Spring Has Sprung: TBL Weekly #40

The acute banking stress has abated, but the decline of new credit issuance and recession is still ahead of us.

Welcome to TBL Weekly #40—the free weekly newsletter that keeps you in the know across bitcoin, rates, risk, and macro. Grab a coffee, and let’s dive in.

Passport is the Bitcoin hardware wallet you already know how to use. With a gorgeous design and familiar interface, Passport makes it easier than ever to self-custody your Bitcoin. No more sitting at your computer or squinting at tiny screens. Passport seamlessly connects to your phone, empowering you to quickly view your balance and move Bitcoin in and out of cold storage.

See what best-in-class Bitcoin storage feels like at thebitcoinlayer.com/foundation

& receive $10 off with promo code BITCOINLAYER

Acute banking stress is gone, for the time being

Big banks beat earnings on Friday in a move that marked a fitting poetic end of the three-week stint of acute banking credit stress. Despite JPMorgan, Citigroup, PNC, and Wells Fargo all experiencing deposit outflows between 5% and 8%, some of the US’ largest banks managed to rise above earnings expectations thanks in part to higher net interest income from higher interest rates.

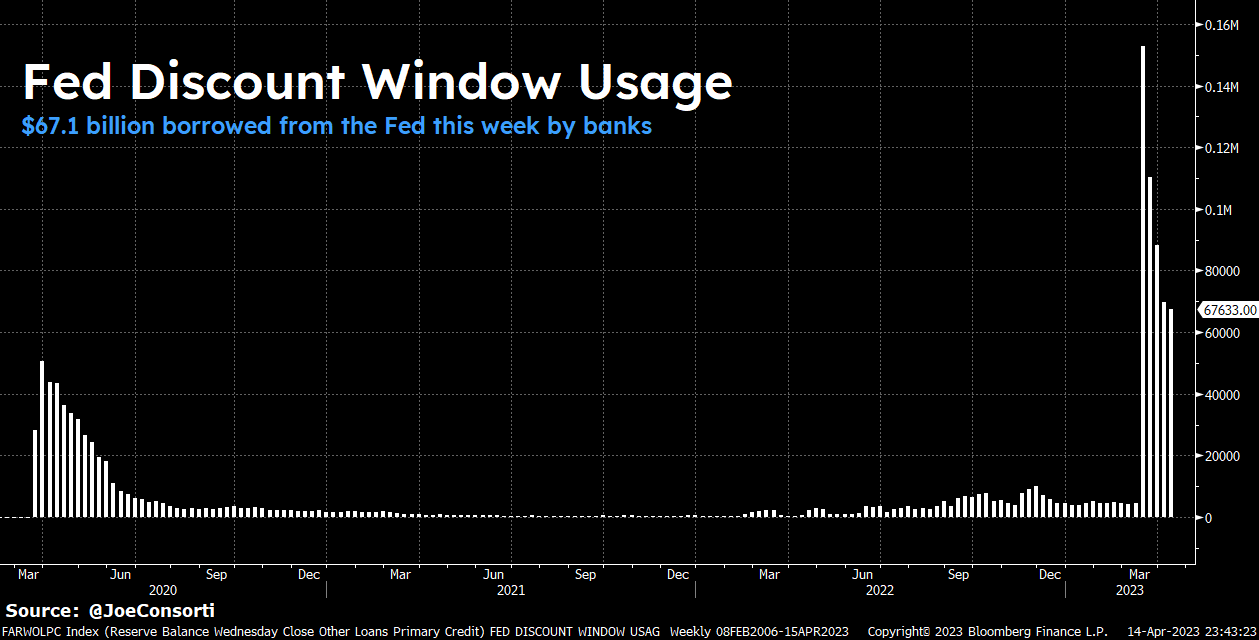

Emergency loan demand from US banks is on the decline, indicating that banks are having their funding needs sufficiently met. All told, last week the Fed loaned $67.6 billion from the discount window and $71.8 billion from BTFP—the Fed's emergency measures to stabilize the banking sector are working:

Banks also survive a credit crunch by lowering the number of new loans they intend to write so they don’t need as much funding as conditions grow tighter and tighter.

US commercial bank lending has fallen from its $12.19 trillion peak to $12.065 trillion, a fall of $104.5 billion in total credit lent by US banks in just two weeks. This week saw a slight $10 billion rebound in credit growth to $12.075 billion, but the downward direction is clear.

For now, this is circus peanuts compared to 2008/2009, which saw a several-month period of declines in US bank lending. While the acute stress within the banking sector is behind us, lending will decline, as lending standards tighten due to heightened risk aversion and higher rates leading to banks extending fewer loans to US consumers and businesses. The credit cycle downturn is only just beginning:

Stagflation fear rising, keep your eye on the ball!

Retail sales saw a massive slump this week, adding to the long list of indicators and investor positioning as of late that signals the slowdown in the US economy. ISM manufacturing PMI is in the below-50 recession zone, with services not far behind:

The economic recession is crystal clear.

To remind readers, we are looking past May’s possible rate hike, past oddball prints here and there that deviate from the secular trend, and identifying our place in the cycle: recession. No trend is a straight line—on the way to recession you will have hiccups and positive prints, but you’ll never find an economic cycle in history where every indicator is in confluence with all the others.

Are you in desperate need of a bitcoin 101? Catch Nik in Los Angeles for “Bitcoin & The Future of Money” on April 29th for a bitcoin bootcamp to bring you up to speed!

A print in disagreement with the slew of deflationary data received in recent weeks was the University of Michigan 1Y consumer inflation expectations, which beat survey expectations and rose to 4.6%:

This is driven mostly if not entirely by the rise in gas prices this month. Consumer sentiment about inflation is particularly sensitive to changes in prices of essential items due to the tight financing situation many find themselves in between price inflation and rising interest rates— a reported 70% of Americans are financially stressed, with 58% living paycheck to paycheck. Consumers don’t care about the fact that ISM prices paid is in deflation, they care (and rightfully so) about the price at the pump! Not to mention, 5-10Y consumer inflation expectations remain anchored at 2.9%, signaling this uptick in 1Y expectations is fleeting. Another print that deviates from the downtrend, but doesn’t signal a reversal in growth or inflation.

Keep your eye on the ball!

Bitcoin is worthless, so worthless it threatens to destabilize nation-states

We sometimes like to sit back and watch the oligarchs get upset at magic internet money. In a stunning display of financial illiteracy, Hillary Clinton (who has opined that bitcoin has no intrinsic value and is simply a waste of energy) says that bitcoin has the ability to threaten nation-states and undermine the US dollar.

Listen to this ~45-second clip from November 2021 that is making the rounds again:

Hillary, you’re correct—bitcoin disrupts nation-states that horribly mismanage their own currencies and drive consumers, businesses, and sometimes the nation-state itself to begin leveraging bitcoin and bitcoin mining for wealth preservation, transactions, and profiting from natural resources.

A permissionless monetary network, still in its infancy, is monetizing in parallel to the existing global financial system—an exclusive system, one that distorts price signals and floods the world with poorly allocated capital from interest rate manipulation, and funnels purchasing power to those with their hands on the wheel.

Bitcoin poses no intense threat to the US dollar over the next couple decades. The dollar is so entrenched that its demand will only rise as more fragile fiat currencies tumble into worthlessness. What Hillary means when she says it undermines USD is that by enabling sovereignty and removing the immediate need for USD by smaller nation-states, it detracts from the US’ influence over those countries. She doesn’t like that.

Come to think of it, it makes perfect sense that a state actor like Hillary Clinton would be terrified of the Bitcoin network. The mask of disregard and indifference is slipping. Fear lies underneath.

The Week Ahead

In the week ahead, we look to Empire Manufacturing on Monday as well as Friday’s prelim S&P Global PMI data releases to add to the heap of contractionary data prints from the business activity side of things. We look to Tuesday’s building permits and Thursday’s home sales data for insight into the speed of contraction in the housing sector. Finally, we will have our eye on Thursday’s jobless claims data which has taken on heightened importance lately as the labor market unwind is just getting started:

If you’re enjoying today’s analysis, consider supporting us by becoming a paid subscriber. As a paid subscriber, you get full access to all research as it drops.

Here are your quick links to all of the TBL content for the week:

Monday

In this episode, Joe sits down with Dennis Porter, CEO and Co-Founder of Satoshi Action Fund to discuss the current state of legislation surrounding bitcoin and bitcoin mining. Dennis shares his thoughts on the anti-bitcoin mining bill SB 1751 and drops some key insights on legislative environments in DC and other states.

Check out—Is The US Government Attacking Bitcoin?

Tuesday

Last June here at TBL, we wrote two pieces forecasting the recession we now find ourselves in, and how bitcoin, an asset only just now entering its teenage years, would behave during its first prolonged recession.

Now that the recession is here, let’s renew our analysis to see how bitcoin will fare over the coming months as the Fed pause, contraction, and follow-up easing unfolds.

Check out—Bitcoin's first major recession: Part Three

Wednesday

As bitcoin’s price holds above $30,000, Nik analyzes the economic data received this week and interprets the Fed acknowledging a recession is coming. And while hyperinflation, death of the dollar, and Powell attempting to crush European banks and the Eurodollar system are all entertaining narratives to explore, at The Bitcoin Layer we must sift through the noise to do what we do best—give you a medium-term outlook on the business cycle, the monetary policy, and how it all affects bitcoin. Right now, the market is sending a message, and we’re here to translate it for you.

Check out—Federal Reserve infighting, economy worsens

Thursday

And lastly, one for the visually-inclined TBL subscriber, Joe broke down Tuesday’s piece on YouTube.

In this episode, Joe breaks down how despite bitcoin being created in the wake of the 2008 recession, it hasn't been a mature asset during a major recession yet. He walks through how risk assets perform well during periods where the Fed pauses rate hikes, how bitcoin will behave when the credit stress becomes too much for the economy to bear and the Fed cuts, and what's in store for bitcoin at the start of the next market cycle.

Check out—Bitcoin's First Big Recession | Here's What Will Happen

Our videos are on major podcast platforms—take us with you on the go!

Apple Podcasts Spotify Fountain

Keep up with The Bitcoin Layer by following our social media!

YouTube Twitter LinkedIn Instagram TikTok

That’s all for our bitcoin and macro recap—have a great weekend everybody!

Passport is the Bitcoin hardware wallet you already know how to use. With a gorgeous design and familiar interface, Passport makes it easier than ever to self-custody your Bitcoin. No more sitting at your computer or squinting at tiny screens. Passport seamlessly connects to your phone, empowering you to quickly view your balance and move Bitcoin in and out of cold storage.

See what best-in-class Bitcoin storage feels like at thebitcoinlayer.com/foundation

& receive $10 off with promo code BITCOINLAYER

The Bitcoin Layer does not provide investment advice.

Why don't all newsletters have the audible feature?