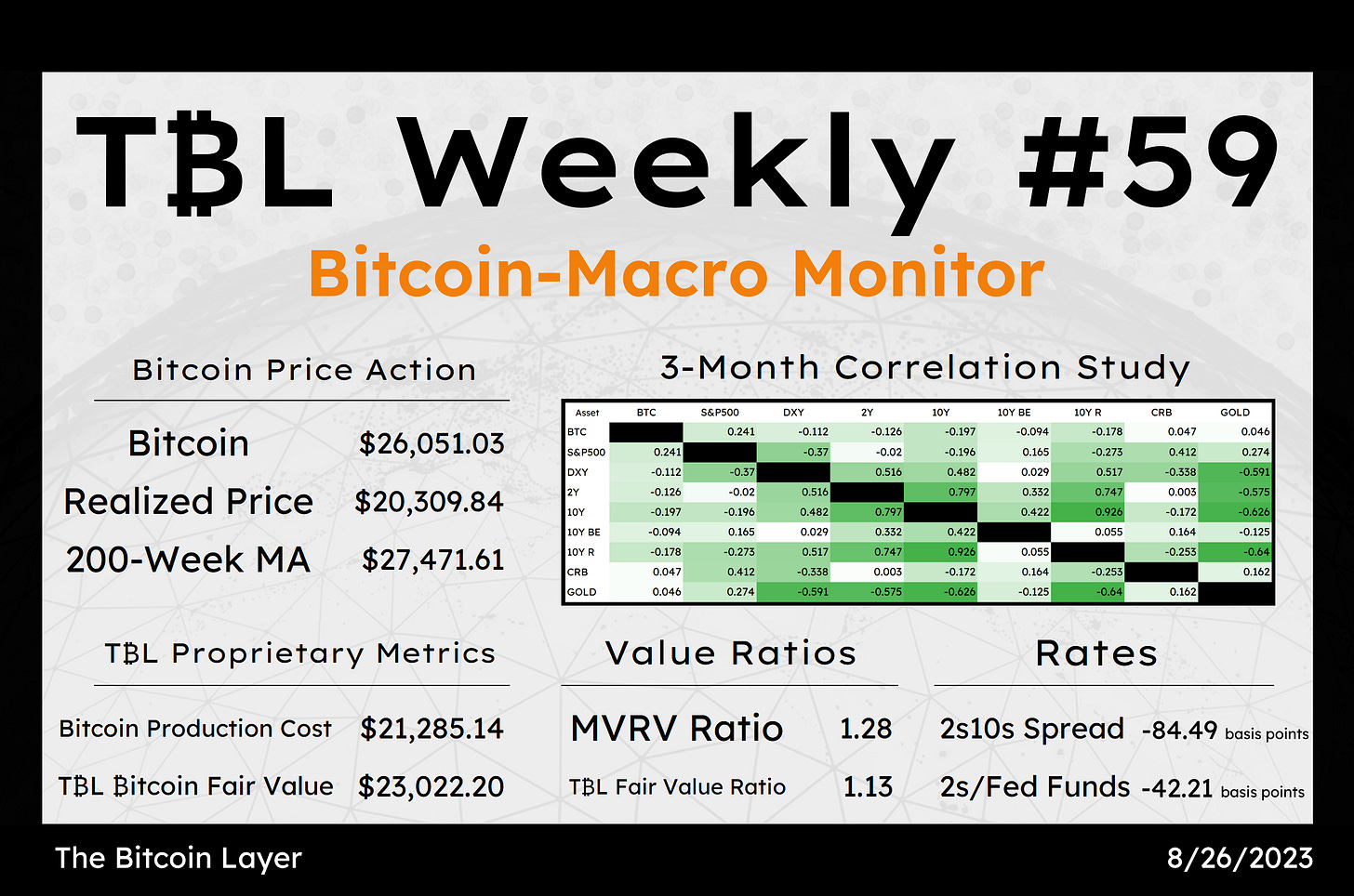

Welcome to TBL Weekly #59—the free weekly newsletter that keeps you in the know across bitcoin, rates, risk, and macro. Grab a coffee, and let’s dive in.

Invest in Bitcoin with confidence at River.com/TBL

Securely buy Bitcoin with 100% full-reserve custody, enjoy zero fees on recurring orders, and even buy a hosted Bitcoin miner, completely hassle-free.

Good morning TBL readers, and happy Saturday!

Yesterday wrapped up this year’s summit at Jackson Hole, a symposium centered around the Federal Reserve Chair’s speech on the progress and path of conducting monetary policy this cycle. Powell was the usual suspect in delivering his firm remarks—unwavering 'higher-for-longer’ goal for interest rates, the Fed’s dual mandate of full employment and price stability, and reiterating his commitment to a long-run 2% price inflation target—but one quote of his struck a particularly ironic cord to our ears:

As is often the case, we are navigating by the stars under cloudy skies.

You’ll know that the Fed’s two main tools to conduct monetary policy are policy rate-setting and asset purchases using its balance sheet. These tools work with long and variable lags, often 18 months or longer until they trickle down from the Fed’s gavel to actually tightening or loosening financial market conditions and attaining real economic changes. Essentially—the Fed is steering the US economy and having to wait several months to really see the tightness or damage it’s caused. What’s more, the data they use to make decisions is lagging heavily behind the real economy, too. In this way, the Fed is driving a vehicle with a busted steering wheel while looking in the rearview mirror to decide where it should turn.

That is the translation of Powell’s poetic waxing and waning about being a sailor. His aim was to deliver a stoic yet calm quote about how the Fed is doing its best with the data that it has, but Powell inadvertently showed the hand we’ve been saying he has all along—the Fed is driving blind with tools too blunt for the job.

Don’t get overly poetic about your glorious ship, Mr. Powell. You may want to instead focus your attention on the mounting icebergs in the water ahead.

Following Powell’s unshaken speech in Wyoming, the market has once again capitulated to his higher-for-longer mission for interest rates. Another 25-bps hike in November has a 41.9% probability. Barring material development of economic weakness between now and then, the skip-then-hike approach to FOMC meetings is likely to continue:

On the topic of front-end interest rates pricing in a higher policy rate from the Fed, the 2-year US Treasury yield reached 5.07%—its highest level since 2006:

Powell is talking tough now, he has to. Changing his language one iota towards easier policy is risking higher spending. He's fighting for his own credibility as much as he is the Fed's. Even as the risks continue teetering more towards recession, he'll be more concerned about inflation until he sees the whites of the labor market’s eyes. He doesn't want to go down in history for the 2019 Powell Pivot™ and will wait until the last tenable moment before cutting interest rates. If the era of easy money is over, Powell must prove it to himself and us all by being reluctant to ease.

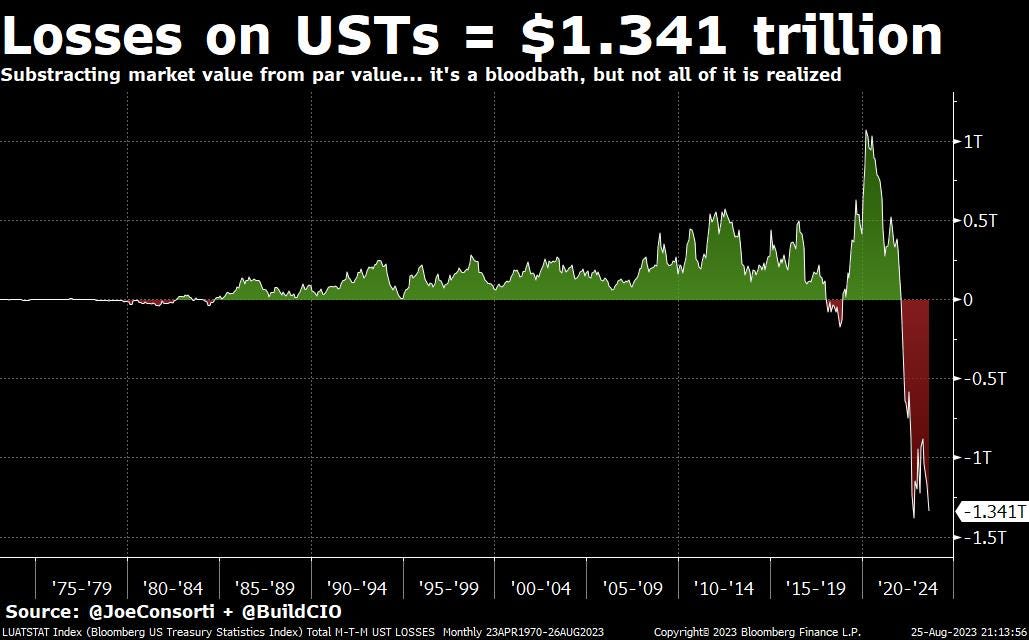

The burden of interest payments as public and private debt rolls into new issuance at much, much higher rates will have to be addressed eventually. Tax receipts continue to disappoint, so the US government will have to increasingly fund interest payments on outstanding debt with revenue from new debt, all of which is being issued at an ever-higher rate. Rate hikes are also impairing the balance sheets of global financial institutions which are already strapped for liquidity as depositors rush for the exits and higher-yielding products. Over $1.3 trillion has been sliced off the top of the US Treasury market—mostly from hikes:

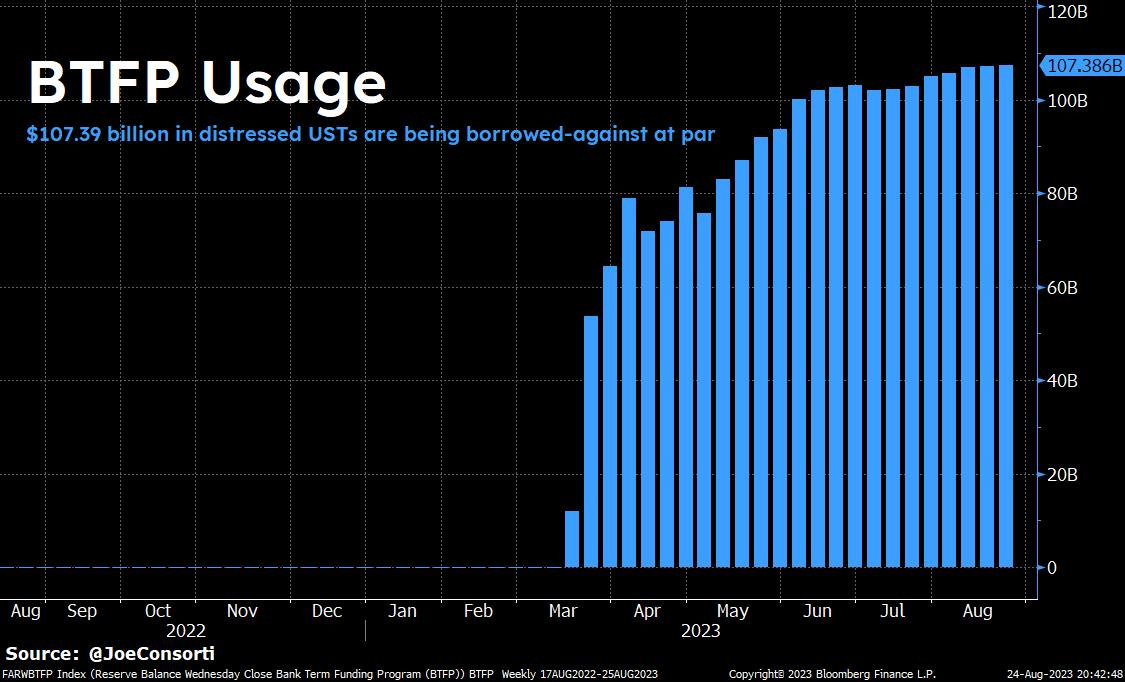

Total emergency loans from the Fed's BTFP facility have hit a new high of $107.39 billion—so some 10% of all banks' losses on impaired US Treasuries are being papered over. New program, same old can-kicking:

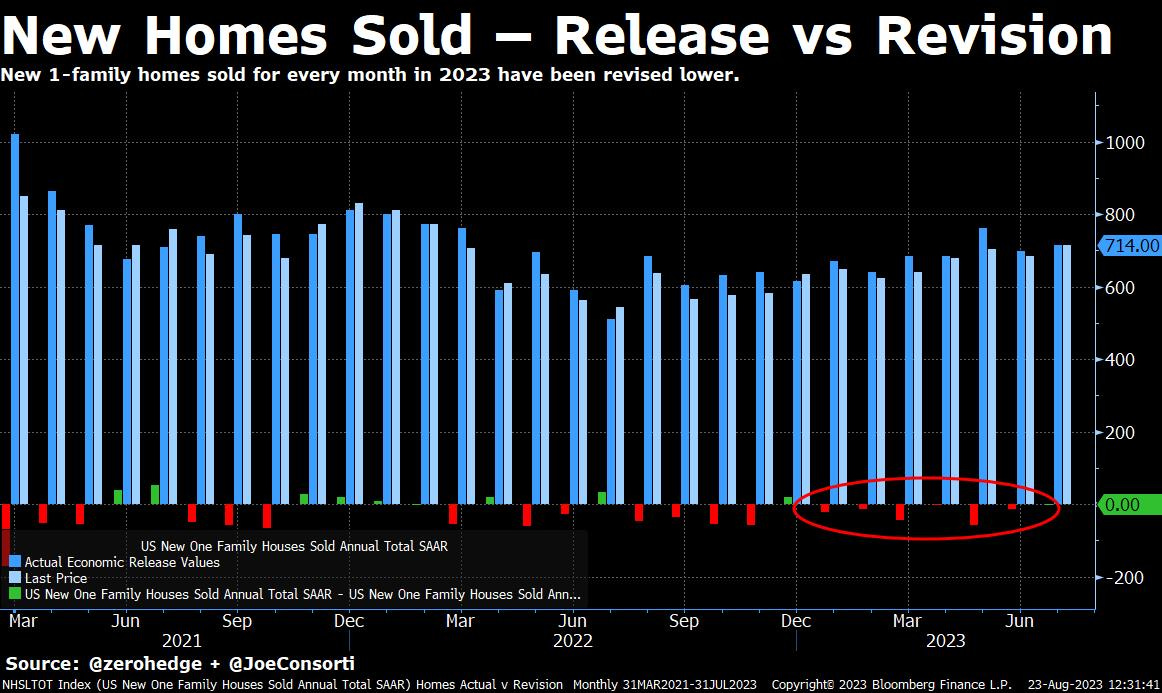

The US housing market continues to be weaker than expected. New home sales data for 13 of the past 16 months has been revised down. What's more, every month's data in 2023 has been revised down. The highest real rates in 15 years are working to destroy residential real estate demand, albeit at a more modest pace compared to the currently up-in-flames commercial real estate market:

Mortgage salesmen are reaching to the bottom of the barrel to stimulate housing loan demand as mortgage rates surpass 24-year highs. Zillow is offering a 1% down payment program in select states, while several other lenders like Rocket Mortgage are offering similar products:

This is far from a systemic problem; it merely paints the picture of where we are in the cycle: eeking out the final drops of debt from the suckers that will borrow before high rates crush demand. Cycles don’t repeat, and this is not 2007, but we imagine that plenty of the ZIRP wunderkind like these two bartenders-turned-mortgage-brokers will not last much longer—think the bubble of Airbnb owners bag-holding now-vacant vacation rentals in the oceanless Austin, Texas:

Let’s close out this week’s analysis on a lighter note. Here are three of the world’s most important lizard peopl—erm—we mean central bankers, at Jackson Hole yesterday; here’s how we imagine their conversation went:

Powell: "We've shrunk our balance sheet by 9.2%"

Lagarde: "We've shrunk ours by 19%"

Ueda: "Wait, you guys are shrinking your balance sheets?"

Next Week

In the week ahead, we’ll receive several economic data points that matter, including home prices, employment and wage data, and the recessionary ISM manufacturing survey. With home prices, fluctuations around current prices are overshadowed by 7% and 8% mortgage rates throughout the country—weakness is to be expected but the American housing market does have a fair amount of resilience. On Friday, we’ll get the all-important payroll data that has suffered massive negative revisions—this data set, although market-moving, always takes a back seat to the wage data that accompanies it. In the search for lower inflation, lower wages are a precursor, and wages are expected to remain solid at a 4.3% increase year over year.

Lastly, ISM manufacturing is expected to remain in recessionary territory, which we believe is a sign of global economic weakness. After all, Europe’s PMI data is indicating a lasting recession, China’s economy shows evidence of weak global demand, and oil prices struggling also tell us the not-so-great state of the global economy. We’ll still be watching markets more than economic data in the coming week, because we believe a little bit of inflation or deflation doesn’t change the fundamental dynamic threatening markets: the crowding out effect of half a trillion dollars of new Treasuries.

Foundation Devices is self-custody done right.

Start with their easy-to-use and private mobile wallet with Envoy, then transfer it to the most intuitive hardware wallet in Bitcoin with Passport.

If you’ve been on the fence about taking your bitcoin off of exchanges, Foundation’s suite of intuitive self-custody solutions is for you.

Take custody of your Bitcoin today by visiting foundationdevices.com

If you’re enjoying today’s analysis, consider supporting us by becoming a paid subscriber. As a paid subscriber, you get full access to all research as it drops.

Here are your quick links to all of the TBL content for the week:

Tuesday

We’ve got a rapid-fire bitcoin chart pack for you. We dissect how much leverage has been purged from the market, where coins are moving, and what the rest of the year has in store now that volatility is back on the menu.

Grab a coffee and let’s dig in.

Check out—Bitcoin Liquidations, Volatility, and Flows Chart Pack

Wednesday

In this episode, we’re joined by Build CIO Matt Dines. Matt walks us through the epic bear market in Treasuries and projects that investors are approaching yield levels that will bring portfolios a lot of pain. Nik asks Matt to explain why the 3-month/6-month Treasury bill curve is inverted and what it means for markets.

Check out—Is The Treasury Market BREAKING? | Matt Dines

Thursday

As we approach the annual central banking symposium at Jackson Hole, economists and the financial media will focus on 2% inflation targets, 3% inflation targets, and central banking divergence. At The Bitcoin Layer, we’re more focused on prices, but that doesn’t mean Wyoming comments are superfluous. While we looked at weekly candles and longer-term charts last week, today’s chart pack looks more closely at daily candles and looks to identify key swing levels ahead of any market-moving words in Jerome Powell’s speech.

Check out—Jackson Hole Chart Pack

Our videos are on major podcast platforms—take us with you on the go!

Apple Podcasts Spotify Fountain

Keep up with The Bitcoin Layer by following our social media!

YouTube Twitter LinkedIn Instagram TikTok

That’s all for our markets recap—have a great weekend, everyone!

River is the Bitcoin exchange of choice for the long-term investor.

Securely buy Bitcoin with 100% full-reserve custody, enjoy zero fees on recurring orders, and even buy a hosted Bitcoin miner, completely hassle-free.

Invest in Bitcoin with confidence at River.com/TBL and receive $5 free when you buy $100 in Bitcoin.