Bitcoin Fair Value Analysis: TBL Weekly #28

We've got you covered on all the latest in bitcoin and macro.

Welcome to TBL Weekly #28—the free weekly newsletter that keeps you in the know with everything going on in markets. Let’s dive in.

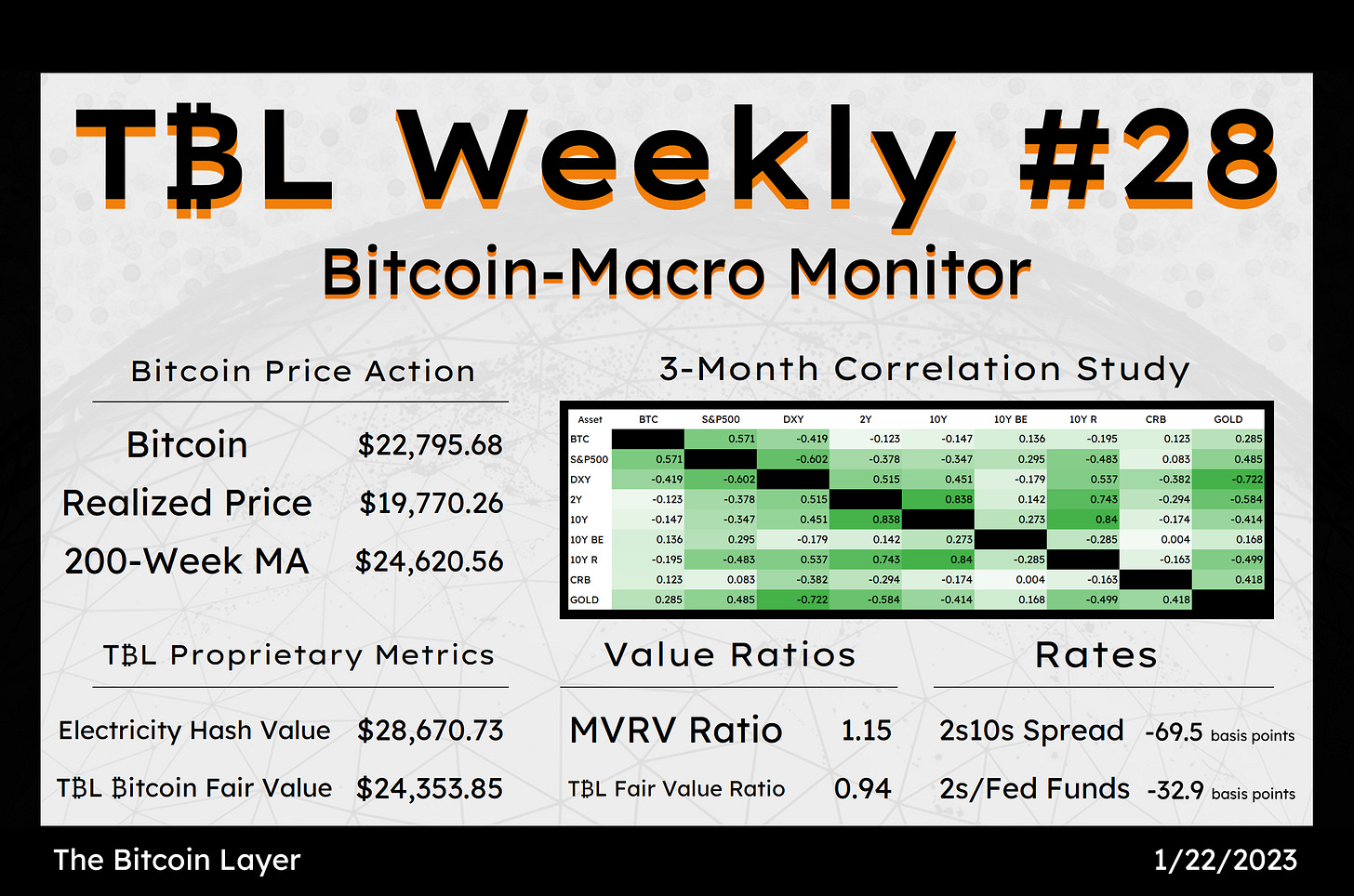

Bitcoin-Macro Monitor

Just quickly grabbing the headlines?

Here’s your rapid-fire recap of the relevant action in bitcoin and macro:

Refer to TBL’s Bitcoin & Macro Term Glossary: thebitcoinlayer.com/glossary

Bitcoin extended its unexpected but welcome rally this week. After moving higher from $16,500 to $21,000 over the past week, it managed to achieve yet another new local high of $23,000 over the weekend. A well-forgotten trend of higher highs has made its return for now, replacing the tumultuous negative price action that plagued bitcoin as a result of crypto contagion and aggressive Fed policy tightening. The conditions that hampered bitcoin last year have turned into tailwinds.

Bitcoin and the S&P 500 have become more correlated as a Fed pause draws near and the (preemptive) reaction to the liquidity tide is raising all proverbial risk ships, and the link between bitcoin and gold is weakening as the digital commodity outpaces its physical counterpart to the upside.

The 2s10s curve normalized (steepened, curve became less inverted) slightly this week off the back of a stronger relative bid for the 2-year US Treasury note, reinforcing the market expectation of a Fed downshift in February and a lower eventual terminal rate. The 2s yield still remains markedly below the Federal Funds target rate, reiterating the above.

There are your headlines, now let’s take a look under the hood.

Markets Analysis

Here’s a comprehensive recap of last week’s action across markets:

Forced selling by entities like Luna Foundation, Three Arrows Capital, Celsius, and FTX along with impacted counterparties was a drag on bitcoin’s price all 2022. This was coupled with unprecedented liquidity contraction in the form of aggressive Fed rate hikes, by both size and cycle length, and the Fed removing liquidity in the form of bank reserves from Fed banks as it started QT. Asset pricing reflects prevailing liquidity above all else (a bold claim but something we believe structurally), and given bitcoin’s small market capitalization and high leverage profile, its price reacted about as negatively to last year’s liquidity contraction as you’re going to find across most assets. Now that we’re turning the corner into what may be more favorable risk conditions, bitcoin is once again approaching our approximation of its fair value.

Bitcoin Versus 200wk MA

The 200-week moving average is one of our favorite metrics at The Bitcoin Layer. Its elegance is in its simplicity. A level that has never declined, this rolling average of bitcoin’s price over the last four years is a robust floor in the eyes of the market. This is the first protracted period bitcoin’s price has been beneath the 200wk MA, and it’s a lengthy one, clocking in at 222 days and counting. While we are still beneath the level, the retracement back toward it is encouraging—buyers have reemerged, and they’re serious about accumulating bitcoin while it’s considered cheap (price remains 8% below the 200wk MA):

Bitcoin Versus Realized Price

The same story of bottom buying can be told with the next chart, albeit with a different methodology. The Market-Value-to-Realized-Value ratio plots bitcoin’s price against its average cost basis; showing if bitcoin is cheap or expensive relative to the average price at which it was purchased. After spending the second-longest period ever below the network cost basis, bitcoin has rocketed up above it like a spirit exhumed from the grave—no more patty cake bidding, this is material buying pressure (realized price is slightly below $20,000, and MVRV is once again above 1):

Bitcoin Versus Electricity Hash Value

Electricity Hash Value (EHV) is our approximation, using publicly available data from miners, electricity prices, and rigs, of bitcoin’s average production cost. The heat has been on miners for several months—as mining grew in difficulty and bitcoin’s price fell ~75%, the onus was on miners to keep their lights on, either through debt financing or selling their bitcoin. Given the aversion of lenders to the space during bear markets, many miners opted to sell their bitcoin as a short-term fix, or shutter their operations entirely. The miner capitulation dynamic is still active as difficulty continues rising relentlessly, but this recent rally offers a sigh of relief for those miners who may have been under pressure and can now sell their production for a higher price:

Here are all three of the above metrics charted in our Fair Value Framework for bitcoin:

Here are all three lines combined and averaged into a single line to compare with bitcoin:

Bitcoin is finally returning to what we believe to be its fair value using our TBL Fair Value Framework.

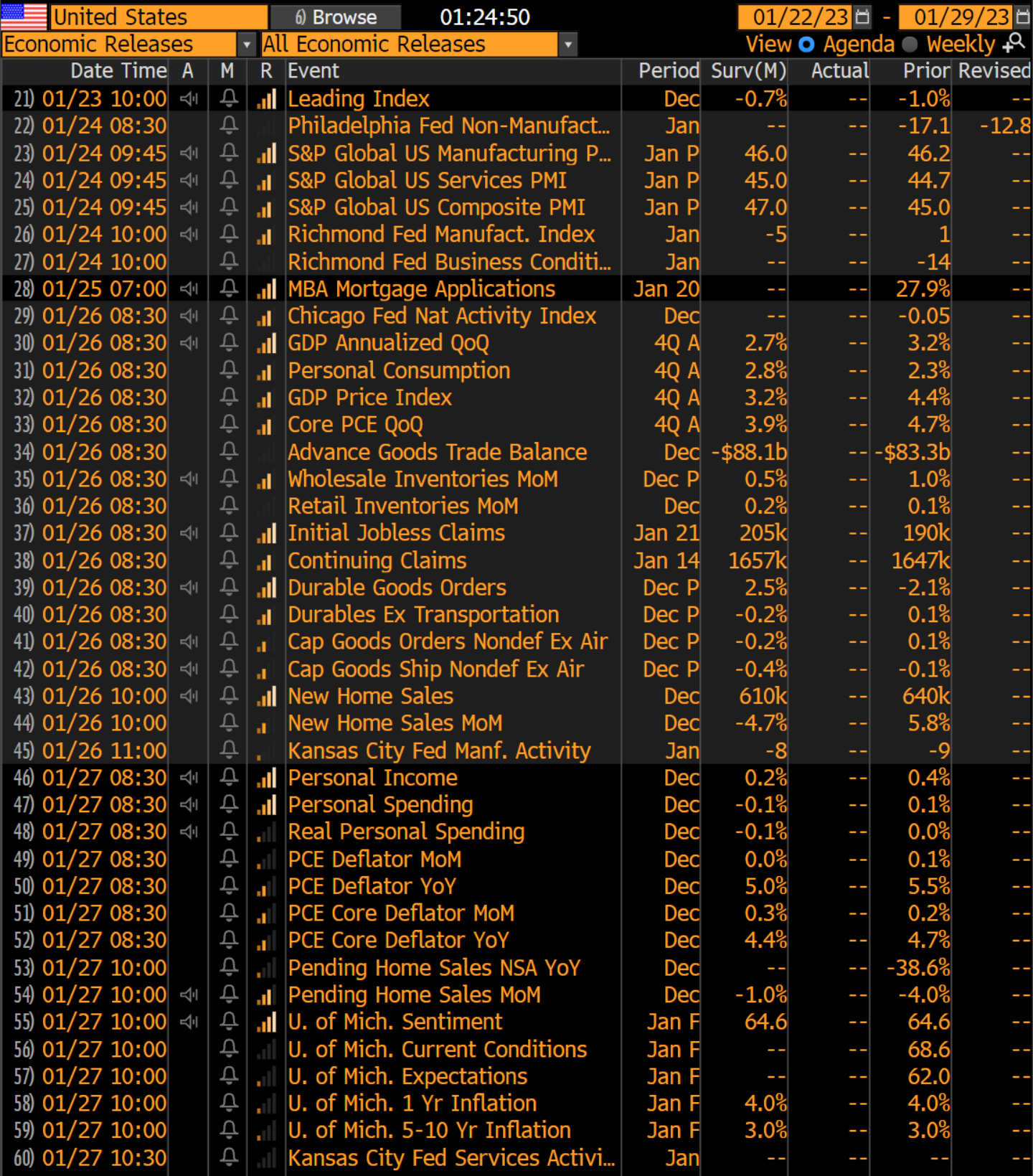

The Week Ahead

In the week ahead, the most important economic data points will be Personal Spending and Personal Income on Friday—this will set the tone for Q1 GDP. On the backwards looking side of things, we’ll also receive Q4 GDP on Thursday to offer confirmation of a still-robust, albeit slowing economy. Given the market’s expectation of positive real growth in the fourth quarter, we don’t feel any GDP surprise will dissuade a downshift to 25 basis points at the next FOMC meeting from consensus opinion. Also noteworthy on Tuesday is the US PMI data series from S&P Global, which will offer yet more color to the slowing economic outlook:

If you’re enjoying today’s analysis, consider supporting us by becoming a paid subscriber. As a paid subscriber, you get full access to all research as it drops.

Here are your quick links to all of the TBL content for the week:

Tuesday

As the end of the hiking cycle draws near, whether February marks the final hike of the cycle or we witness multiple 25 bps increases, the longer stage of higher for longer is about to begin. As the Treasury is faced with record-high interest expense and a wall of maturing debt that needs to be refinanced, it doesn’t seem tenable for government financing to have the same elevated price that the Fed intends to maintain with its suite of policy rates. Despite Jerome Powell’s hawk talk and inflation-busting mission, he may not be able to hold policy rates as high or as long as he’d like.

Check out Higher for (not much) longer

Wednesday

Nik sat down with Caitlin Long, the Founder and CEO of Custodia Bank, which specializes in digital asset payment and custody solutions for US commercial customers.

Caitlin delivers a great lecture on paper bitcoin, the paths forward for GBTC, the many intricacies of the demise of FTX, risks posed to Binance, and the concept of layered money:

Friday

We have just entered the beginning of one of the Fed’s “Blackout Periods,” during which Fed speakers may not comment on monetary policy in the lead-up to each FOMC meeting. With the next meeting not until February 1st, we’ll finally get a break from their babbling on about the hawks and the doves. Scant top-tier economic data releases during the quiet period lead us to believe that prices, as they have settled today, largely give us the playbook up until the FOMC statement is released.

Check out The Quiet Period, Bitcoin hits $22,000

Nik sat down with Adam Popescu, a Los Angeles-based writer and journalist, to discuss his recent article on Bitcoin mining in Africa.

Adam offers a unique and nuanced perspective on how Bitcoin can potentially help address violence and other issues going on in Africa:

Our videos are on major podcast platforms—take us with you on the go!

Apple Podcasts Spotify Fountain

Keep up with The Bitcoin Layer by following our social media

YouTube Twitter LinkedIn Instagram TikTok

That’s all for our bitcoin and macro recap—have a great weekend everybody!

The Bitcoin Layer does not provide investment advice.

The Bitcoin Layer is sponsored by Voltage: provider of enterprise-grade Bitcoin infrastructure. Create a node in less than 2 minutes, just visit voltage.cloud