Welcome to TBL Weekly #57—the free weekly newsletter that keeps you in the know across bitcoin, rates, risk, and macro. Grab a coffee, and let’s dive in.

Invest in Bitcoin with confidence at River.com/TBL

Securely buy Bitcoin with 100% full-reserve custody, enjoy zero fees on recurring orders, and even buy a hosted Bitcoin miner, completely hassle-free.

Headlines about a soft landing for the US economy have dominated financial news media lately. A soft landing is defined as a slowdown in economic growth that does not teeter negative into a recession. This is what the Fed is trying to achieve so it can fulfill its dual mandate of full employment and stable prices.

Just about half of all programming on CNBC, Fox Business, and Bloomberg TV is now devoted to the idea that the Fed’s rate hikes have accomplished the mission of returning CPI inflation to its long-run average without upending the US labor market and economy.

Not so fast, hopefuls.

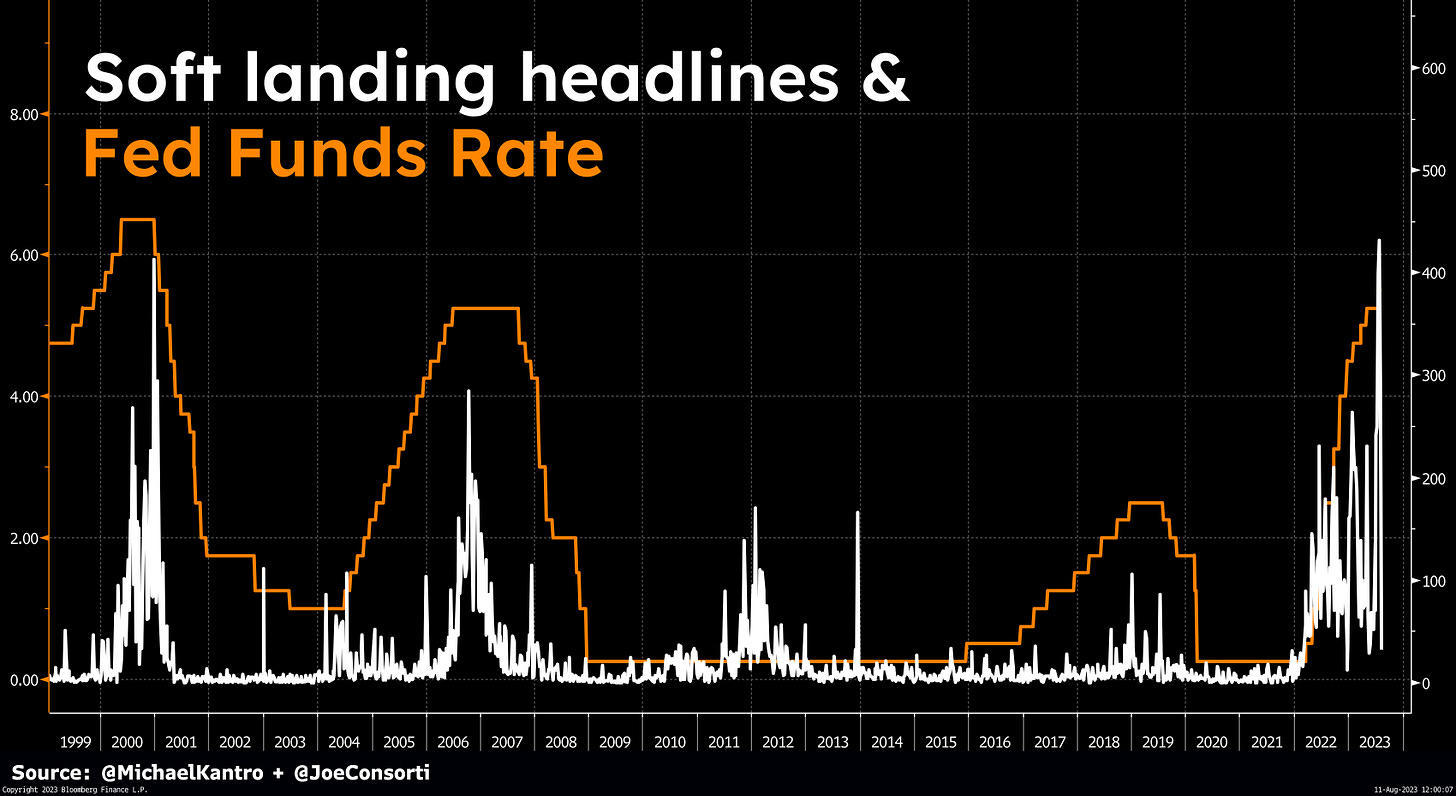

To visualize how this is nothing new under the sun, here is a graph going back to 1999 plotting soft-landing headlines and the Federal Funds Rate. It is abundantly clear: every time the Fed approaches the peak of its rate hiking cycle, news headlines about a soft landing surge:

We are in a transient period when rates peak but the economy is still OK—it only lasts a few months, then the lags of 12-18 months of rate hikes hit and the economy unwinds. This time is no different. If history is our guide, there will not be a soft landing.

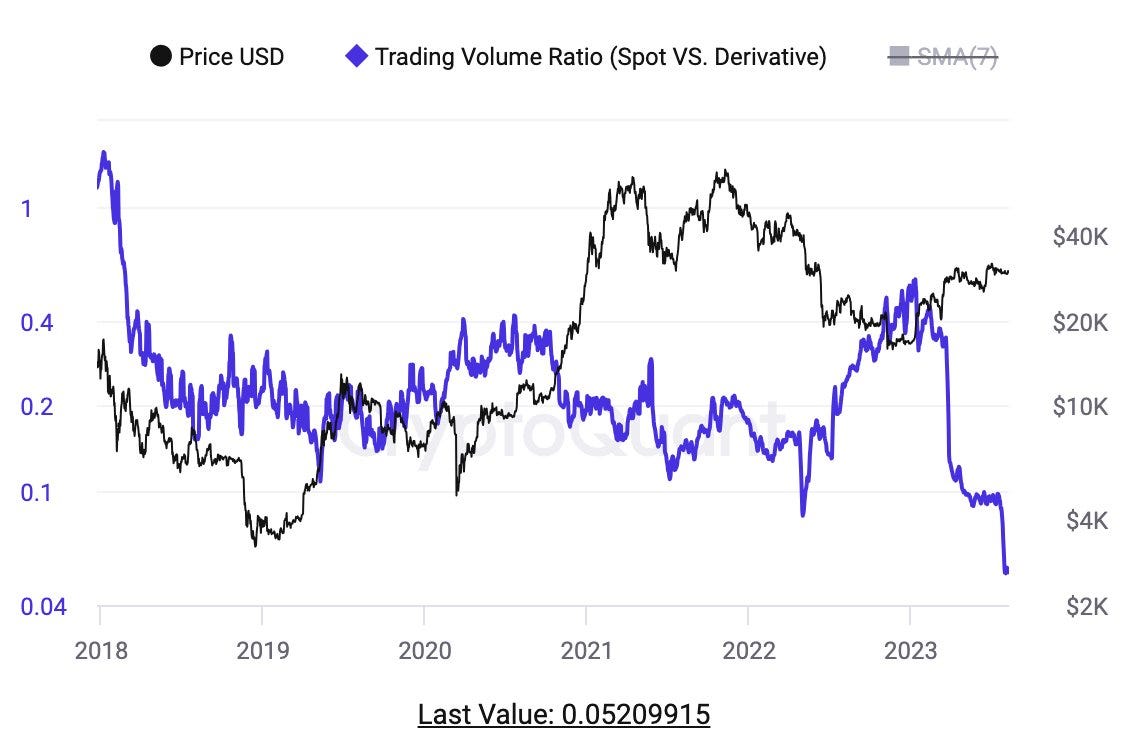

Institutional and retail interest in bitcoin is arguably at a multi-year low. Bitcoin’s price action has devolved into that of a stablecoin, dominated by low spot volume with the baton passed off to derivatives traders to battle against one another and generate the minor chop we’ve now observed for 3 months. This dynamic is confirmed by the spot/derivative ratio trading at all-time lows:

It’s all about macro. Crude oil’s price is up $15/barrel over the last 6 weeks as a function of still-strong global demand and supply constraints from OPEC, Saudi Arabia, and now US producers that have cut domestic oil and gas drilling to its lowest level since April 2022:

This move and any continued strength in oil will have little to no impact on CPI inflation. Why? Despite being the most important price for 95% of US citizens, gasoline represents just 3.415% of the weight of the CPI inflation measurement.

Nonsense, we know.

In reality, prices have doubled since this time in 2021, yet the central bankers cheer that CPI inflation is closing in on its long-run average.

CPI inflation rose marginally in July per Thursday’s new data, with energy leading the minor 0.2% increase to 3.17% price inflation since last July:

Despite this minor uptick in price inflation, let’s not forget that given prices are downstream from the money supply so the risks have teetered toward deflation. Money supply as measured by M2 is at its deepest negative point since the early years of the Great Depression; imagine a world where prices follow:

Interest rate expectations have been below the Fed’s policy interest rate for 8 months now, approaching the average length of time before the Fed gives way and cuts rates. With credit conditions finally tightening as shown by fewer corporate loan deals and a reduction in consumer credit, it’s safe to say that the day of uninversion may soon be upon us in the months ahead:

Next Week

In the week ahead, we receive a nice chunk of July economic data, but by the third week of August, we are certain that economic activity still remains relatively robust in the third quarter of 2023. Retail sales should confirm this.

On Wednesday, we’ll read how the FOMC is treating its hiking cycle when minutes from the July meeting are released. The Fed hiked, so we know how they felt about whether or not their job was complete, but will the minutes give any indication of how much longer this hiking cycle continues? We doubt it, especially because the Fed is known to pivot on a dime when things go south.

A reminder to our readers that Fed Funds expectations (not 2-year yields, as we discussed above) have been fairly offside since March. Looking back at previous posts, the expected policy rate by September (in March) would have meant about 50 basis points of cuts when we’ve actually had 50 basis points of hikes instead. Basically, trades that expected the Fed to pivot to cutting rates were rinsed. Now, we see another wave of cuts being priced into the market for 2024—many, including ourselves, are wondering whether these expectations will be just as wrong as they were in March of this year. At The Bitcoin Layer, we must use the lagged effects of monetary policy tightening as our best guide. A recession and rate cuts remain our base case scenario, but the timing has been impossible to pin down. With our cycle approach, we remain steadfast that tougher times for the economy are approaching:

Foundation Devices is self-custody done right.

Start with their easy-to-use and private mobile wallet with Envoy, then transfer it to the most intuitive hardware wallet in Bitcoin with Passport.

If you’ve been on the fence about taking your bitcoin off of exchanges, Foundation’s suite of intuitive self-custody solutions is for you.

Take custody of your Bitcoin today by visiting foundationdevices.com

If you’re enjoying today’s analysis, consider supporting us by becoming a paid subscriber. As a paid subscriber, you get full access to all research as it drops.

Here are your quick links to all of the TBL content for the week:

Tuesday

The era of easy money is over.

After 14 years of near-zero policy interest rates, followed by a 15-month grace period during which the effects of policy tightening had yet to impact borrowing costs, the price of money is finally rising—to the dismay of borrowers the world over.

Capital has been grossly misallocated across corporate debt and real estate thanks to zero-interest rates shifting time preference forward and quality backward. As the piper comes a-knockin’ to be paid, that grossly misallocated capital will be wiped out.

Check out—The Corporate, CRE, and AirBNB Debt Timebomb

Wednesday

In this episode, Nik takes us on a tour across asset classes. He examines the price action and behavioral impulses of buyers and sellers for US Treasuries, bitcoin, ETH vs BTC, the stock market, volatility, and oil.

Check out—7 CHARTS TO WATCH: Stocks, Bonds & Bitcoin

Thursday

We pause our US-centric macroeconomic analysis for a look at China’s economy, and what we see is not exactly pretty. In fact, when looked at with a critical eye, what’s happening right now in China is downright scary. That is, of course, if you’re looking at it from Xi Jinping’s perspective.

Check out—China Defaults Coming, What Will Xi Do?

Friday

The era of easy money is over—for borrowers the world over, it's time to sell assets or downsize to operate at higher rates. Anything to avoid default.

Check out—The Corporate, CRE, and AirBNB Debt Timebomb

Our videos are on major podcast platforms—take us with you on the go!

Apple Podcasts Spotify Fountain

Keep up with The Bitcoin Layer by following our social media!

YouTube Twitter LinkedIn Instagram TikTok

That’s all for our markets recap—have a great weekend, everyone!

River is the Bitcoin exchange of choice for the long-term investor.

Securely buy Bitcoin with 100% full-reserve custody, enjoy zero fees on recurring orders, and even buy a hosted Bitcoin miner, completely hassle-free.

Invest in Bitcoin with confidence at River.com/TBL for $5 free when you buy $100 in Bitcoin.