Bitcoin Pukes 15% & SpaceX Sells Its $373 Million Holdings: TBL Weekly #58

There's the volatility we've all been waiting for.

Welcome to TBL Weekly #58—the free weekly newsletter that keeps you in the know across bitcoin, rates, risk, and macro. Grab a coffee, and let’s dive in.

Invest in Bitcoin with confidence at River.com/TBL

Securely buy Bitcoin with 100% full-reserve custody, enjoy zero fees on recurring orders, and even buy a hosted Bitcoin miner, completely hassle-free.

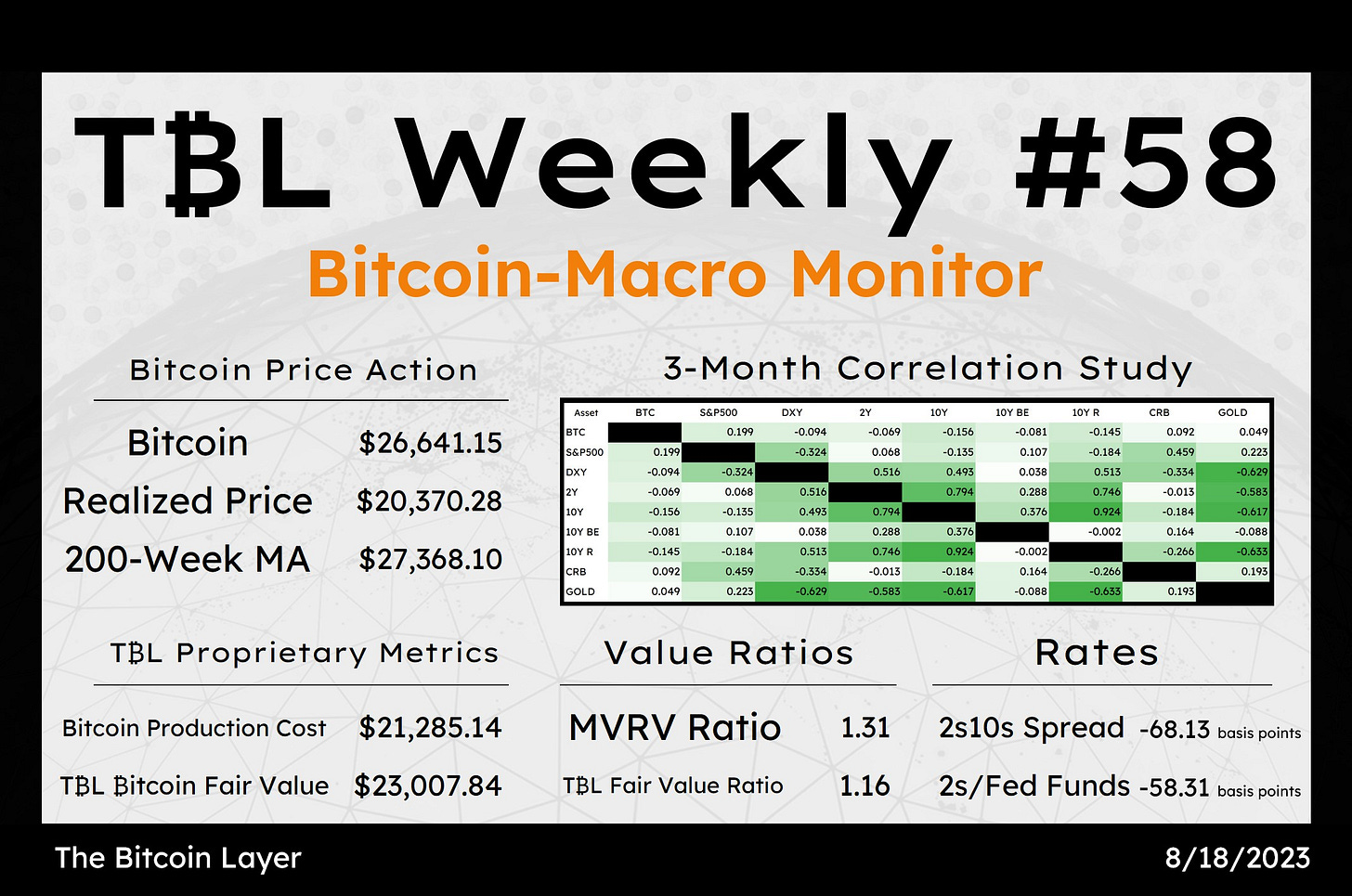

Bitcoin is finally waking up and puking. After a 1-2 week holdout period where bitcoin wasn’t budging despite major stock indices falling, it is now mirroring the selloff in stocks with very high sensitivity, as per usual—dropping by 15% on Thursday to as low as $24,900. Why the sudden move?

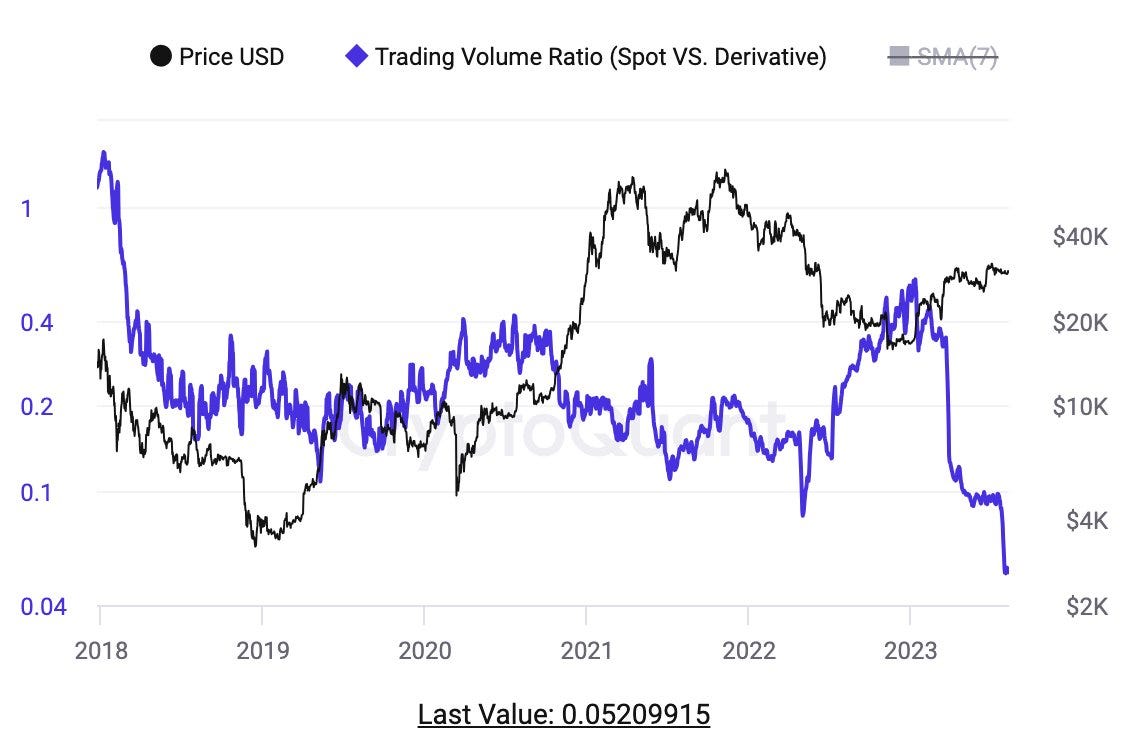

A high amount of leverage and derivatives activity relative to spot-buying. We reported this in last week’s TBL Weekly:

Institutional and retail interest in bitcoin is arguably at a multi-year low. Bitcoin’s price action has devolved into that of a stablecoin, dominated by low spot volume with the baton passed off to derivatives traders to battle against one another and generate the minor chop we’ve now observed for 3 months. This dynamic is confirmed by the spot/derivative ratio trading at all-time lows:

Spot-buying, or simply purchasing bitcoin without the use of leverage means you can weather sudden shocks—you aren’t borrowing money or taking on 100:1 leverage to go buy bitcoin. With leverage, sudden moves create forced buyers and sellers as margin gets called in and people are liquidated from their positions. When leveraged buyers are forced to sell, the price is pushed down to another liquidation target, creating more forced sellers, and so on and so forth. This repeats like a waterfall until all offside positions have been rinsed.

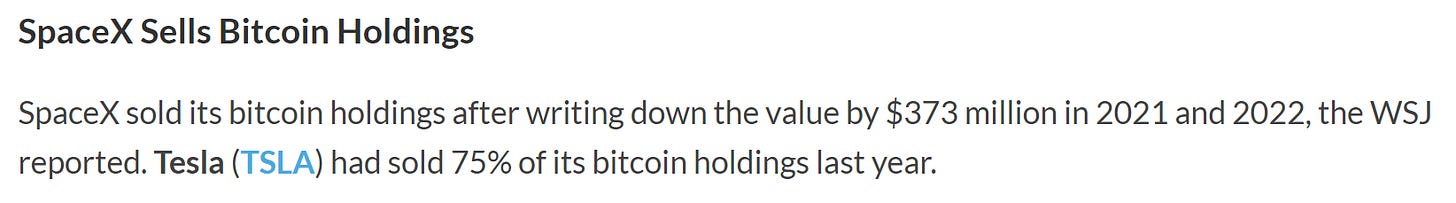

The news of SpaceX selling its $373 million in BTC it accumulated in 2021 and 2022 was not the reason for the selloff, though it certainly didn’t help in giving people a reason to sell and exacerbating the liquidation cascade:

Across all bitcoin derivatives, there were $497.4 million in liquidations over the past 24 hours, dominated by $369.5 million in leveraged-long positions and a more modest but still-alarming $127.8 million in shorts facing the music:

Thursday was BTC’s most volatile day in the past 365 by a country mile. Look at the long (red) and short (green) liquidation candles towering over the past year’s:

On a more zoomed-out view, this is the most liquidations in a single 24-hour period since December 2021 after bitcoin put in its all-time high of $69,000:

This is healthy.

A market propped up solely by leverage is doomed to fail, like building a skyscraper on a sinkhole. Occasional, violent unwinds of leverage acts like a wildfire that clears the underbrush for a healthier, new spot foundation of bitcoin-buying; this dynamic build a stronger, lasting market.

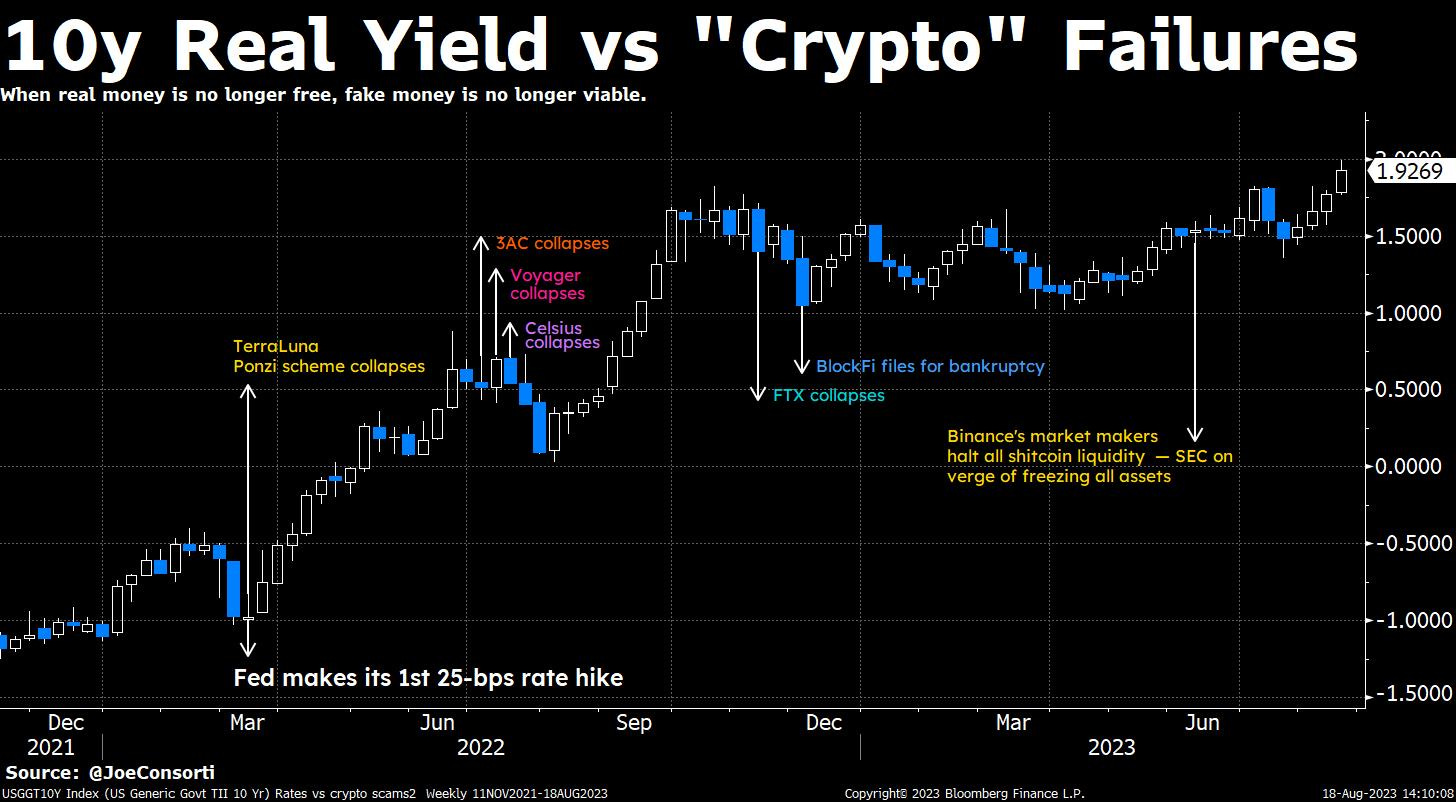

Not a good situation for more illiquid “crypto” tokens that fall more when bitcoin falls, and it’s even worse for people who are leveraged against them. And if you’re a corporation that’s doing corporate borrowing against an illiquid shitcoin, like Binance is despite their efforts to say the contrary, it’s like armageddon.

Binance HQ is scrambling behind the scenes right about now. Binance has ostensibly been staunchly defending the $215-220 level on its token for months by selling reserves and purchasing BNB to offset rampant selling. Why exactly? The most reasonable explanation is that it’s a liquidation target on a large loan collateralized by Binance Coin (BNB), and the company is propping it up to stave off a margin call on that loan:

We’ve jumped deep into BNB and its shady attributes extensively in previous posts, but the TLDR is that BNB is a native token issued by Binance—essentially the equivalent of common stock in the company.

CZ, the CEO of Binance, has stated exhaustively that Binance does not have any debt. A laughable assertion. A firm does not grow to the size of Binance without any leverage, especially not without borrowing against its own common stock.

Binance is the only player in town with a vested interest in the price of BNB. Who else would be the mystery buyer of last resort? Zoomed out, you can clearly see how staunchly defended this $215-220 level has been:

Either the investing public is bidding up BNB, common stock in a shoddy overseas casino, during a macro risk-off event, or Binance is buying. We are confident that Binance is draining bitcoin and its other reserves to buy BNB; whether it is illegally selling customers’ BTC is a matter up for debate.

Like a junk corporation, these “crypto” bucket shops and frauds can’t sustain positive real interest rates for very long without failing spectacularly. Ten-year real yields are at 1.92%—real money is no longer free so fake money is no longer viable. What's the next "crypto" scam to get flushed?

The latest in a long line of payment processors to dump Binance is Checkout.com, citing money laundering concerns, and overly-inflated transaction figures. The reasons to get off of exchanges and onto cold storage devices—like the Passport by Foundation Devices 😉—just keep piling up:

Correlations are shifting risk-off. Stocks are down 5% as the 10y UST rate equaled a 16-year high of 4.3% on Thursday. The $800 billion of US Treasury issuance in just a few months has flooded the market with fresh, safe, higher-yielding assets and has sucked away money from risk assets. If yields keep moving higher as the UST flood persists, exacerbated by the Fed's QT too, risk markets become even more dangerous. A market-wide liquidity vacuum has been plugged in and is working its magic:

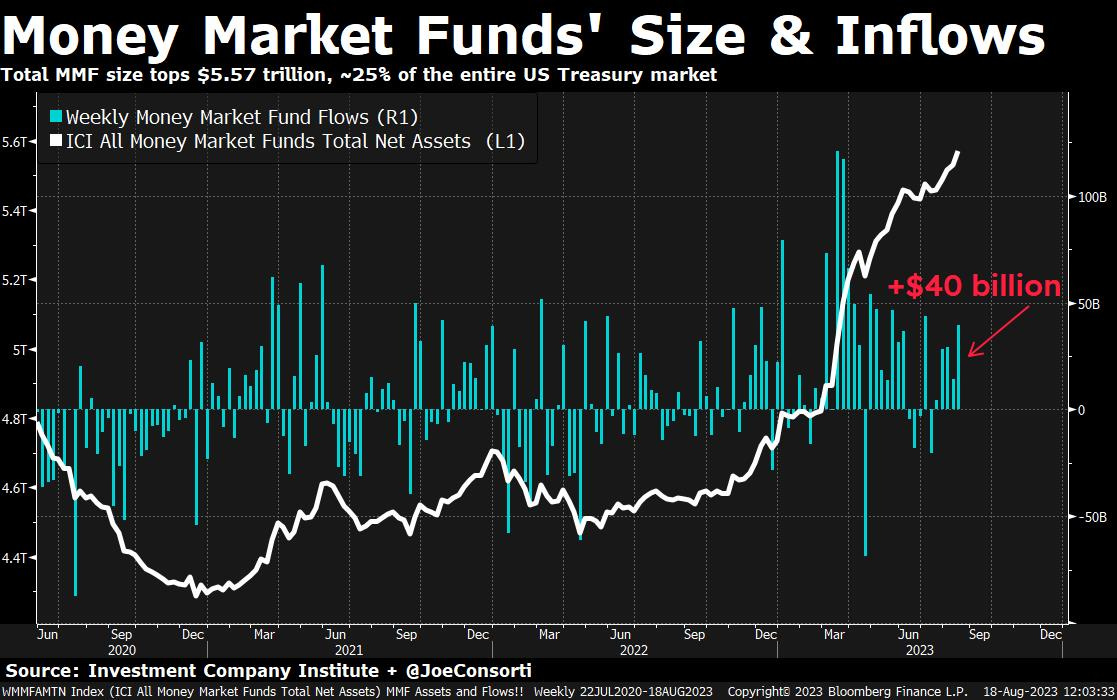

Moreover, US money market funds grew by $40 billion to $5.57 trillion this week as investor derisking persists—they have now swelled to ~22% the size of the entire US Treasury market. Capital is flocking out of risky credit & securities and into safer, higher-yielding T-bills. 5.5% interest is just too good to pass up:

Bitcoin is a mirror of global liquidity, particularly US dollar liquidity. As the world’s central banks tighten their money supply in unison and US investors derisk, barring imminent spot ETF approval, there are no upward catalysts for bitcoin. As we’ve now been trumpeting for several months, the bucket of risks unequivocally skew to the downside.

Every time that bitcoin has fallen below its 200-day moving average, as it did yesterday, it has continued to fall an average of 20%, according to Joe Carlasare:

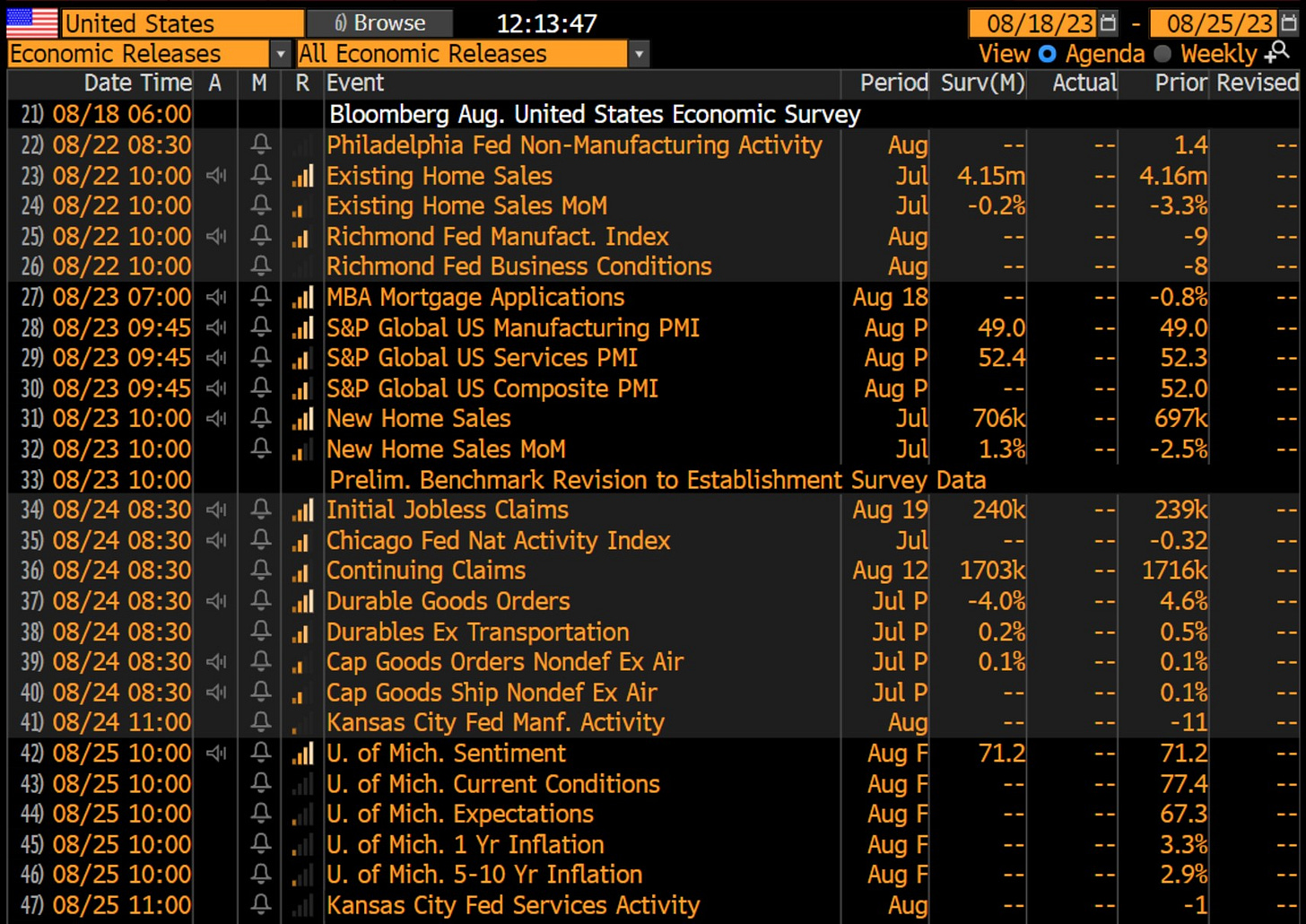

Next Week

In the week ahead, all eyes and ears will be on Jerome Powell’s Jackson Hole speech. But the reality, for us at The Bitcoin Layer, is that Powell’s words don’t seem to matter much anymore. He had his hawkish run, and now with the vast majority of short-term interest rate traders and Wall Street economists seeing no chance of a September hike, what is happening with Treasury yields, corporate credit spreads, and equities matters more than any rhetoric from Wyoming. Powell is expected to reiterate that the Fed’s job on inflation isn’t yet done, but we believe the market wants cuts (it has wanted them since March and Silicon Valley Bank’s collapse) where there are none. In other words, investors are hoping the Fed’s restrictive policy rate is lowered over the coming months, but without any signal on this front from the Fed, risk allocations are now being shed. Investors are frustrated with the lack of dove sightings.

Lastly, we don’t anticipate that economic releases will be market-moving in the days before Powell’s Friday speech.

Foundation Devices is self-custody done right.

Start with their easy-to-use and private mobile wallet with Envoy, then transfer it to the most intuitive hardware wallet in Bitcoin with Passport.

If you’ve been on the fence about taking your bitcoin off of exchanges, Foundation’s suite of intuitive self-custody solutions is for you.

Take custody of your Bitcoin today by visiting foundationdevices.com

If you’re enjoying today’s analysis, consider supporting us by becoming a paid subscriber. As a paid subscriber, you get full access to all research as it drops.

Here are your quick links to all of the TBL content for the week:

Tuesday

Only three things are certain in life: death, birth, and change. — Anonymous

Benjamin Franklin famously truncated this idiom into two certainties: death and taxes. 52 years to the day after detaching money from physical reality when we left the gold standard, it’s time to add another certainty: money devaluation.

The Fed’s monetary policy tools of interest rate manipulation and large-scale asset purchases, paired with the US Treasury’s perpetual fiscal deficit, have had the impact of making assets more expensive, making the rich who own them richer and the poor exactly in the same place they were half a century ago.

Check out—Rich in the '70s is poor in 2023

Wednesday

In this episode, Nik discusses the future monetary order. He compares bitcoin, which is almost 15 years old and has the adoption of over 100 million people worldwide, to the idea of a gold-backed currency issued by BRICS, the geopolitical group of China, India, Russia, Brazil, and South Africa. One is real, and the other is imaginary.

Check out—Bitcoin Will Challenge Dollar, Not Gold-Backed BRICS Currency

Thursday

Can you feel it? That tremble is volatility waking up from a sleepy summer. Now that the dog days are over, portfolio managers are returning from vacation to find some serious alarm bells in the price action. We take a trip around US rates, FX, global rates, commodities, volatility, stocks, and bitcoin to set up the rest of the year—we have a feeling drama awaits. Another essential chart pack from Nik.

Check out—Reality Check Chart Pack

Friday

Was it Elon dumping all that SpaceX owns? Was it a high amount of leverage? Was it BTC following the move in stocks? A little bit of all 3 with some shady business going on behind the curtains, Joe breaks it all down.

Check out—Bitcoin Puked 15% — Here's Why

Our videos are on major podcast platforms—take us with you on the go!

Apple Podcasts Spotify Fountain

Keep up with The Bitcoin Layer by following our social media!

YouTube Twitter LinkedIn Instagram TikTok

That’s all for our markets recap—have a great weekend, everyone!

River is the Bitcoin exchange of choice for the long-term investor.

Securely buy Bitcoin with 100% full-reserve custody, enjoy zero fees on recurring orders, and even buy a hosted Bitcoin miner, completely hassle-free.

Invest in Bitcoin with confidence at River.com/TBL and receive $5 free when you buy $100 in Bitcoin.