Welcome to TBL Weekly #74—the free weekly newsletter that keeps you in the know across bitcoin, rates, risk, and macro. Grab a coffee, and let’s dive in.

River is the Bitcoin exchange of choice for the long-term investor.

Securely buy Bitcoin at the tightest spreads in the industry, have peace of mind thanks to their 100% full-reserve cold storage custody, and enjoy zero fees on recurring orders. Need help? They have US-based phone support for all clients.

Invest in Bitcoin with confidence at River.com/TBL

Good morning everyone, happy Saturday ☕

This was a wild, action-packed week in markets.

As you know from Nik’s unrelenting post on Thursday and our pre and post-Fed meeting coverage on Wednesday, the Fed changed its tune on rate-cut timing and shifted forward its projections for when it would bring down its policy rate. This capitulation and consensus pricing of 100 bps worth of cuts in 2024 sent shockwaves through an already risk-taking and anticipatory market.

Realistically, this was a major blunder for Jerome Powell’s Fed.

It has not reached its long-run price inflation target of 2% but has publicly declared its projection to cut interest rates. Financial conditions are already loose relative to where the Fed wants them to be to achieve its inflation target; with this move, it risks loosening them further, driving spending higher as expectations for cheaper credit rise and igniting a reacceleration in prices.

For what it has accomplished so far, however, credit is due. The Fed has successfully increased interest rates from 0.25% to 5.5% without destroying financial markets or creating sweeping unemployment. If they manage to return to 2% price inflation for a meaningful period of time, eventually performing maintenance rate cuts to mitigate overtightening risks, and avert any kind of financial or economic calamity, Jerome and the gang should receive an award for landing the plane on soft landing island.

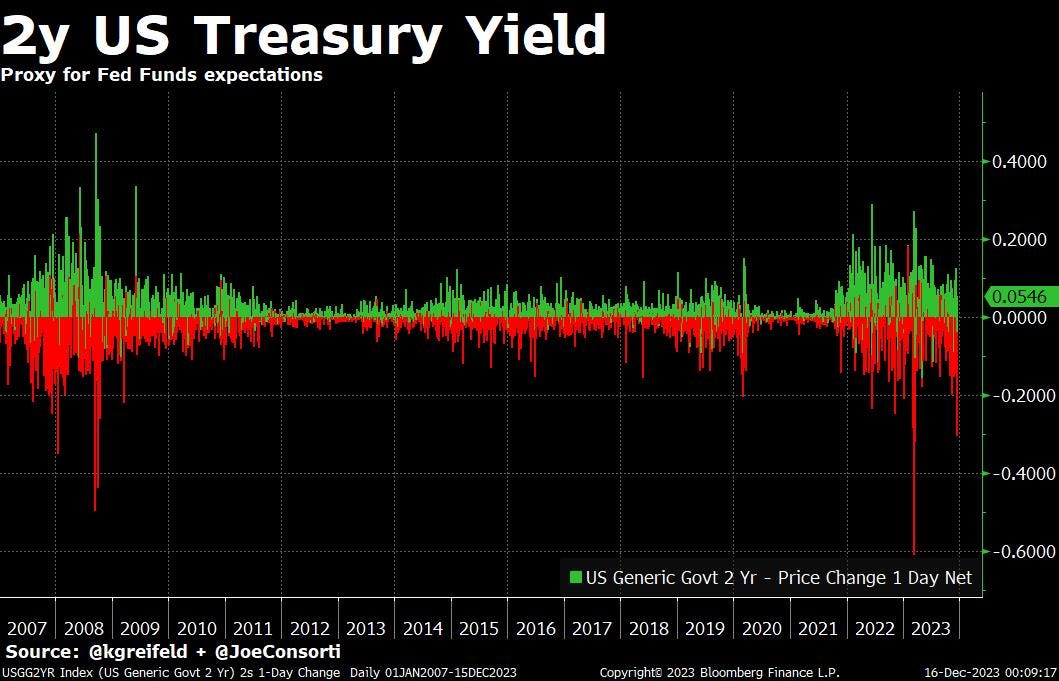

As the Fed embarks on a damage control tour across financial media to temper expectations, we’re left with a market already pricing in several rate cuts for next year. Wednesday, following the Fed’s comments, saw the biggest single-day drop in the 2-year US Treasury yield since the March banking crisis:

Zooming out further, it’s one of the biggest sudden drops in the 2y yield of all time, including the Great Financial Crisis and dot-com crash:

This volatility in the US Treasury market that we’ve experienced for more than two years hasn’t been observed since the 1980s—a decade demarcated by volatile price inflation, volatile economic activity, and volatile Fed policymakers.

Markets are merely a forward discounting mechanism, taking all available information and synthesizing it into actionable investment vehicles. What are they saying? Fed Funds futures believe that a rate cut as early as March is a coin toss, while by June on is practically a certainty:

Christmas came early for market participants 🎄

The market is partying in the wake of Powell’s presser and the Fed’s new dots, and rightfully so. Having had its punch bowl removed some 21 months ago, the market has been sober off of increasingly positive real interest rates and a diminishing Fed balance sheet. Now that the prospect of the punch bowl returning is here, the market is starting its long-awaited pregame, however preemptive it may be.

The Dow Jones and Nasdaq both hit all-time highs on the same day this week, and the S&P 500 is just 1.6% away from an all-time high:

Bitcoin is washing ashore with the risk tide just like stocks, however it’s still well off its all-time high level. It hasn’t spent a lot of time in the $35,000 to $45,000 range historically—generally breaks above or below this range, it doesn’t hang out here. Having broken above the $40,000 with force last week, but not enough to reach the 50-handle, it makes sense that we’re experiencing minor turbulence here given the lack of historical support.

Given Powell’s unintentional go-ahead to risk markets, paired with the bitcoin-native catalysts approaching in the year ahead, it’s all systems go for bitcoin until further notice:

On the plumbing side of things, there’s plenty of liquidity sloshing around in financial markets before we run into serious trouble.

Powell cited the Fed’s overnight reverse repo facility, which has decreased from $2.5 trillion to $600 billion in a matter of months, as a key resource in cushioning the blow of the US Treasury’s issuance deluge on the real economy. We still have roughly 3 months before this facility is drained to $0—in that time, it will continue acting like a buffer between the Fed’s rate hikes and a real derisking impulse hitting financial markets, and then the real economy:

Bank reserves have also risen since the Fed began hiking rates. As banks remain flush with reserves, risk-taking goes on, as observed in the S&P 500 within striking distance of an all-time high:

Things may start to turn next quarter though, when the Fed’s reverse repo facility is slated to run out, and the Fed’s primary emergency loan facility that is propping up a great deal of banks is set to expire.

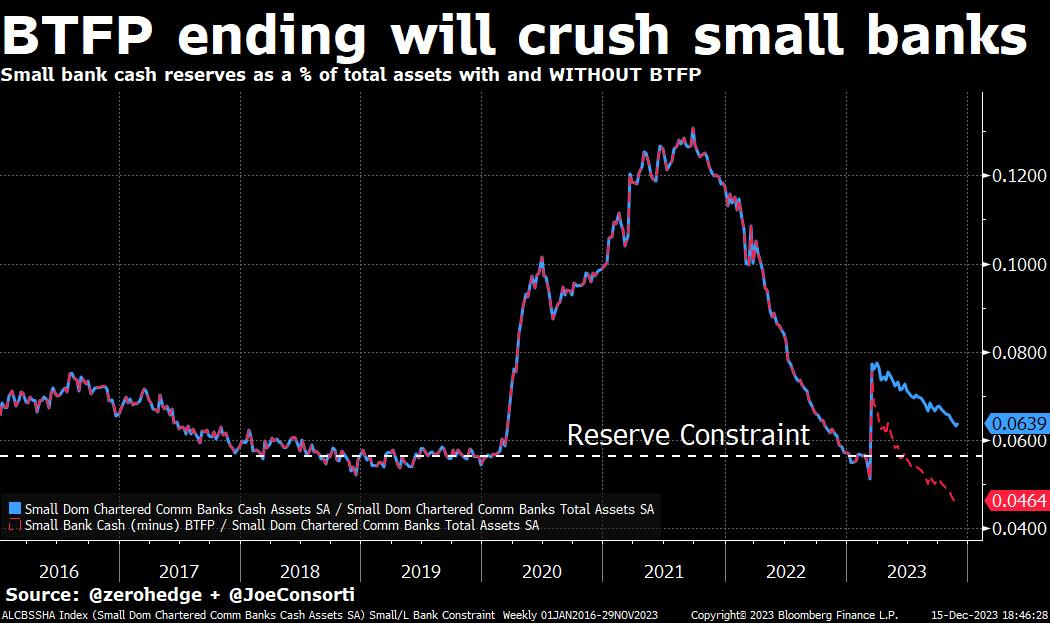

Emergency loans from the Fed's BTFP facility have risen to a fresh high of $123.76 billion in total. The pace of new loans from the facility has risen in the last two weeks, presumably as more and more banks seek to cash in on the blank check and recover their mark-to-market losses before the facility expires. on March 11, 2024:

If the Fed allows BTFP to expire, small banks’ reserves immediately fall below the level where they’ve started failing in quick succession during the last 3 periods of acute stress in 2007, 2019, and 2023.

The party must go on, or the Fed must be content with allowing financial institutions to fail and the growth risk that entails. Given the Fed’s no-recession shadow mandate, we know which options they’ll likely choose:

Deposits have stabilized since the acute banking crisis back in March, a tailwind for many smaller banks who saw the whites of bankruptcy’s eyes:

—and as a result of these stable deposits and the still-steady risk-taking thanks to the Fed’s intervention, lending has remained marginally positive, albeit still coming well off of its post-COVID ZIRP highs.

In the credit-based world we inhabit, as long as credit growth is steady, the economy won’t collapse… until it does. We’re teetering on that contraction line that has been the tipping point for every modern recession. Given the nature of this cycle, reverting to the monetary mean after the adrenaline shot of 2020/1 stimulus, it’s anybody’s guess as to when we’ll actually head into credit contraction:

Next Week

In the week ahead, markets will to continue to digest all that Powell said last week, as well as attempt to interpret the countersignals that will assuredly come from other Fed speakers. We will also receive a fair amount of housing, consumer, and inflation data, but nothing that has us sitting at the edge of our seats. Instead, we will observe how markets continue to waver between March, May, and June rate cuts and get a better sense of where they land. We’ll make one thing clear, however: cuts will arrive in either March, May, or June, and it is simply a matter of time before one of these meetings becomes locked in. For now, traders expecting cuts by June will certainly be in profitable positions next year as long as they were entered before the FOMC meeting on Wednesday. The drama will basically only revolve around which meeting cuts commence:

If you’re enjoying today’s analysis, consider supporting us by becoming a paid subscriber. As a paid subscriber, you get full access to all research as it drops.

Here are some quick links to all the TBL content you may have missed this week:

Tuesday

The Digital Asset Anti-Money Laundering Act, introduced last year by US Senators Elizabeth Warren and Roger Marshall, is officially a bill to “mitigate the illicit finance risks that crypto poses by closing loopholes and bringing the digital asset ecosystem into greater compliance with the anti-money laundering and countering the financing of terrorism frameworks.”

Unofficially, however, it is a targeted attack on American freedoms, an abject desecration of the Constitution, and the largest attempted encroachment on personal liberties via surveillance since the Patriot Act in 2001.

Don’t worry folks, Liz will lose this fight. She’s pretty good at it.

Check out—Liz Warren can't stop losing

Thursday

On November 3rd, we wrote “Did you feel that?” and described the stunning move that made us feel a shift. On November 30th, we followed up with “Have you recognized this warning sign?” in which we put 3.5% 10-year yields in play. Yesterday, we officially received the hammer from Jerome Powell—rate cuts are not just around the corner as we previously wrote, but are now officially locked in. Even though I constantly remind myself of how quickly the shift happens, it never fails to amaze me. We begin with a self-administered report card from my January outlook to reflect on whether I should even bother with another in 2024, and we conclude with what might be the most important news in the history of bitcoin accounting.

Check out—The feeling, the warning, and the hammer

In this episode, Nik recaps yesterday's FOMC meeting and discusses incoming rate cuts. He starts with an explainer of Treasury supply and the difference between gross and net issuance, continues with a full breakdown of Jerome Powell's press conference and the admission that rate cuts are around the corner, and concludes with the enormous news for bitcoin accounting standards.

Check out—FED PIVOT: Rate Cuts Coming Soon

Our videos are on major podcast platforms—take us with you on the go!

Apple Podcasts Spotify Fountain

Keep up with The Bitcoin Layer by following our social media!

YouTube Twitter LinkedIn Instagram TikTok

That’s all for our markets recap—have a great weekend, everyone!

River is the Bitcoin exchange of choice for the long-term investor.

Securely buy Bitcoin at the tightest spreads in the industry, have peace of mind thanks to their 100% full-reserve cold storage custody, and enjoy zero fees on recurring orders. Need help? They have US-based phone support for all clients.

Invest in Bitcoin with confidence at River.com/TBL for $5 free when you buy $100 in Bitcoin.

But I thought the world was going to end. Damn.

Wow this is a change of tone. Do you still insist there will be a recession in the near future or did you totally abandoned the idea? It really looks like the FED could achieve a soft landing, but something is off to me..this economic cycle really is something special. If you think about that since january 2020 around 80% of all USD in existence was printed, and more in two months than in the last 20 years, then it's no surprise that there is still enough liquidity/money available and risk apetite to pump the markets.