"Strong" Labor Data Solidifies July Rate Hike, Sovereign Debt Crisis Brews: TBL Weekly #52

Welcome to TBL Weekly #52—the free weekly newsletter that keeps you in the know across bitcoin, rates, risk, and macro. Grab a coffee, and let’s dive in.

Receive 50% off an annual subscription to The Bitcoin Layer — only 4 days left!

Invest in Bitcoin with confidence at River.com

Securely buy Bitcoin with 100% full-reserve custody, enjoy zero fees on recurring orders, and even buy a hosted Bitcoin miner, completely hassle-free.

Foundation Devices makes self-custody hardware done right.

Start with their easy-to-use and private mobile wallet with Envoy, then transfer it to the most intuitive hardware wallet in Bitcoin with Passport.

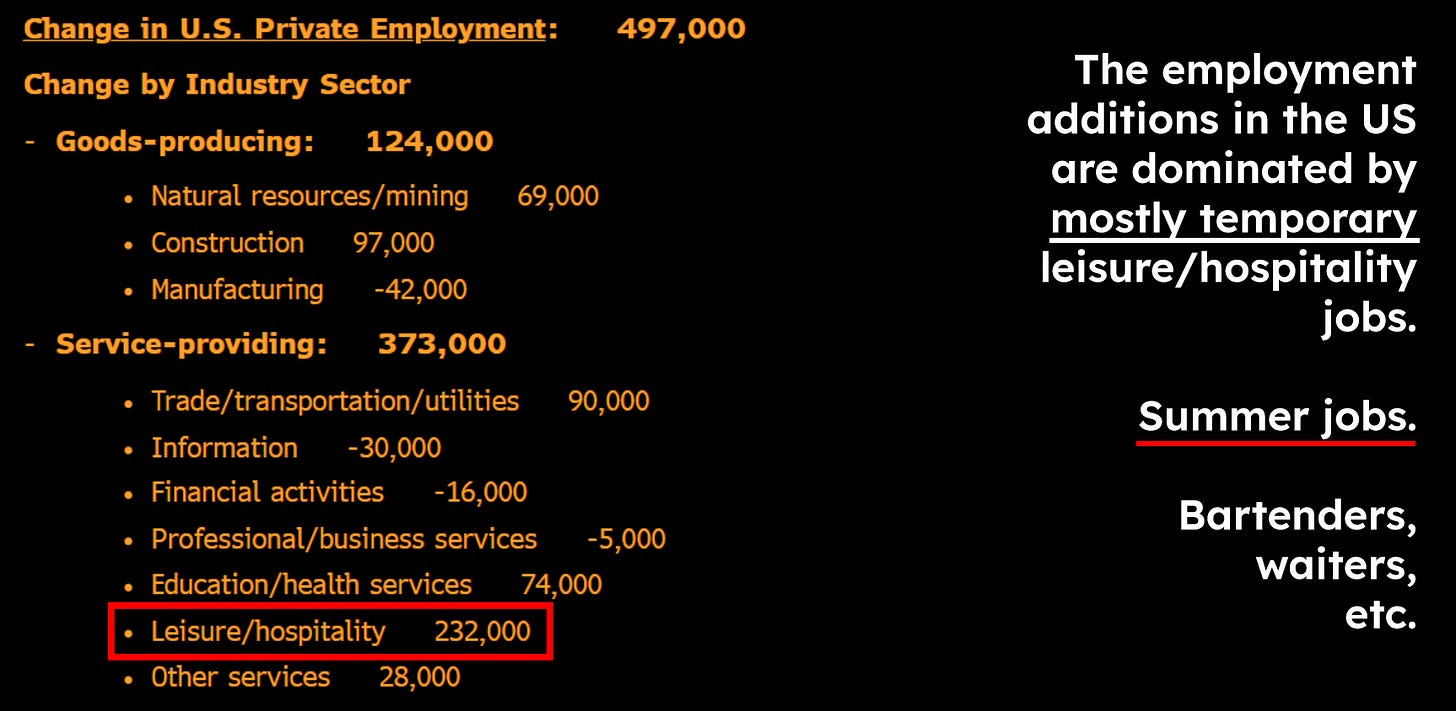

ADP Employment data signaled that 497,000 jobs were added in the month of June—more than double the analyst expectation of 225,000 jobs:

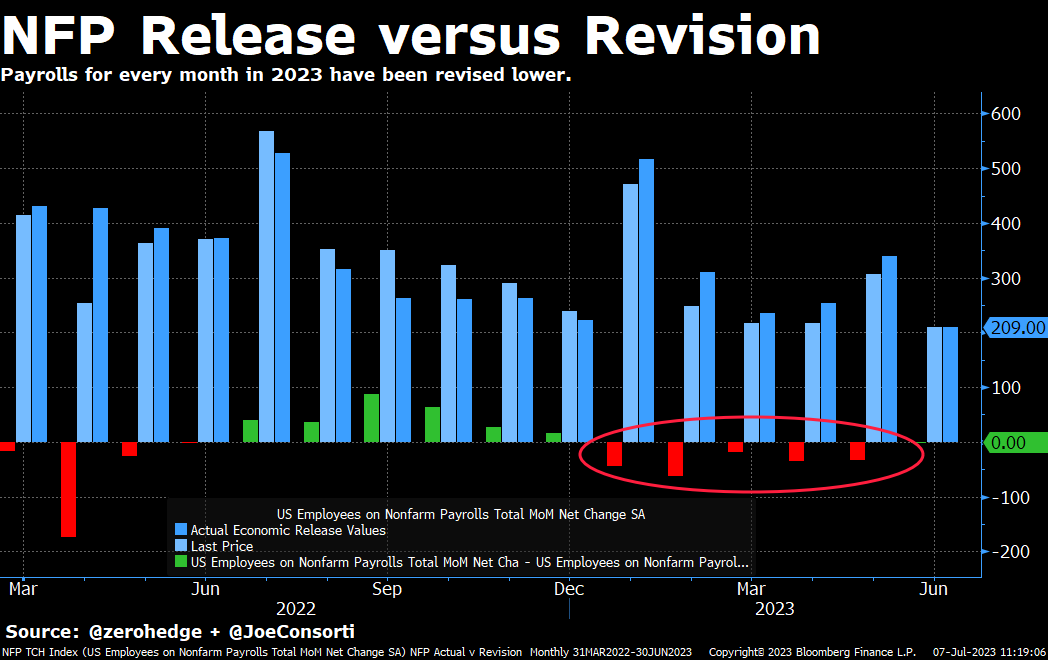

We received a similarly-robust payrolls report today—adding 209,000 jobs in the month of June, declining from May and missing analyst expectations by 22,000. Wages also managed to rise 0.4% in June.

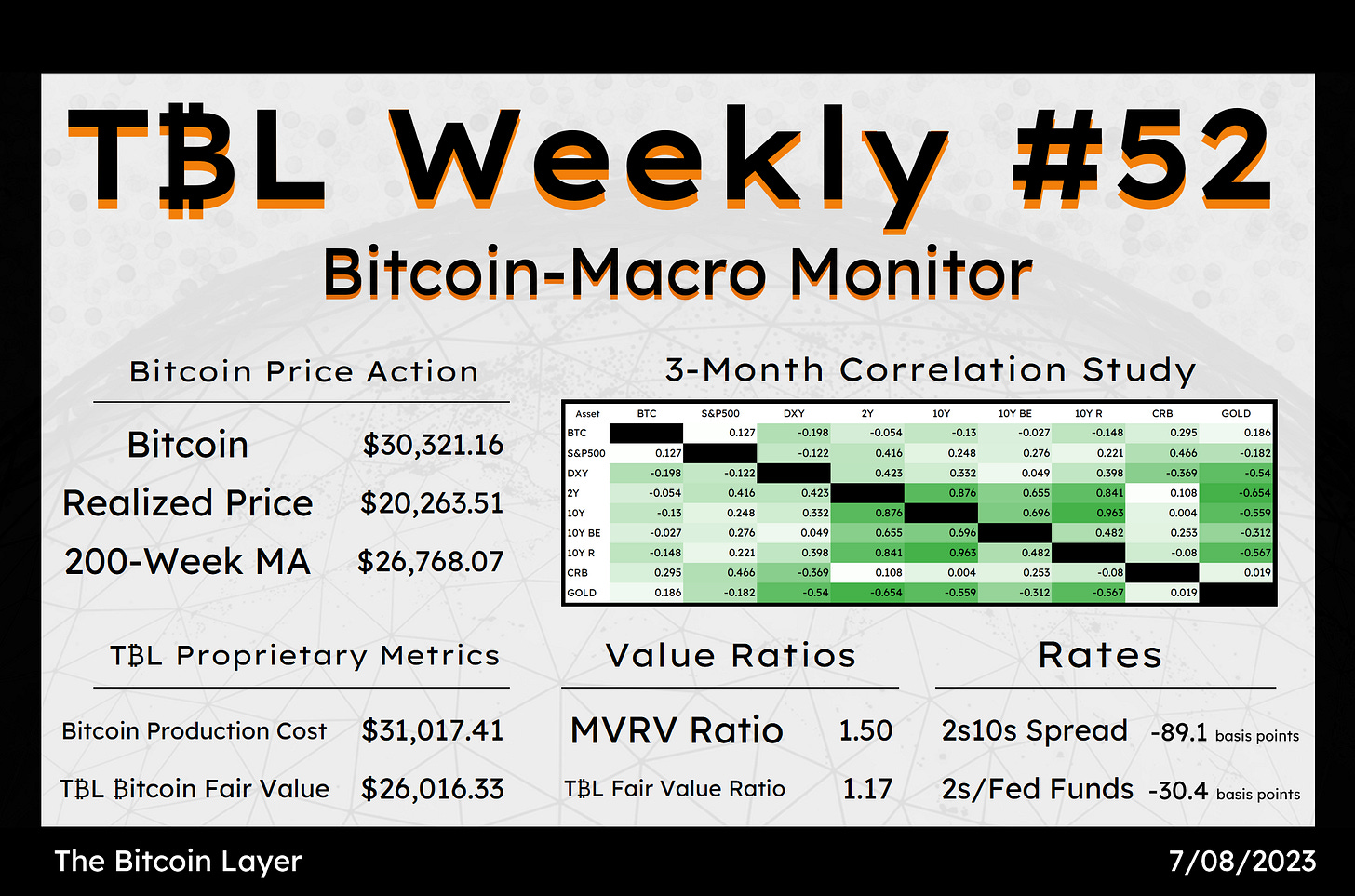

This strong two-day stretch of labor market data sent yields soaring. Markets have priced growth expectations higher and repriced for a higher policy rate from the Fed to counteract it.

Rates have gone back to their cycle highs, erasing the entire post-SVB derisking flight to bonds that sent yields plummeting.

There is now a 92.2% chance that the Fed hikes at the next meeting on July 26th, and in contrast to one month ago, rate cuts have been entirely priced out:

The Fed’s response function to a strong labor market is to tighten conditions.

Why does the Fed want the labor market to deteriorate? In no uncertain terms: It wants people to lose their jobs so discretionary spending falls and prices fall thereafter.

There’s just one problem with this outwardly strong labor market: these gains have been composed largely of temporary leisure and hospitality jobs that will fade away after the North American summer months are over:

June is a strong hiring month as vacation time kicks into high gear and demand for part-time workers to fill the hospitality gap rises. Lifeguards, bartenders, waiters, and others. In seven of the 10 Junes since 2012, jobs have risen:

These are bartenders and waiters, not coal miners and steel fabricators.

June isn’t representative of the growth or decay of the labor market, so the Fed kickstarting its hiking campaign could prove ill-fated if the state of the regular labor market is worse than headline additions suggest.

As for the added payrolls, 60k of the 209k were government jobs—some 28% of the total increase. On top of that, roughly 8,000 of the jobs “created” were people taking on a second job, referred to as “Multiple Jobholders” in the BLS’ June Report. Plenty of temporary hires, government fluff, and full-time employees taking on additional work to make ends meet helped window-dress the headline numbers.

We are suspicious these job gains won’t hold in hindsight, as payrolls for every month in 2023 have been revised lower the following month. Economists have had a recent record of overestimating the strength of the labor market:

The Fed will hike, absent a very weak CPI data report, because it wants to tame this deceptively strong labor market, but at least half of these job gains will be erased when the summer months are over and the workers won’t have that discretionary income stream anymore.

Said differently, the Fed will hike to fix a problem that will mostly correct itself in two months.

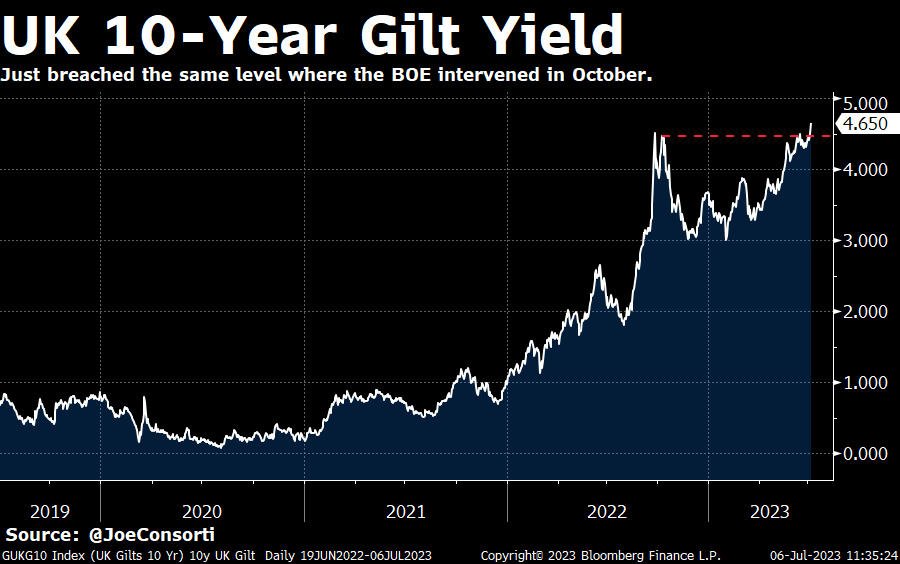

Which begs the question: how high can yields go before things get dicey?

It’s important to remember: yields are low historically.

We just wrapped up a 50-year bond bull market, where the only direction for rates was down—now that we’ve breached the 0-lower bound, the only secular direction for rates is back up. A bond bear market, however long it will last, could be what’s next on the docket. We’ve only just seen the beginning of it:

Look at gilts, for example. A more illiquid sovereign debt than US Treasuries has started exhibiting the up-only selloff behavior. Rates have nowhere else to go:

This is going to explode some financial institutions, UK Pension Crisis-style.

If rates keep ripping higher, the duration losses on all sovereign incurred by financial institutions will continue racking up, in the US and otherwise. Think about what happened in last year’s UK gilt crisis.

Central banks may have to step in as the marginal buyer and stave off this wave of defaults to ravage the economy.

And lastly for this week, stocks are overextending themselves.

Total Fed liquidity is flat over the past year since May 2022, while stock indices continue to stretch for their all-time highs—look at the divergence between liquidity and the S&P 500:

Take a look at the period from 2018-2019 above. Net liquidity dropped for two years while the S&P 500 exhaustively rose at a steepening pace until COVID kicked the fragile legs out from underneath the rally that didn’t have any basis in liquidity, to begin with.

Just like that period, it cannot last today. It may take a year or two as it did last cycle, but the reality of flat liquidity and rising stocks indicates a market built on a foundation of air. Until reality sets in though, the party will rage on.

The music is still playing, but the chairs are being slowly removed as the market dances around them:

In the week ahead, we receive the most important economic data point of the month: CPI. In June, month-over-month inflation is expected to increase 0.3%, while the annual rate of inflation is expected to drop all the way to 3.1%, only a few tenths of a percent above the Fed’s official target. Core inflation, annually, is expected to fall to 5% from 5.3%. We will also receive producer inflation on Thursday and learn more about current disinflationary trends. All in all, this is a massively important release for the FOMC. If the rate hike pause we experienced in June is to continue, the Fed must be able to point toward an inflation trend heading in the proper direction. Any sign of heat will essentially lock in the July hike toward the end of the month, while a CPI reading of a hair beneath 3% could take another hike off the table.

Invest in Bitcoin with River, then store it with Foundation Devices

If you’re enjoying today’s analysis, consider supporting us by becoming a paid subscriber. As a paid subscriber, you get full access to all research as it drops.

Here are your quick links to all of the TBL content for the week:

Wednesday

In this episode, Nik examines the next few months of monetary policy. With yield curves deeply inverting once again and risk markets off to the races, how will the Fed respond? We also identify some key trends in bitcoin and rates.

Check out—Trend Watch: Treasuries & Bitcoin

Thursday

Larry Fink, BlackRock co-founder and CEO, called bitcoin an “international asset” and spoke about the revolutions underway in finance. His claims are neither new nor interesting from an investment thesis perspective—sorry Larry, we already knew that bitcoin represents a hedge against discretionary money. Statements made in mainstream media forcefully endorsing bitcoin move the perception needle, but the latest remarks by Fink are recycled in the mainstream financial sphere and rejected by others. We will break down some history of bitcoin institutional adoption, which institutions are embracing bitcoin, which ones are rejecting it, and the why of it all.

Check out—Asset Managers Are Pro-Bitcoin

Friday

WARNING: Labor Market In Mirror May Be Weaker Than It Appears. Joe breaks down how the "strong" ADP employment data paired with today's NFP and wage data paints a deceptively strong picture of the labor market, one that the Fed will use as cannon fodder for another ill-fated hike on July 26th.

Check out—"Strong" Labor Market Is Really Just Summertime Bartenders

Our videos are on major podcast platforms—take us with you on the go!

Apple Podcasts Spotify Fountain

Keep up with The Bitcoin Layer by following our social media!

YouTube Twitter LinkedIn Instagram TikTok

Receive 50% off an annual subscription to The Bitcoin Layer — only 4 days left!

That’s all for our bitcoin and macro recap—have a great weekend everybody!

River is the Bitcoin exchange of choice for the long-term investor.

Securely buy Bitcoin with 100% full-reserve custody, enjoy zero fees on recurring orders, and even buy a hosted Bitcoin miner, completely hassle-free.

Invest in Bitcoin with confidence at River.com

Bitcoin's most intuitive hardware wallet just got cheaper.

Passport is now just $199. Set it up in minutes, take your bitcoin off of exchanges with ease, and experience unmatched peace of mind.

Get it at thebitcoinlayer.com/foundation & receive $10 off with code BITCOINLAYER