Welcome to TBL Weekly #64—the free weekly newsletter that keeps you in the know across bitcoin, rates, risk, and macro. Grab a coffee, and let’s dive in.

River is the Bitcoin exchange of choice for the long-term investor.

Securely buy Bitcoin at the tightest spreads in the industry, have peace of mind thanks to their 100% full-reserve cold storage custody, and enjoy zero fees on recurring orders. Need help? They have US-based phone support for all clients.

Invest in Bitcoin with confidence at River.com/TBL

In precisely 17 hours, a government shutdown looms on the horizon, soon after narrowly averting shutdown in June by suspending the debt ceiling (as if there ever was one). The Speaker of the House insists on border closure as a prerequisite for any spending package to dodge the impending shutdown. The urgency stems from an uncontrollable surge of migrants—7.1 million since January—who are capitalizing on the porous nature of the Southern US border, a geographical arbitrage that extends beyond Central and South America to migrants from the world over. Another government shutdown paired with the calamitous state of US immigration risks creating a crisis of confidence that could exacerbate the ongoing UST selloff and yield spike. The situation demands immediate attention and action.

Not to mention that as members of Congress continue to be paid during this period, their staffers and Federal employees will not be! Thanks, Uncle Sam.

So why is the US government on the verge of a shutdown due to an impasse on passing a spending package? It shouldn’t be, but it is.

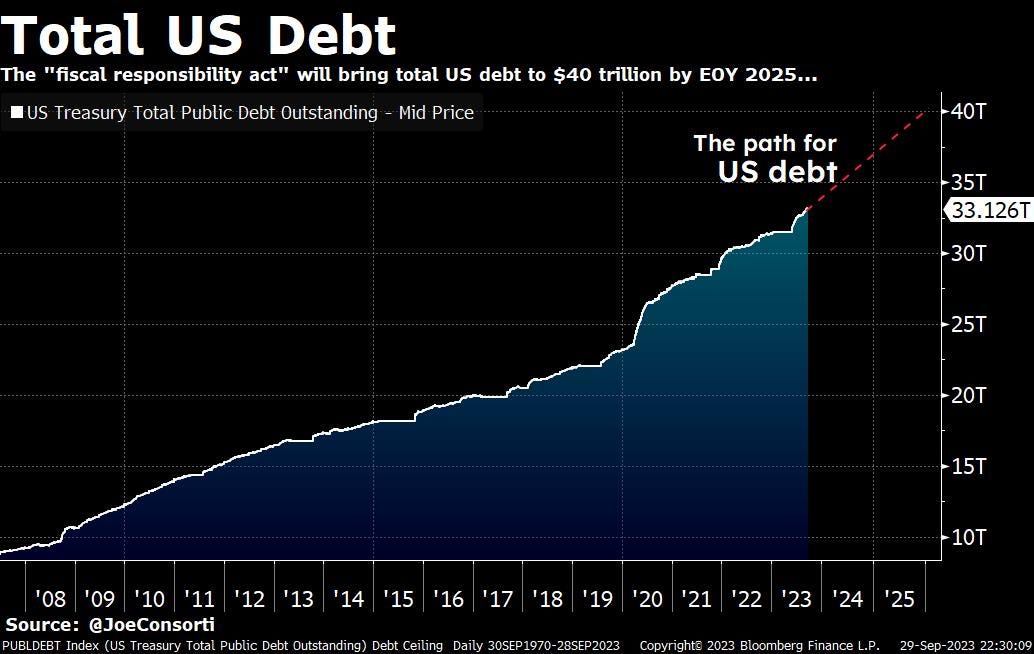

The debt ceiling was eliminated in June under the... "Fiscal Responsibility Act", in the leading contender for the most misleading title for a law in history. At its acreage rate of issuing debt per quarter of $750 billion, total debt from the US Treasury will hit $40 trillion by the end of 2025. Here’s a novel idea: perhaps the government should stay shut down when it closes on Monday:

This flood of issuance will continue to exert upward pressure on yields—time will tell if a marginal buyer can ever overpower the upward pressure that this unprecedented issuance will have on US Treasury yields. After a secular downtrend in yields for half a century, this deluge could be the impetus that puts us in a 50-year secular uptrend, to the detriment of the global economy. The 10-year US Treasury yield, the bedrock of global markets, has extended its selloff and has now risen 30 basis points in 5 days:

The world is credit-based. US Treasuries lubricate the borrowing & lending that make the world economy go around—it's the bedrock underneath it all. Well folks, the bedrock of the global financial system is imploding, and you'd best believe the Fed has its finger on the intervention trigger:

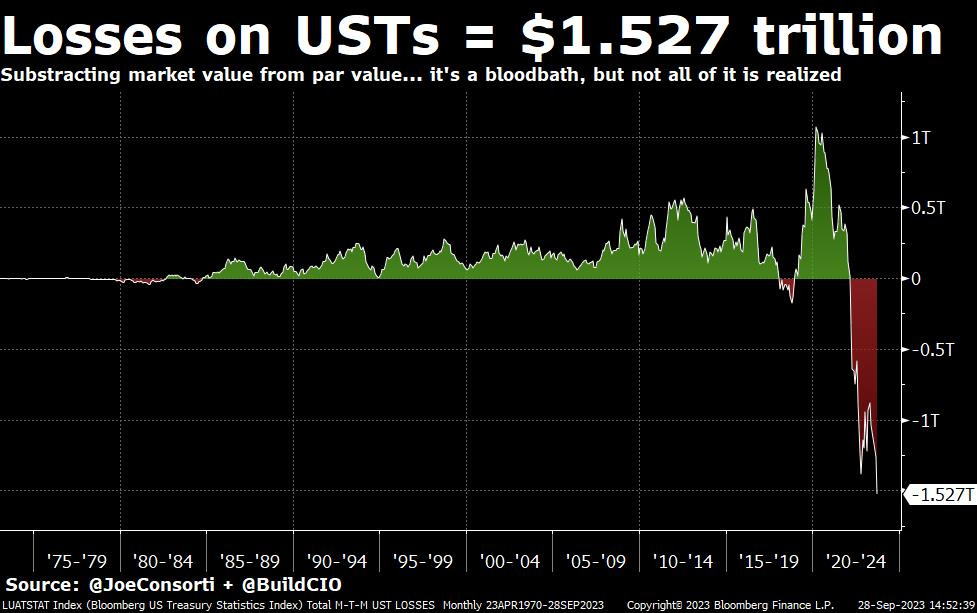

As yields SCREAM higher, total losses on US Treasuries have surpassed $1.5 trillion—now $1.527 trillion. This is “higher for longer” just doing its thing:

US Treasuries are colloquially considered risk-free, unless you have to sell—the Fed has engineered BTFP so devalued Treasuries never have to be sold by banks, therefore the $1.527 trillion in realized and unrealized losses that would normally upend the entire market have the impact of a field mouse. The Fed's BTFP facility will become permanent, mark our words. It just can't let these bonds realize losses.

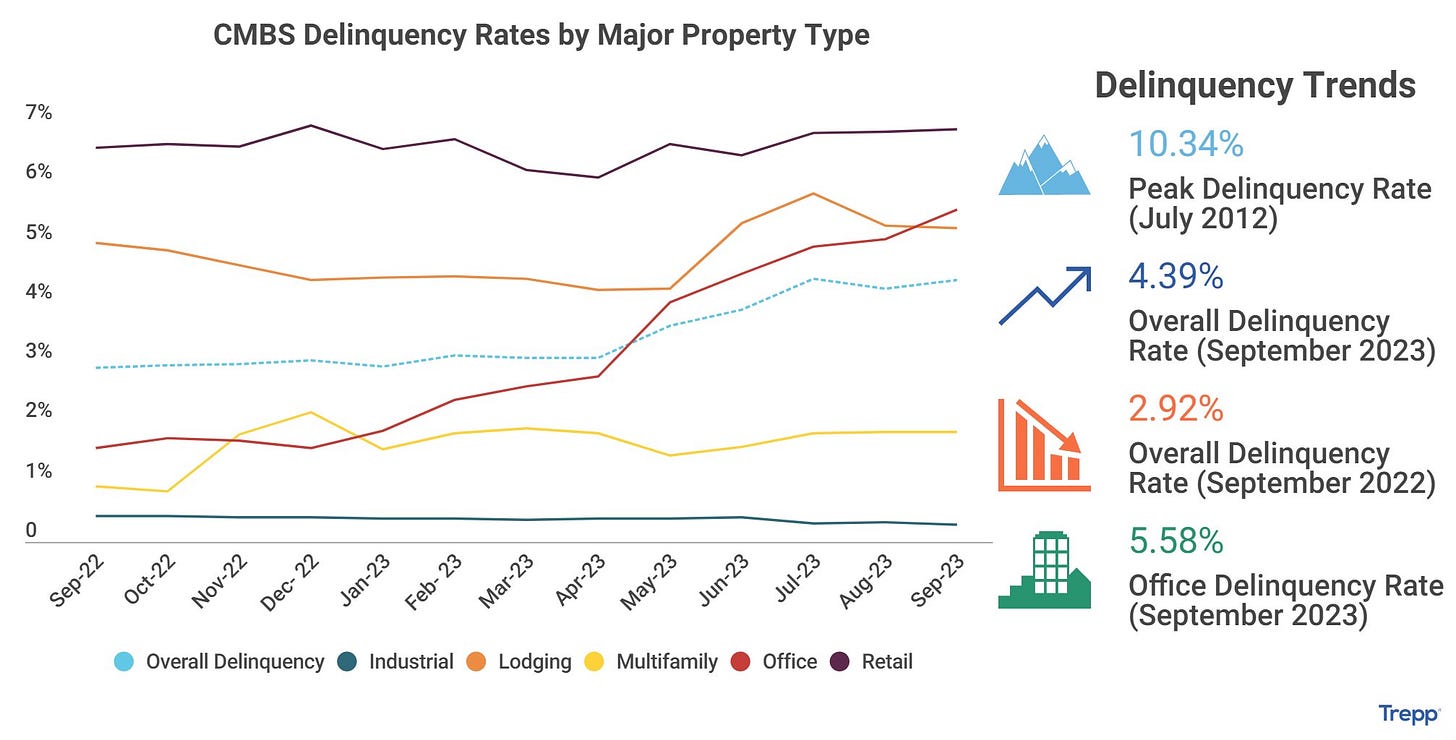

Switching gears over to commercial real estate, developments continue to be negative. Office CMBS delinquencies rose 51 bps in September to 5.58%—meaning some 5.58% of offices are past due on their mortgage payments due to the structural shift in working that has seen tenants abandon their office space never to return, taking their lease revenue with them:

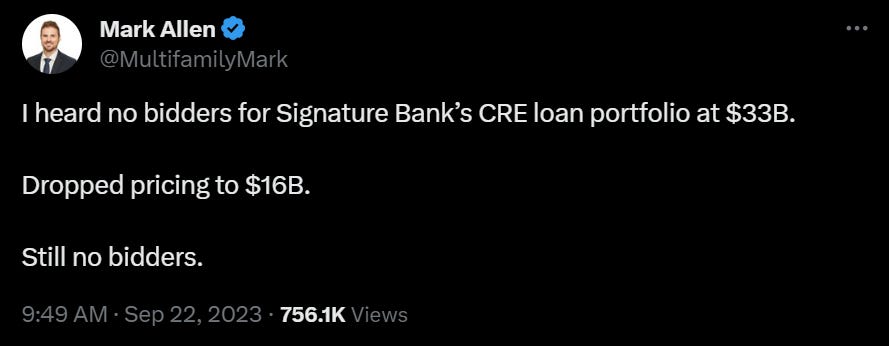

This crisis ultimately comes back to the creditors, they’re the ones who will bear the losses, so they’re trying to dump these loans and securitized loans off of their books. Banks are sitting on huge CRE loan and CMBS portfolios that are devaluing by the day, and nobody will buy them. They can't bring them to the Fed as collateral for an emergency loan either, since it is not acceptable collateral at the discount window or the Fed’s latest emergency Bank Term Funding Program. If we only knew how badly impaired regional banks' balance sheets are behind the scenes, perhaps the market’s mild manner towards this problem would be less so:

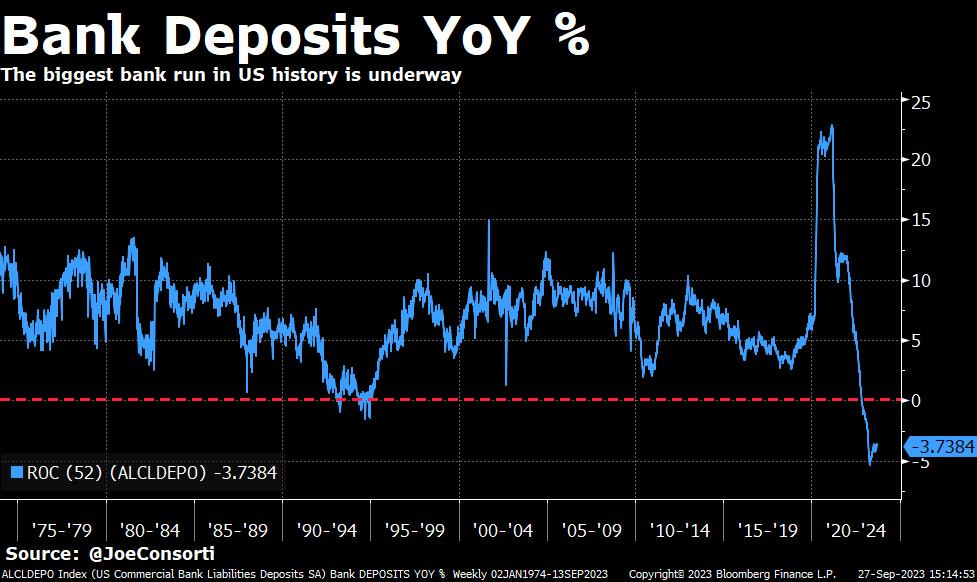

Bank deposits are contracting faster and more aggressively than at any time in the last 50 years—down 3.73% since last year & falling for 10 months in a row. Looking back throughout modern history, this is the biggest bank run the US has ever faced:

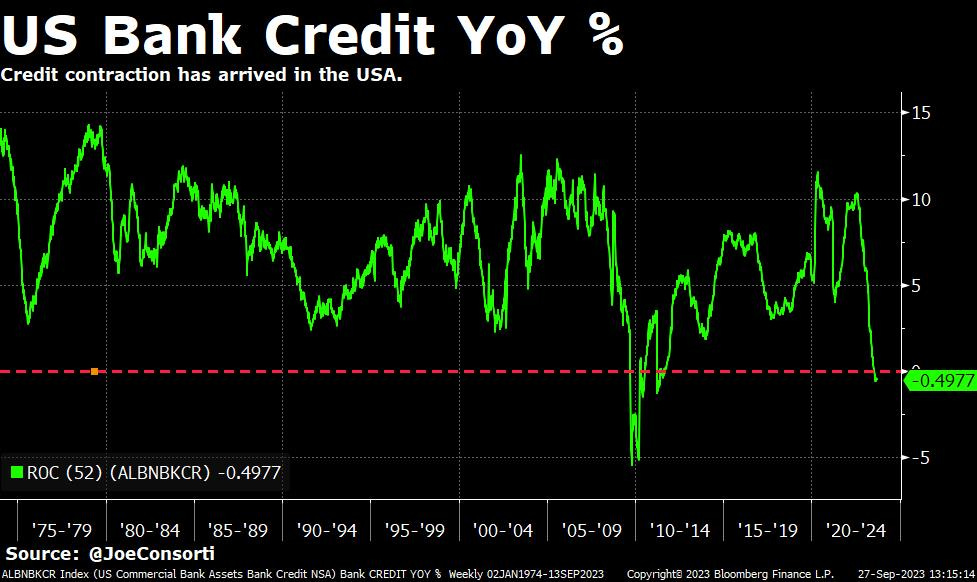

As a function of this unprecedented bank run to higher-yielding money market funds, credit is contracting for the first time since September 2011 here in the US. This is only the 2nd time since 1973 that credit in the US economy has fallen year-on-year. Eighteen months removed from the Fed's first rate hike and several fakeouts later, credit contraction is here.

This is deflationary, and remember: the Fed engineers inflation because in a credit-based world, it incentivizes economic growth (spending) by withering away at people’s savings—so deflation on the other hand is joined by economic calamity, and the Fed won’t let that happen without bringing out the US dollar bazookas once again:

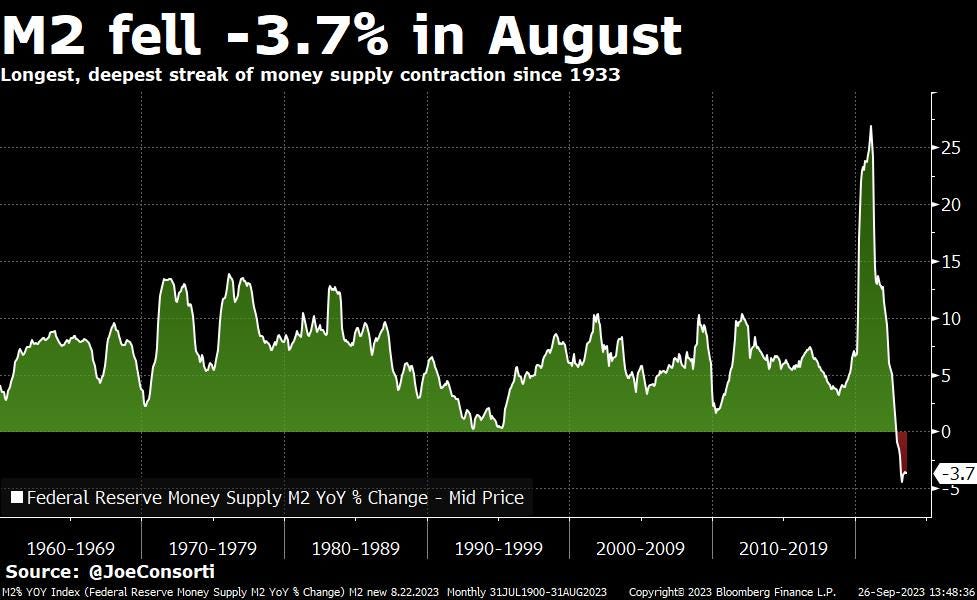

And wouldn’t you know it, we’re already experiencing deflation, just not in prices. M2 money supply in the US fell 3.7% in August. The longest, deepest streak of money supply contraction in 90 years continues. The ebbs and flows of money supply lead price inflation and deflation by many months—despite the Fed’s best efforts and wishes, this could get ugly if spendable money continues shrinking:

Next Week

In the week ahead, US economic data will flow like water and in all likelihood, continue the trend of worsening across the board as the economy slides. Inflation and growth have both found a lukewarm middle ground, reducing expectations for aggressive Fed moves while simultaneously removing talk of a “soft landing” from the mainstream market’s zeitgeist. The Treasury's supply issuance spree is causing market indigestion, evident in soaring yields. Watch out for ISM surveys for insight on Q3 growth and Friday's job data for potentially market-moving action. Just remember, until unemployment rises materially above 4%, the Fed will remain thrilled with its "soft landing" abilities—Fed policymakers often get caught up in smelling their own farts to see the train barreling towards them until it’s too late. Hold off on the celebrations for now:

Foundation Devices is self-custody done right.

Start with their easy-to-use and private mobile wallet with Envoy, then transfer it to the most intuitive hardware wallet in Bitcoin with Passport.

If you’ve been on the fence about taking your bitcoin off of exchanges, Foundation’s suite of intuitive self-custody solutions is for you.

Take custody of your Bitcoin today by visiting foundationdevices.com

If you’re enjoying today’s analysis, consider supporting us by becoming a paid subscriber. As a paid subscriber, you get full access to all research as it drops.

Here are your quick links to all of the TBL content for the week:

Tuesday

We interrupt your regularly scheduled bond market meltdown for a brief look at how bitcoin is holding up amidst all of the chaos.

Check out—Bitcoin Analysis As Markets Dwindle On The Precipice

Wednesday

In this episode, Nik is joined by Raj Wadhwani, a bankruptcy attorney based in California. Raj explains to us how bankruptcies are spiking both for consumers and small businesses, and why he thinks that inflation, student loans, personal loans, and high interest rates are combining to create a tornado of problems in the economy.

Check out—Bankruptcy Attorney: "Busiest I’ve EVER BEEN"

Thursday

“Something will break” can be the most tiring phrase to hear around financial markets. These three words are often muttered to describe the dynamic in which the central bank tightens policy to the point that broken financial plumbing and asset writedowns threaten a systemic calamity. It is then assumed that the central bank pivots within days or even hours to save the day. This premise carries heavy assumptions in two forms: 1) the financial system is inherently unstable and is prone to calamity, not just isolated problems, and 2) the Fed is a willing lender of last resort. Not only are each of these assumptions warranted, they should anchor any multi-asset investment framework. Today, we’ll outline five of the most important governing factors in today’s investment landscape to help you find direction in a fast-moving and hectic macroeconomic environment.

Check out—5 Most Important Drivers Right Now

Friday

In this episode, Nik breaks down what's going on with the S&P 500, which is experiencing its worst month of the year, and explains why Treasury yields spiked throughout September.

Check out—WORST Month Of The Year For Stocks, Here's Why

Our videos are on major podcast platforms—take us with you on the go!

Apple Podcasts Spotify Fountain

Keep up with The Bitcoin Layer by following our social media!

YouTube Twitter LinkedIn Instagram TikTok

That’s all for our markets recap—have a great weekend, everyone!

River is the Bitcoin exchange of choice for the long-term investor.

Securely buy Bitcoin at the tightest spreads in the industry, have peace of mind thanks to their 100% full-reserve cold storage custody, and enjoy zero fees on recurring orders. Need help? They have US-based phone support for all clients.

Invest in Bitcoin with confidence at River.com/TBL for $5 free when you buy $100 in Bitcoin.

Hey Nick and Joe, for a future article if I may: It would be super interesting to get your insight/an in-depth analysis on the current bear steepening (10s minus 2s). Tbh 6 month ago the only way that I thought the 10 minus 2 would un-invert was a bull steepening, but now we actually have 10s ripping higher. I think we can agree that 10s are not going higher because of a positive outlook on the US economy ... This only leaves the US fiscal deficit on the table. Is the current dynamic literally the moment we will look back to and say: This was when the treasury market finally started agreeing with Luke Gromen? Also is this the setup that inevitable leads to yield curve control ... As always. Love and appreciate your work!