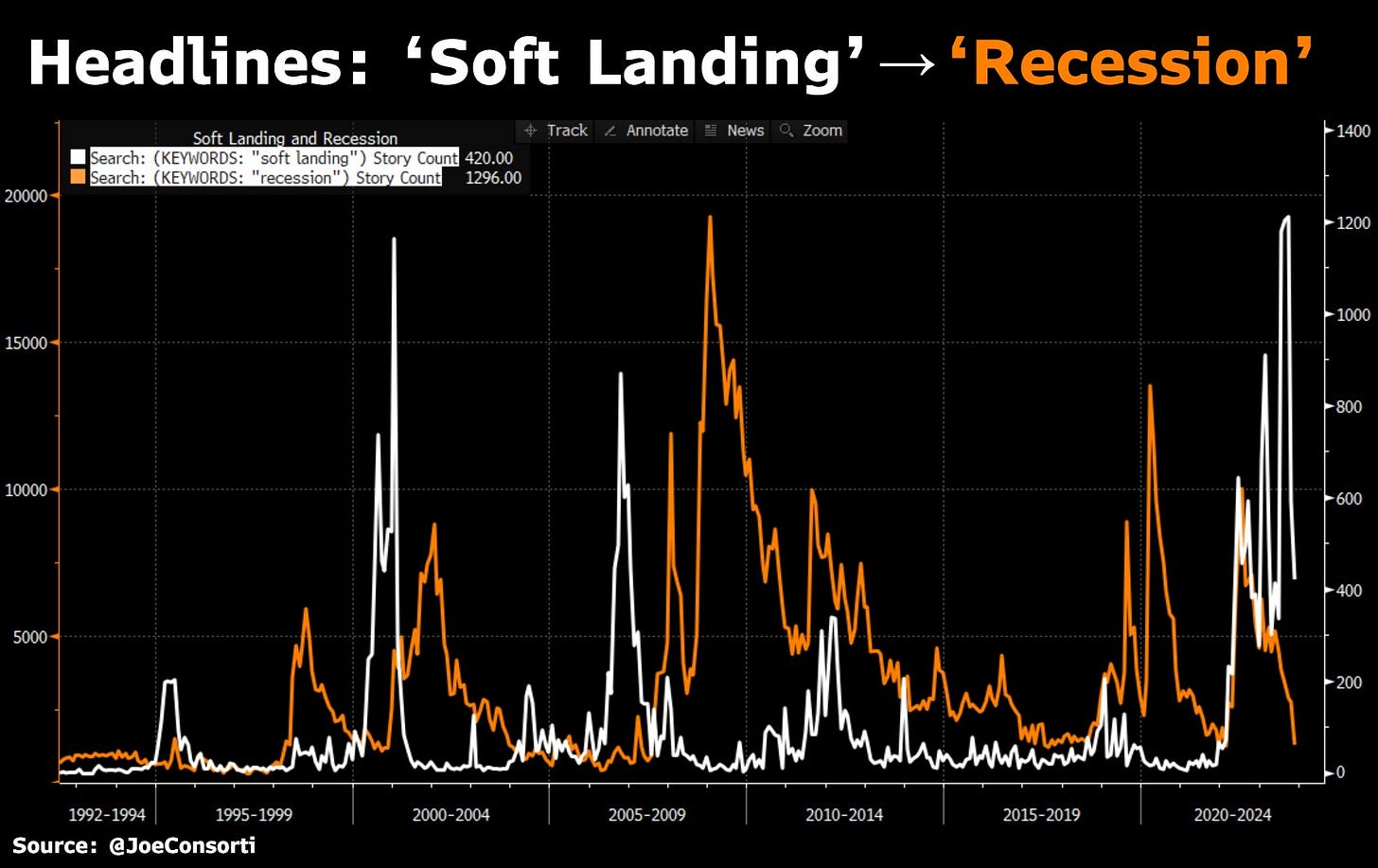

'Soft landing' news headlines are making a comeback. Not for long, I'd suspect, considering the headlines for ‘recession’ and a coinciding recession succeed these spikes in soft-landing bulletins and news chyrons:

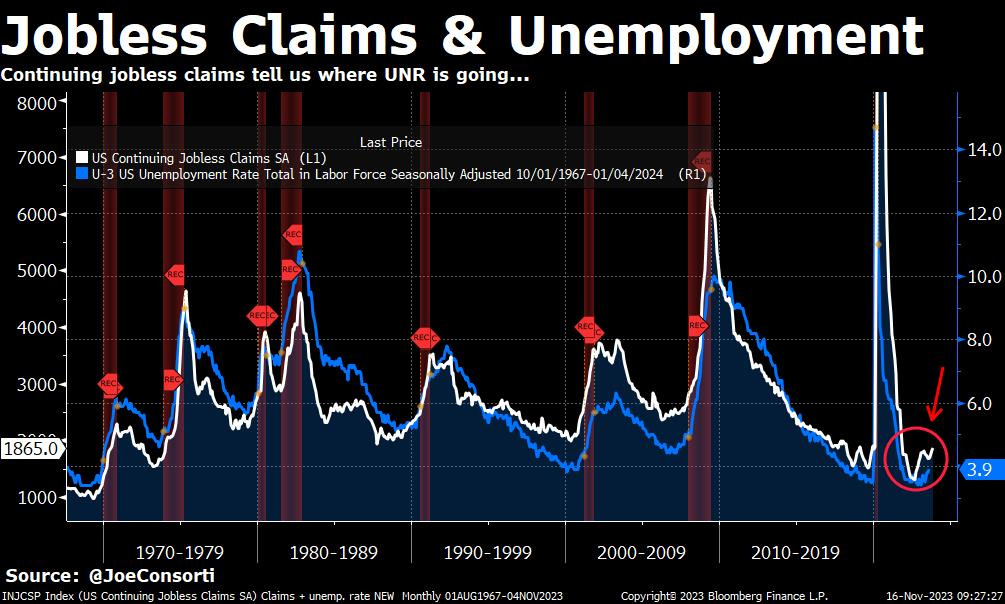

Adding more bread to the recessionary basket, continuing jobless claims rose to their highest level since 2021 on Thursday. Currently, 1.865 million people remain on unemployment benefits. Jobless claims historically lead the unemployment rate by 2-3 months. Looks like a 5% unemployment rate isn't very far away:

Walmart, the world's largest retailer, is worried about consumer resilience. It saw a "sharper falloff" in recent weeks and expects consumers to rely on discounts, citing high rates and student loan repayments as the culprits behind consumer weakness. In all of our macroeconomic analysis, there are some moments when we must pause and reflect on what an individual company executive is trying to tell us. Walmart customers are looking for discounts—this is not a strong economy, and far from it. Rate hikes may be done for this cycle, but the consumer squeeze is just getting started:

Friday was a pivotal day for the approval of spot bitcoin ETFs, as the SEC has directly advised all issuers that it would like the ETFs to use cash-create instead of in-kind redemption—one step closer to approval, as the final details on the SEC’s desire for all of the spot BTC ETFs’ mechanics are ironed out.

Bloomberg Intelligence’s Eric Balchunas still has approved odds in 2023 at 90%.

Also from Eric on the risk-taking front, the party in risk is still raging. QQQ just saw its largest single-week of inflows since the fund was created:

The economy is rapidly worsening, with savings dwindling and credit card delinquencies rising precipitously. This doesn’t end well. We reference the ‘soft landing’ chart from earlier: market cycles always end with a bang, never a whimper despite what pundits may push towards the resolution of every cycle. We’ve been documenting economic deterioration for months now; it continues to deteriorate behind the scenes.

Markets are simply still in Goldilocks party mode, and you just can’t fight that.

Next Week

In the Thanksgiving-shortened week ahead, we look forward to elastic waistbands once Thursday arrives, but the early part of the week should give us some data on which to chew. Existing home sales and Fed minutes from the November 1st meeting arrive on Tuesday, with jobless claims hitting on Wednesday instead of the usual Thursday release. Will continuing claims top 1.9 million, and how sharply are existing home sales falling? We don’t expect many fireworks in markets as participants are mostly focused on getting a few days away from the screens.

If you’re enjoying today’s analysis, consider supporting us by becoming a paid subscriber. As a paid subscriber, you get full access to all research as it drops.

Here are some quick links to all the TBL content you may have missed this week:

Monday

In this episode, we are joined by Max Gagliardi, founder of Ancova Energy. We bring Max on to discuss his real estate project, Mountain Fork Vacations in Oklahoma. Max explains the economics of short-term rentals and answers questions about a potential Airbnb bubble.

Check out—Is There An Airbnb BUBBLE Bursting?

Tuesday

Journalists, economists, and the sitting President of the United States use this and other intentional misnomers like the ever-popular "inflation is falling" to fool uninvolved Americans that prices are normalizing leading into an election year.

Why do they do this?

It’s simple: prices never fall.

Check out—Prices Never Fall

Wednesday

In this episode, we are joined by Daniel Batten, cofounder of CH4 Capital. Daniel is a clean tech investor and has been dedicated to the mitigation of methane emissions for the past several years. He now invests in bitcoin mining operations around the world that utilize landfill gases for energy. The implications for bitcoin as an environmental force are wide and powerful, and Daniel guides us through what might happen when bitcoin is recognized for its clean energy potential.

Check out—Bitcoin Is GREEN TECH

Thursday

Unemployment claims have finally entered “spiking” territory, and Industrial Production statistics have fallen deeper into contraction territory. Things aren’t going great, it appears, throughout the economy. But for valid reasons, investors seem to be more focused on falling liquidity. The Fed’s RRP, or reverse repurchase (repo) facility, now dominates the conversation. Is the sky falling now that this facility plummets below $1 trillion? First, we must explain to you what it is, and how it fits into money markets.

Check out—Understanding Reverse Repo (RRP)

Friday

In this episode, Nik dives deeper into the Fed's Reverse Repo (RRP) facility and gives a brief history of its origin and function. He explains how the RRP relates to other portions of the Fed's balance sheet as well as other money market sectors. Lastly, Nik provides an update on Treasury yields, the yield curve, and monetary policy expectations.

Check out—Reverse Repo (RRP) Explainer & Markets Update

Our videos are on major podcast platforms—take us with you on the go!

Apple Podcasts Spotify Fountain

Keep up with The Bitcoin Layer by following our social media!

YouTube Twitter LinkedIn Instagram TikTok

That’s all for our markets recap—Happy Thanksgiving, everyone!

River is the Bitcoin exchange of choice for the long-term investor.

Securely buy Bitcoin at the tightest spreads in the industry, have peace of mind thanks to their 100% full-reserve cold storage custody, and enjoy zero fees on recurring orders. Need help? They have US-based phone support for all clients.

Invest in Bitcoin with confidence at River.com/TBL for $5 free when you buy $100 in Bitcoin.