Tech Layoff Tsunami, Fed Rate Decision, & Bitcoin's Bullish Consolidation: TBL Weekly #29

We've got you covered on all the latest in bitcoin and macro.

Welcome to TBL Weekly #29—the free weekly newsletter that keeps you in the know with everything going on in markets. Let’s dive in.

Bitcoin-Macro Monitor

Just quickly grabbing the headlines?

Here’s your rapid-fire recap of the relevant action in bitcoin and macro:

Refer to TBL’s Bitcoin & Macro Term Glossary: thebitcoinlayer.com/glossary

Bitcoin continues its sensational start to the year, closing down on only 5/23 days so far in 2023. Over the last week, it has finally crested above $23,000 and has been consolidating in a narrow range for several days.

Correlations are unchanged from last week, when we noted that risk assets are lying in wait for the downshift at the February FOMC meeting and are gathering bullish momentum heading into this year’s Fed pause.

Similarly, rates are virtually identical this week to last. 2s remain well below the Fed’s policy rate target and 10s continue consolidating around 3.50% as investors brace for an anticipated economic slowdown.

There are your headlines, now let’s take a look under the hood.

Markets Analysis

Here’s a comprehensive recap of last week’s action across markets:

It’s encouraging to see continued bitcoin strength juxtaposed against our three favorite fair value indicators. Spot price is now within striking distance of the 200-week moving average, a critical level that has served as one of bitcoin’s most robust floors throughout the years. As these fair value levels continue being flipped by bitcoin’s spot price, our cautious optimism that these levels will hold rises too, particularly heading into this year’s Fed pause within which bitcoin has always rallied:

When an asset is sold, you’re either realizing a profit or a loss—the ratio of realized profits to realized losses in bitcoin has flipped positive for the first time in nine months. As bitcoin extends its rally, the individuals that are choosing to cash out of their position are realizing more profit than losses on average:

Tech layoffs have been the story of the week, with major names like Amazon, Google, and Microsoft laying off a considerable portion of their global workforce. They are joined by several crypto companies, which laid off a much higher percentage of their employees relative to the much larger FAANG technology companies:

Tech layoffs are the first wave you generally observe before a wider labor market downturn. Due to their dependence on debt financing, they are more sensitive to changes in interest rates—as the Fed’s hikes are passing through into corporate borrowing, these rate-sensitive tech firms are the first to tighten their belt by winding down their headcount. If rates are held higher for longer as the Fed plans, this is a bellwether of the wider labor market loosening that will eventually make its way into less interest-rate-sensitive firms in the quarters ahead.

The Week Ahead

In the week ahead, there are three key economic data points we have our eye on. A downshift from 50 to 25 bps hike increments is solidified for Wednesday’s FOMC meeting, given the Fed has not wanted to surprise market expectations this close to a meeting for the entire cycle. The nonfarm payroll release on Friday will add some color to the question of whether we’re months away from a higher unemployment rate, or if a loosening labor market is at our doorstep. Lastly, Friday’s ISM Services PMI release will shed light on the pace of the slowdown in one of the stickier sectors for inflation this cycle, particularly the prices paid component:

If you’re enjoying today’s analysis, consider supporting us by becoming a paid subscriber. As a paid subscriber, you get full access to all research as it drops.

Here are your quick links to all of the TBL content for the week:

Tuesday

Price guides the narrative. As rates fall and Treasuries find a consistent bid to begin 2023, the price action can easily be described by pointing to slowing growth and inflation metrics. And as stocks fell last year, we knew the source: higher rates.

As the drama around Fed tightening fades, along with the threat of 5-8% US Treasury rates, which market has us the most curious? It was, until recently, bitcoin. But now that bitcoin has dusted off its graveyard dust for the 469th time, the highest drama now revolves around the stock market. Depending on what time of day it is, pour yourself a glass of something, and let’s assess the risk market’s nerves.

Check out Stock Market, Unresolved

Wednesday

In this episode, Nik discusses how inflation and the path for Fed hikes have been resolved as the market's most pertinent issues, with the path for the stock market at a critical inflection point:

Friday

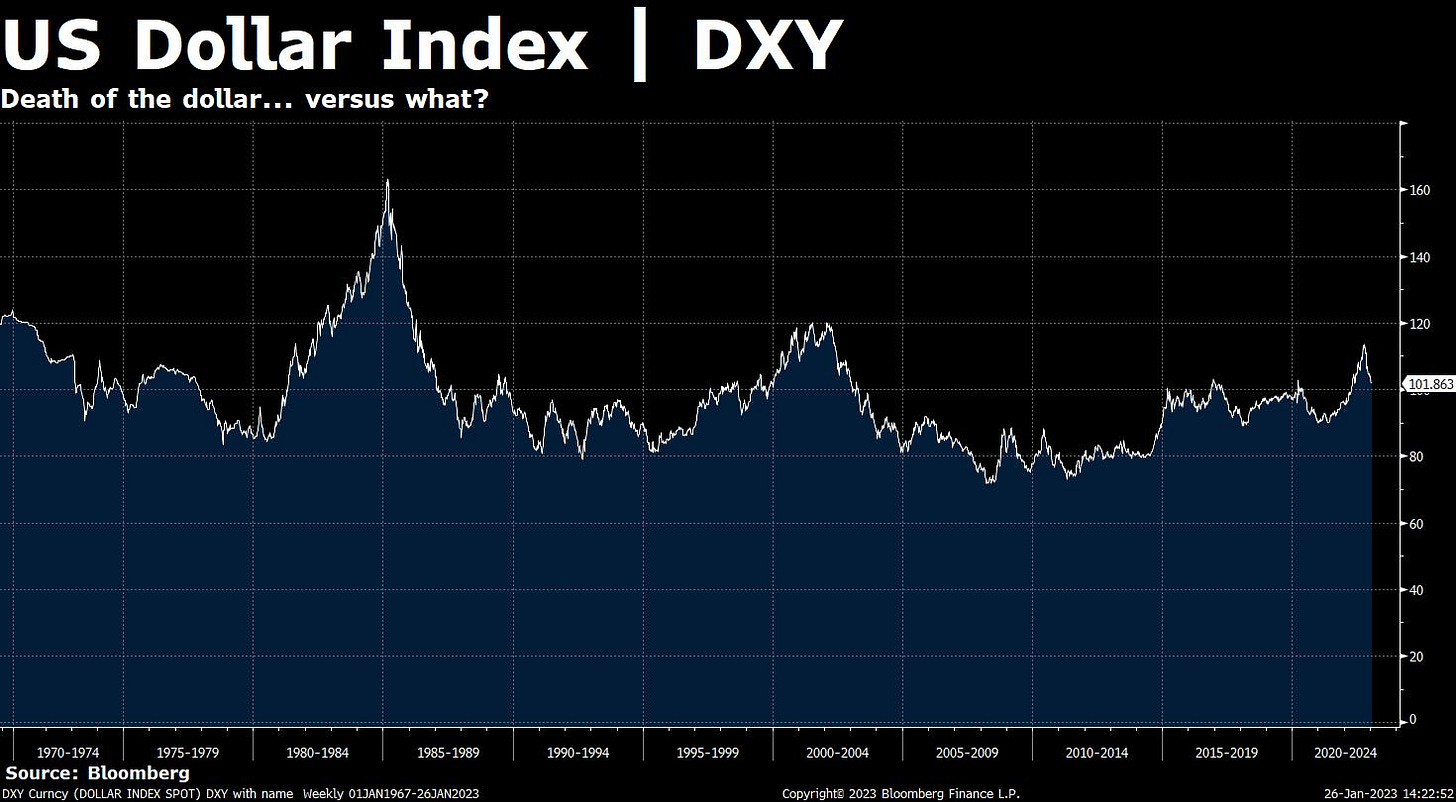

Reports of the dollar's death have been greatly exaggerated.

We invoke Mark Twain's infamous reaction to the false report of his death in our title today because the longstanding narrative of the US dollar's imminent demise is just as inaccurate.

An excerpt from this NYT article on the Monday following Nixon’s departure from the gold standard colors the consensus view of the dollar’s collapse, some 50 years ago:

Arthur M. Okun, Chairman of the Council of Economic Advisers under President Johnson said he could not say by what degree other currencies would rise in value relative to the dollar, but he was certain that they would rise.

The dollar has been dying over and over again since the post-Bretton Woods era of the global monetary order began in 1971, with the dollar being allowed to fluctuate freely against gold, and with that, the global currency regime undergoing a 51-year period of price discovery. Yet half a century later, the dollar remains king in the universe of currencies.

The United States dollar is globally entrenched to the nth degree—it helms the deepest and most liquid fixed-income market in the world, which provides securities that receives a healthy, structural bid from every capital allocator with dollars on their balance sheet, sovereign and non-sovereign. Lending is collateralized by these securities, foreign nations and their businesses purchase them, and world interest rates bend at their whim.

Uprooting this critical financial infrastructure would prove lengthy, costly, disruptive, and impractical, not to mention there is no clear reason for another national currency to displace the US dollar as the world’s primary reserve currency.

Inflation, money printing, and endless deficit spending aside, the US dollar works for what it was intended to do: lubricate global trade and financial markets with deep enough liquidity.

With all of this in mind, today we beg the question: will the real dollar replacement please stand up?

Check out Reports of the dollar's death have been greatly exaggerated

We had a double feature for you on Friday—if you’re more of a visual or audible learner, you can tackle the death-of-the-dollar narrative in video form too.

In this episode, Joe delivers a rebuke of the popular "death of the dollar" narrative in markets. He discusses how dollars are entrenched in global financial plumbing, the deep liquidity across USD-denominated assets, how dollars still dominate FX reserve composition around the globe, and the current ill-fated attempts at "displacing" the dollar in its role as the preferred global medium of exchange:

Our videos are on major podcast platforms—take us with you on the go!

Apple Podcasts Spotify Fountain

Keep up with The Bitcoin Layer by following our social media

YouTube Twitter LinkedIn Instagram TikTok

That’s all for our bitcoin and macro recap—have a great weekend everybody!

The Bitcoin Layer does not provide investment advice.