There Is No New Money: TBL Weekly #47

Highest risk-free rates in two decades, Fed balance sheet and credit contraction, and no volatility to speak of. We've entered the Twilight Zone.

Welcome to TBL Weekly #47—the free weekly newsletter that keeps you in the know across bitcoin, rates, risk, and macro. Grab a coffee, and let’s dive in.

Bitcoin-Macro Breakdown

Bitcoin had another week full of inaction on the price front, to no fault of its own—liquidity across all markets is stagnant or on the decline. Bitcoin is a sub-$500 billion asset in a vast ocean of multi-trillion dollar equity indices—boring weeks are going to be expected in bitcoin from time to time. Bitcoin is now facing off with its 200-week moving average:

Bitcoin is far more than an asset simply algo-traded as if it were the Nasdaq—and on the Bitcoin network front, the action is anything but boring. Our estimate of the average cost to produce one bitcoin, EHV, has risen by a whopping $10,000 since the beginning of the year. With almost half of 2023 now behind us, the Bitcoin network is growing increasingly competitive despite price action being relatively flat since March. For those who may be new to this dynamic, increasing hash rate is a mainstay of Bitcoin—miners are in a constant, cross-continent capital allocation battle to mine bitcoin as cost-efficiently as possible. As the hash rate rises and the Bitcoin protocol systematically adjusts the mining difficulty upwards, inefficient miners are pruned. The current dynamic is one in which miners are not yet capitulating—instead, hash rate ripping day after day points to a network only growing more secure & competitive:

The correlation between the S&P 500 and bitcoin has risen this week as the market eeks out what may be its last major risk-on breath, with a potential liquidity drain right around the corner. The correlation between rates and the S&P 500 also continues falling as the historically inverse stock-bond relationship rematerializes.

Market reaction functions flipped around this week after the Fed’s perhaps ill-timed pause comments that it tried to then correct as “skip, not stop” considerations. Whatever word salad the Fed concocts, it is simply trying to dissemble its dovish move to pause with hawkish language in order to limit wild risk-taking in markets, which is the last thing it wants. The Fed continues to paint itself into a corner—now it has to sit and wait for that paint to dry before it can walk back over it. The pause is here, whether it likes it or not.

Fed Funds futures experienced a fair amount of volatility over the last two weeks, but the market has finally decided that June will likely see no rate move.

The 2s10s curve has flattened -27.5 basis points in a month—the resteepening trade that prices in rate cuts has faded as “higher for longer” continues to hang around as the dominant theme in yield curves.

The 2sFFs curve has steepened +28.5 basis points in a month—the market has walked back rate cut expectations by roughly one full-sized cut. With 2s still inverted by -75 bps to Fed Funds, it indicates the prevailing market sentiment is for a pause soon, just not cuts as imminently as was priced in a couple months ago.

Envoy is an easy-to-use Bitcoin mobile wallet with powerful account management & privacy features.

Set it up on your phone in 60 seconds then set it, forget it, and enjoy a zen-like state of finally taking your Bitcoin off of exchanges and into your own hands.

Download it today for free on the iOS App Store or the Google Play Store.

There Is No New Money

It all started with too much new money. If you’re in need of an economic orientation, we’re here for you. With the S&P 500 at 8-month highs and volatility at 2-year lows, it can be easy to forget the risks at hand. Today, we’ll walk through the major forces we believe are being exerted on the US economy, and why we’re starting to get nervous.

5% Hurdle Rates

First and foremost, the largest problem facing the economy is the 22-year high in the risk-free rate. Now, granted, we’ve seen yet another example of why Treasury-critics laugh with their heads stretched back at the moniker “risk-free,” but semantics aside, all other credit products trade wide of Treasuries, meaning that Treasuries still always have the lowest yield in the market. How did we get here? Trillions in stimulus, monetary and fiscal both, over the 2010s, trillions in stimulus again in 2020 and 2021, the global supply chain breaking, and finally the inflation we’ve all worried about since the first time the Fed rushed to purchase a trillion dollars of mortgage-backed securities. With price increases at 40-year highs, it makes sense that T-bill yields are at 22-year highs:

Lurking Secular Bubbles

Undercurrents from a couple decades of internet disruption and ultra-low rates worry us as well. By themselves, each one of these trends cannot suddenly combust, but all together, and with the business cycle getting long in the tooth, they bring about nerves.

On residential real estate, we’re all familiar with how, prior to 2007-2009, home prices had never declined in the US on a nationwide basis. Now, after a decade of very strong gains, nationwide housing prices are falling again, on an annual basis. That means this is the second time in history this has happened. While residential real estate is not our biggest worry, it does remain in a precarious position with rates expected to remain high. Redfin and Zillow, our new favorite housing data providers, are both pointing toward annualized losses and falling sales. Airbnb and other short-term rental trends are also negative, something that is also interest-rate sensitive. At this point in the housing cycle, each one of these pockets of marginal demand can turn to marginal selling, and we do believe this has already begun. Work-from-home dynamics can support housing, in our view, but to which degree, we are unsure.

Speaking of the shifts in work dynamics, office commercial real estate might never be the same again. With cell phone activity down sharply and barely recovering in metropolitan areas around the nation, office vacancies up, and companies barely trending toward 3-day in-office requirements, we see a large problem on the horizon for office buildings.

The last secular, long-term shift that worries us is the echo boom of Amazon itself. We’re all familiar with the JCPenneys and Bed Bath & Beyonds succumbing to a dying brick and mortar retail culture, but how many thousands of businesses have suffered due to shifts online, and how many of those commercial real estate leases have never realized ultimate default and impact on the land value itself? We imagine a lot, and the pandemic probably extended the lifeline for several businesses that experienced some rent relief during that timespan.

While none of these alone are alarm-ringing today, we must consider 5% hurdle rates, meaning the risk-free rate against which all other assets are measured, in the face of larger secular trends that can affect broader economic sentiment.

Join Nik for a free, live 90-minute lesson to learn all about the history of Bitcoin, its blockchain, mining, and associated technologies, such as stablecoins and CBDCs.

RSVP for the June 15th online class here.

Bills, Bills, Bills

For the next part of the story, we must point you to our TGA explainer from earlier this week, in which we outline why $1 trillion of Treasury bills are about to be issued and the potential impact on liquidity throughout the financial system. How the great T-bill issuance of June 2023 will impact stocks and risk assets was the focus of our research, but how it will affect the economy is more of an exercise of patience. See, with record levels of Treasury issuance, all yield levels will rise in order to attract the necessary demand. This drags other Treasury yields up and overall makes the economy’s entire hurdle rate even higher. Risk-adjusted returns start to look worse for other assets, and the flood of bills extends throughout the rest of the yield curve as the Treasury can’t roll bills forever.

Such a large influx might not hit stocks tomorrow, but combined with strong employment and inflation still a mile away from the Fed’s 2% target, there’s just absolutely nothing on the horizon to bring yields back down. This means more punitive conditions for the consumer, real estate participant, and corporation for all purchases and projects. Higher for longer, they’ve said, and we can’t argue.

The Fed has finally announced that June will be a “skip,” but the market has interpreted that without expecting much in terms of rate cuts. We say “finally” because the Fed has clearly acknowledged a set of risks, and while perhaps not as comprehensive as our list, enough to get them to mutter the word “skip” several times, from more than one voting member, a mere hours before the quiet period began.

Risks Everywhere

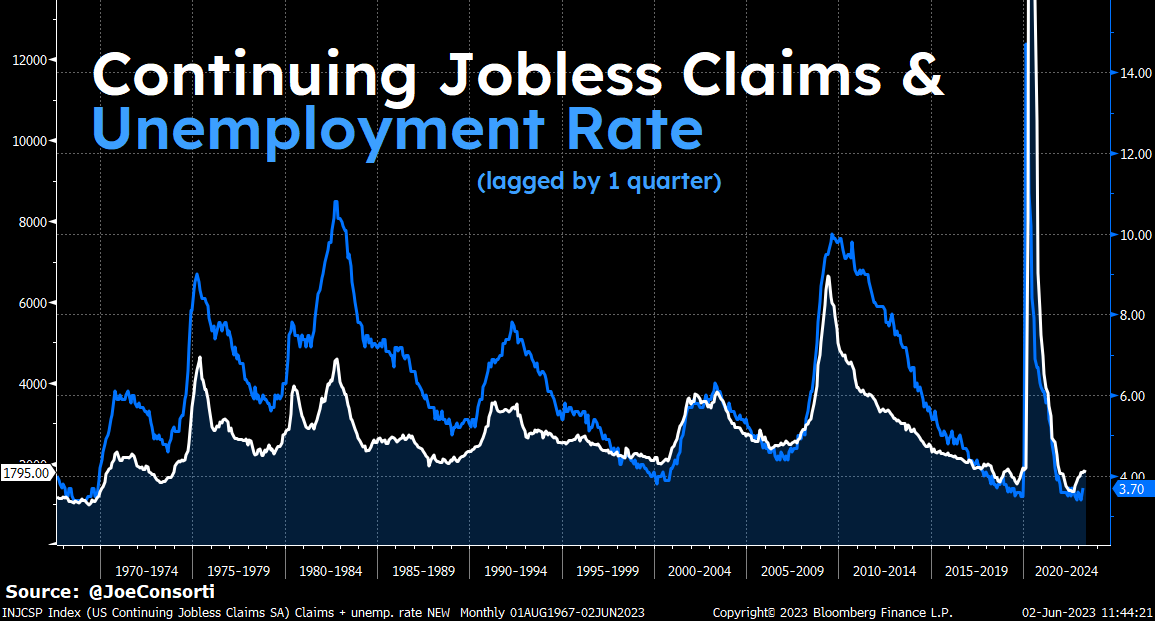

Risks to the economy, consumers, and the job market are extremely present. This is not a post about how much stocks can go down—it’s about assessing and outlining all components of our bearish economic outlook. Inflation remaining well above the 2% target and unemployment still below 4% will not lead to the Fed slashing rates any time soon. The pain of higher rates is hitting the economy and will continue to hit it very hard over the coming months. A build of the TGA isn’t the main event, but it is absolutely surrounded by moving parts that make us nervous about the economic outlook. There is no new money, and that is what makes this start to feel like the Twilight Zone:

Fed assets are meaningfully declining for only the second time ever, and credit is tight due to this year’s regional banking crisis. New Fed money usually can fix things like trillions in Treasury issuance or a slowing economy or tightening credit. Where is the new Fed money? Absolutely nowhere to be seen. March was a preview of what can happen when new money is explicitly required by the system, but we know how desperate the Fed is to protect its reputation and shed the QE-forever crown that keen participants can still see sitting on Jerome Powell’s head.

One bonus chart is option-implied S&P 500 volatility, which has fallen to its lowest point since pre-COVID of 14.60—equity volatility is highly compressed, clamoring for a big move that this week’s low volumes simply won’t allow for. An eery quiet sweeps over risk assets, for now:

The Week Ahead

In the week ahead, markets will have sparse new trade-worthy data in what could end up being another low-volume and inactive week. We will have our eye on the flash S&P Services PMI and ISM Services PMI on Monday for insight into one of the stubborn areas of the economy still propped up by hearty consumer spending. Other than some light data, a quiet week without Fed speakers precedes CPI and the FOMC during the week of June 12th:

If you’re enjoying today’s analysis, consider supporting us by becoming a paid subscriber. As a paid subscriber, you get full access to all research as it drops.

Here are your quick links to all of the TBL content for the week:

Wednesday

The US Treasury’s debt ceiling is close to being raised, again. With a deal now reaching the Senate for consideration before hitting the President’s desk, the question for you, us, and for markets is what happens next?

Well, one of the market’s constant streams of liquidity will stop flowing.

As the Treasury gets the go-ahead to refill its cash account by issuing T-bills, liquidity that was previously invested elsewhere flocks to the now higher-yielding set of risk-free government debt—bank funding and riskier assets like stocks and bitcoin facing the brunt of the outflows in the process.

Let’s analyze previous cycles, explain why liquidity gets drained, and how a negative market response may set up the Fed’s eventual pivot to rate cuts and QE.

Check out—

Stocks & bitcoin peer over a cliff as the US Treasury is set to refill its coffers

In this episode, Joe discusses how the Treasury is slated to flood the market with over $1 trillion in new bills, severely draining banks of their reserves and potentially sending stocks and bitcoin into a tailspin.

Check out—Debt Ceiling Fallout - Bad News for Risk Assets, Banks

Friday

We proudly present Vailshire Capital Management’s June 2023 Update

Dr. Jeff Ross, Founder & CEO of Vailshire Capital Management LLC, releases a monthly portfolio and markets update for his clients. Thanks to him, we’re privileged to distribute his excellent work to you, our alpha-hungry TBL readers.

In the face of the debt ceiling, the TGA will need to be replenished via the issuance of fresh Treasury bills, notes, and bonds, enticing liquidity out of the private sector, and potentially leading to a period of underperformance for risk assets.

He walks through how he’s adjusting his portfolio in the wake of this TGA refill, and what he’s paying close attention to across the real economy and markets. Read his update here.

In this episode, Nik breaks down what's making him so worried about the economy: there's no new money. He runs through interest rates, home prices, and the looming liquidity drain to make his case.

Check out—There Is No New Money

Our videos are on major podcast platforms—take us with you on the go!

Apple Podcasts Spotify Fountain

Keep up with The Bitcoin Layer by following our social media!

YouTube Twitter LinkedIn Instagram TikTok

That’s all for our bitcoin and macro recap—have a great weekend everybody!

Bitcoin's most intuitive hardware wallet just got cheaper.

Passport is now just $199. Set it up in minutes, take your bitcoin off of exchanges with ease, and experience unmatched peace of mind.

Get it at thebitcoinlayer.com/foundation & receive $10 off with code BITCOINLAYER

Hey @joe. I’m confused by a concept that you shared in the Debt Limit video on today’s content. If the $1T in new b-bills is sold on the open market, how does the sale of those T-bills and the use of those funds have the effect of draining commercial bank reserve balances at the Fed?

Perhaps I’m confusing two simultaneous efforts, but don’t understand how the TGA spending down its fresh funds had the effect of reducing commercial bank reserve balances at the Fed.

Thanks for clarifying!